Making Sense of Market Instability: Key Updates and Future Trends

As market trends oscillate between optimism and caution, a deep dive into various indicators helps provide a nuanced understanding of the economic landscape.

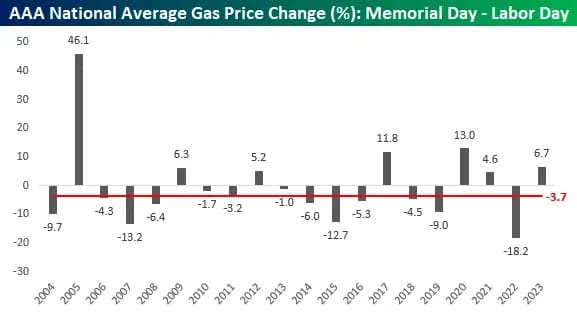

Consumer Sentiment Wobbles Amid Rising Fuel Prices

Last week, consumer confidence recorded a dip, according to data released by the University of Michigan. A major contributing factor? A spike in fuel prices. This could be indicative of mounting inflationary pressures that have the potential to erode purchasing power and subsequently weigh on economic recovery.

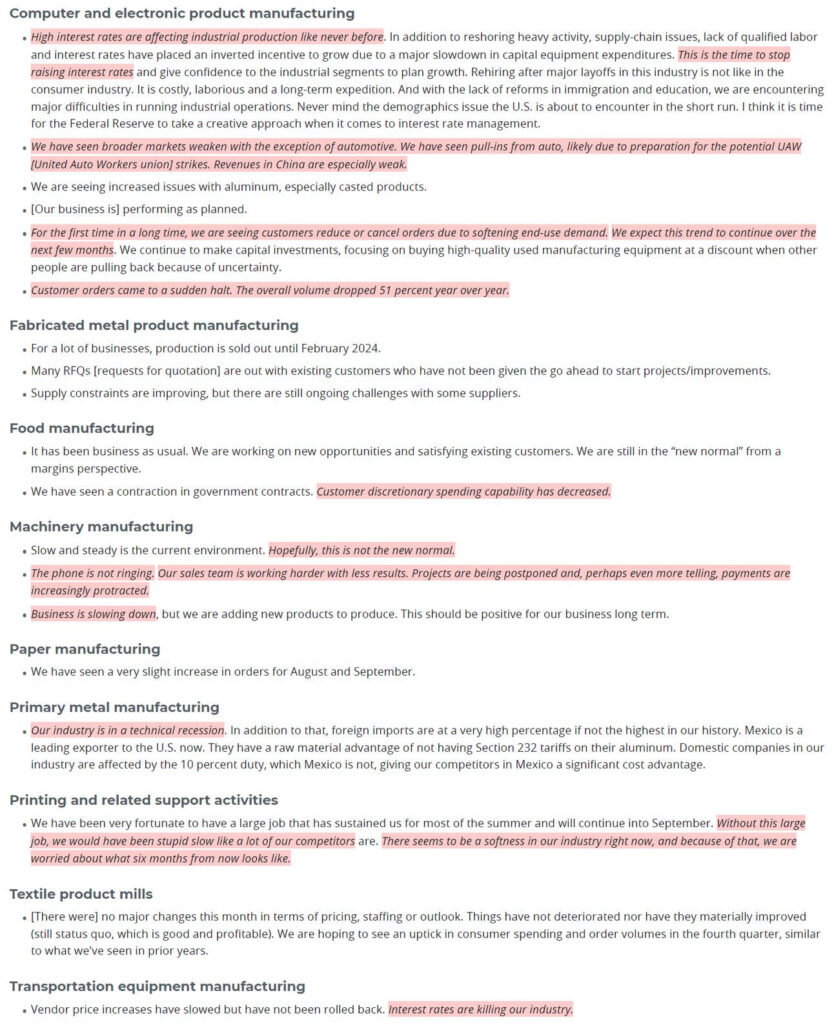

Manufacturing in Texas: A Mixed Bag

On the other hand, the Dallas Federal Reserve reported a surprising turn in Texas’ manufacturing activity, which saw its highest level in five months. Although the index improved to -17.2 in August, beating forecasts of a further decline, there are underlying issues that hint at tough times ahead for businesses. High interest rates and a weakening demand landscape make for a precarious situation, as seen in the production index, which has hit its lowest since May 2020.

Shaky U.S.-China Relations: A New Phase?

