Market Overview June 27 2023

With a lot of uncertainty and volatility coming out of a very “busy” couple of years, today, we are taking another look at what’s going on in the US and abroad.

A New Dawn: SEC Greenlights Leveraged Bitcoin Futures ETF

The SEC has made history by approving the first ever leveraged Bitcoin Futures ETF. Over the past six months, Bitcoin has witnessed a staggering surge, up 83%. As enthusiasts and investors alike wonder, the question remains: Are we set to see even greater heights?

Biden’s Broadband Vision: High-Speed Internet for All by 2030

Channeling his inner Franklin D. Roosevelt, President Joe Biden has unveiled an ambitious plan to provide high-speed internet access to every American household by 2030.

With a hefty budget of $42 billion approved for the Broadband Equity, Access, and Deployment program, the United States is poised for a digital revolution. States are set to receive a minimum of $107 million, with 19 states on track to receive over a billion dollars in funding.

The Fading Hope for Rate Cuts in 2023

Investors are beginning to give up on the possibility of rate cuts in 2023. Despite the Fed’s recent dot-plot forecast, traders are pricing in a peak after just one more 25bps hike. They anticipate a 77% chance on a 25bps raise to 525-550 in July but foresee rates lingering there through year’s end.

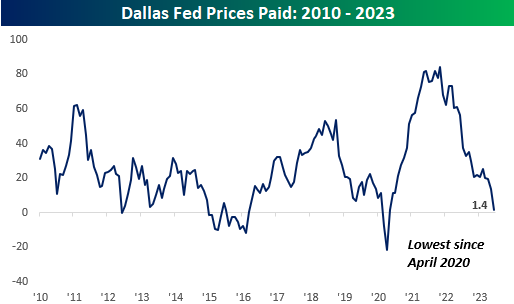

Texas Manufacturing: A Three-Month High Amidst Contractions

In the Lone Star State, regional manufacturing activity has climbed to a three-month high in June, reflected in an improved Dallas Fed Manufacturing Index. Despite this uptick, business conditions have been hampered with contractions in production, new orders, shipments, and capacity utilization.

Electric Revs Up: Aston Martin and Lucid’s Collaborative Drive

Aston Martin, the famed automaker behind Bond’s vehicles, is steering towards an electric future in collaboration with EV-maker Lucid. This partnership will boost both companies’ long-term growth strategies amidst financial challenges, with Lucid supplying components to Aston Martin and earning $142 million and a 3.7% stake in return.

S&P 500 and VIX: An Unusual Correlation

The established market wisdom is being challenged as the correlation between the S&P 500 and VIX reaches unprecedented levels. Over the past 10 days, the correlation has shot up to +0.61, marking a three-decade high, even as stocks continue to rally.

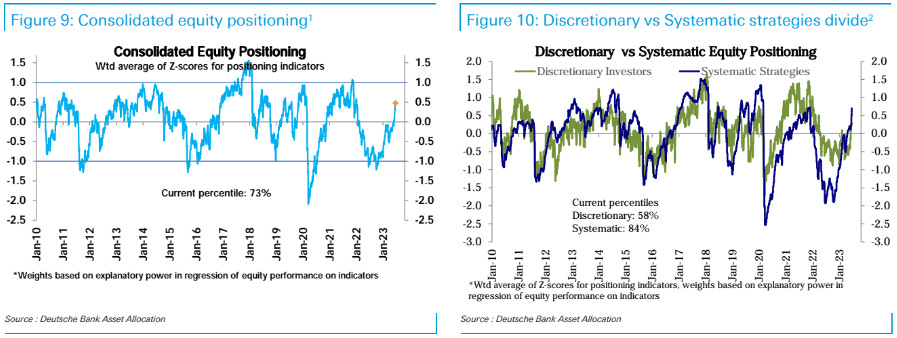

Investor Positioning: A Changing Tailwind

Investor positioning has been favoring stocks recently, but the winds may be shifting. Goldman’s Sentiment Indicator registered its first “stretched positioning” reading since April 2021, and aggregate positioning is moving further into overweight territory.

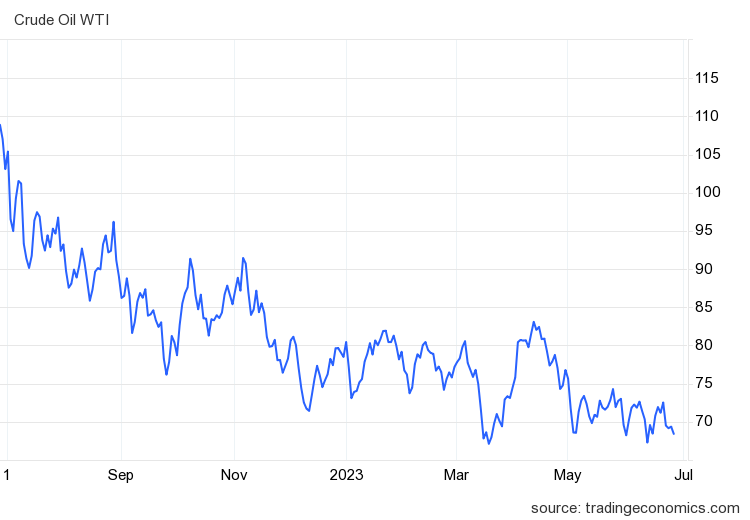

The OPEC Perspective: Global Energy Demand in 2045

According to OPEC, global energy demand is projected to soar to 110 million barrels a day by 2045, a rise of 23% over that period.

Oil is expected to account for 29% of the energy mix by then, a forecast that contrasts with IEA’s estimates of a softening demand growth in the coming years.

Safe Trading

Team of Elite CurrenSea

Leave a Reply