Maneuvers and Market Movements: Examining Financial Triumphs, Global Power Plays, and Technological Tensions

With a lot of uncertainty and volatility coming out of a very “busy” couple of years, today, we are taking another look at what’s going on in the US and abroad.

U.S. Banks Triumph Over Federal Reserve’s Stress Test

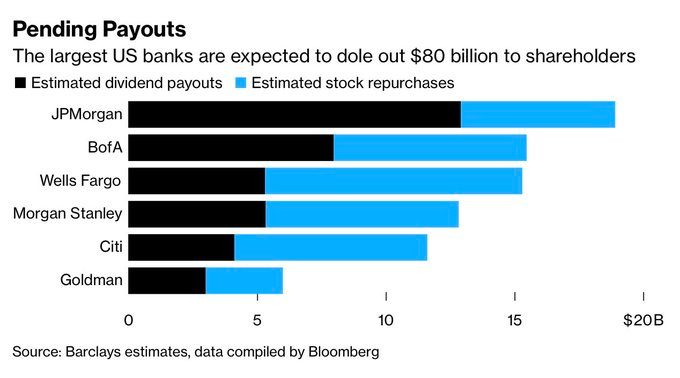

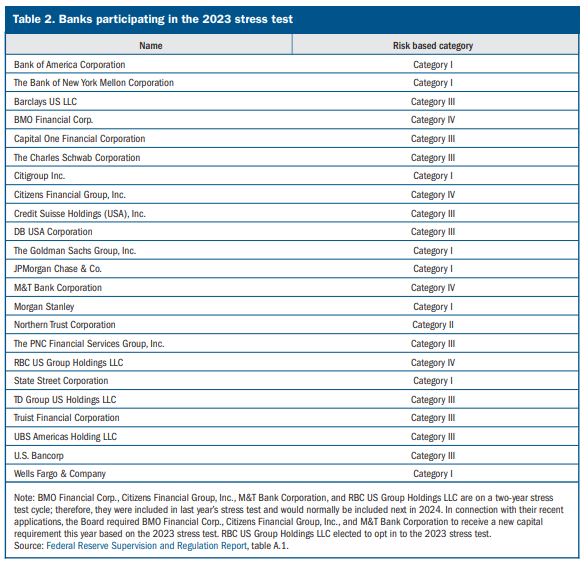

In a significant financial victory, Wall Street’s heaviest hitters have aced the Federal Reserve’s annual stress test. The simulated scenario this year postulated an escalation in the U.S. unemployment rate to 10%, along with a substantial 40% plunge in commercial real estate prices.

Furthermore, it envisaged the dollar strengthening against most major currencies. Clearing these hypothetical conditions allows the banks to reassess and update their strategies for buybacks and dividends.

Putin’s Strategic Moves Towards the Wagner Paramilitary Group

In a geopolitical chess move, Russian President Vladimir Putin is maneuvering to seize control of the Wagner paramilitary group. Russia’s government is engaged in intricate diplomatic dialogues to reassure its African and Middle Eastern allies that the operations of Wagner will persist under this new leadership. Wagner has served as a potent tool for Russia, helping to increase its sphere of influence while providing a veil of deniability for more unsavory activities. This is a valuable asset that Putin is reluctant to relinquish.

The Federal Reserve: An Ongoing Battle Against Inflation

In a financial update, Jerome Powell, the Chair of the Federal Reserve, has indicated that the Fed will likely persist in its course of increasing interest rates. Powell notes that previous hikes have not been operational for a long enough period to have a measurable effect on economic activity or inflation rates.

The Fed’s mission is complicated by the factors of stronger-than-expected economic growth, a tight labor market, and stubbornly high prices. Powell asserts that there is a long road ahead in the fight against inflation, predicting that the core Consumer Price Index (CPI) won’t return to 2% until 2025.

Microsoft’s Landmark Acquisition of Activision Blizzard Faces Hurdles

Microsoft’s monumental $69 billion acquisition of gaming titan Activision Blizzard is on uncertain terrain. Currently, the Federal Trade Commission (FTC) is meticulously scrutinizing the deal, suggesting that it could significantly reduce competition in the gaming industry. In a move to display cooperative intentions, Microsoft’s CEO Satya Nadella has vowed to keep the popular game “Call of Duty” accessible on all platforms. Conversely, Activision’s CEO hinted that the company could abandon the deal if the FTC successfully halts it.

New Trade Restrictions on AI Chip Exports to China: A Concern for the U.S.

The Biden administration is planning to impose stringent restrictions on exports of AI chips to China, a move sparked by fears that China could gain substantial leverage in AI technology and potentially weaponize it against the U.S.

This news has caused semiconductor stocks, which generate approximately 28% of their revenues from China, to dip, led by Nvidia’s downturn. Meanwhile, in China, AI technology has become the latest fixation for tech startups, entrepreneurs, and billionaires, who are pumping funds into this race against U.S. tech juggernauts like Google and Microsoft.

Media Access Blocked for Major Organizations at OPEC Conference

In a move that has stirred controversy and concerns around transparency, OPEC has once again denied accreditation to reporters from three major organizations – Bloomberg, Reuters, and the Wall Street Journal, barring them from covering its upcoming conference scheduled for July 5-6 in Vienna.

Surge in Oil Prices Following Major Reduction in U.S. Stockpiles

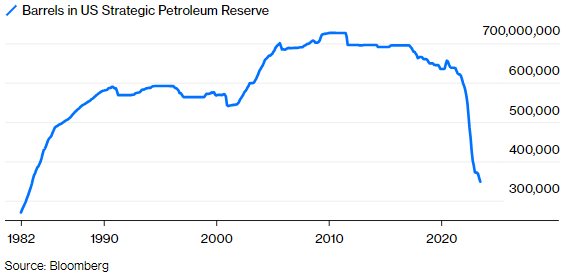

The oil market reacted swiftly to a significant decrease in U.S. stockpiles, leading to a surge in oil prices. Yesterday marked the most considerable reduction in reserves in two months, primarily attributed to a 9.6 million barrel decrease in crude inventories.

Adding to this, the Biden administration drew from the Strategic Petroleum Reserves for the 13th consecutive week. Over the past

You can bet on the general market movements via Portfolio Flagship that has no correlation to the equities, crypto and commodity markets.

Safe Trading

Team of Elite CurrenSea

Leave a Reply