U.S. Commerce Secretary Gina Raimondo is on a mission to mend ties with Beijing. Her four-day visit aims to navigate through significant recent tensions between the two nations, especially concerning export controls. The goal is to increase transparency and limit misunderstandings by setting up an “information exchange,” marking a potentially constructive phase in U.S.-China relations.

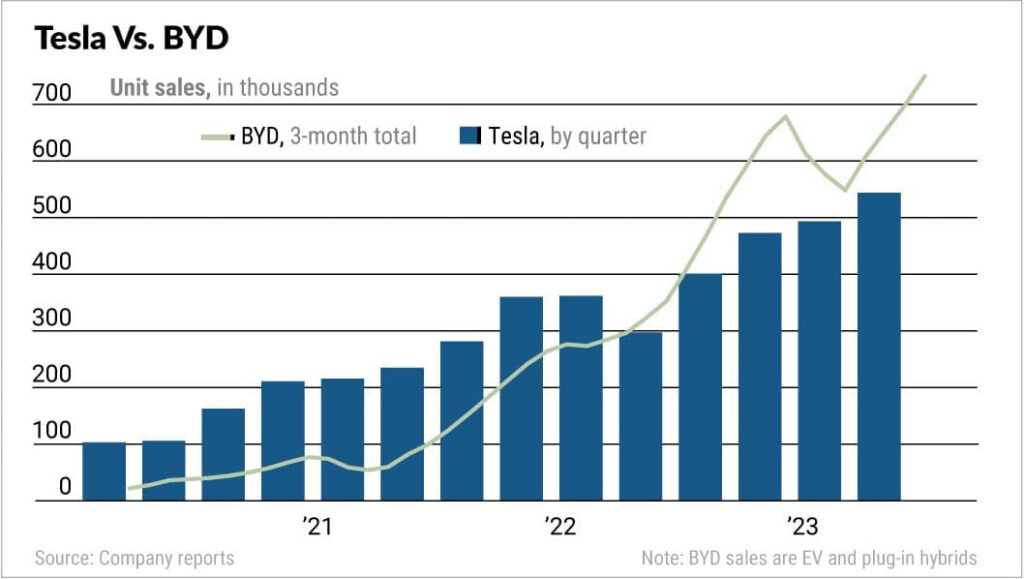

Not Just Tesla: Other EV Makers Surge

It’s not just Tesla that’s enjoying profitability in the Electric Vehicle market. China’s BYD saw a whopping 205% increase in earnings for the first half of 2023, alongside a 73% sales increase. The upswing in Chinese EV manufacturing indicates a shift in market dynamics that could have global repercussions.

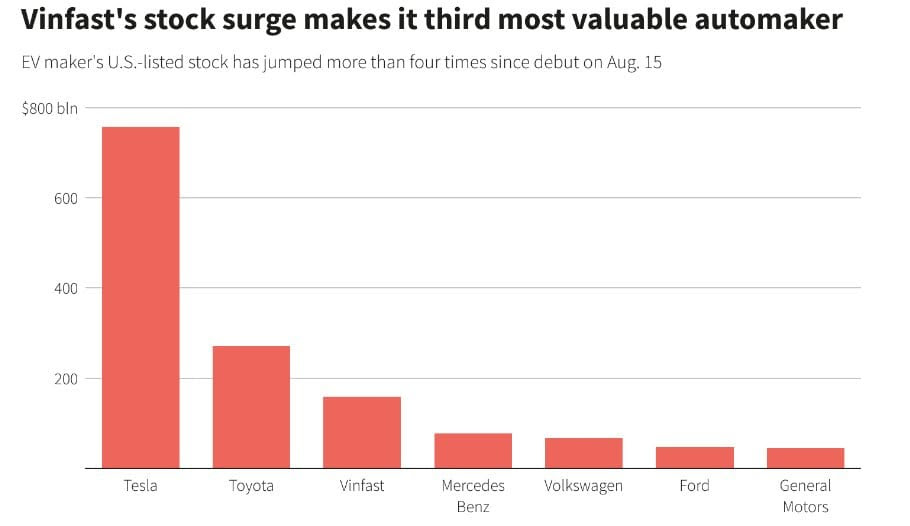

The VinFast Surge: A Meme Stock or a Real Contender?

VinFast Auto, a non-American automaker, has seen its stock price increase by nearly 700% since its debut less than two weeks ago. With the company now worth more than General Motors, Ford, and Stellantis combined, the question arises: Is this another meme stock, or is VinFast poised to disrupt the automotive industry?

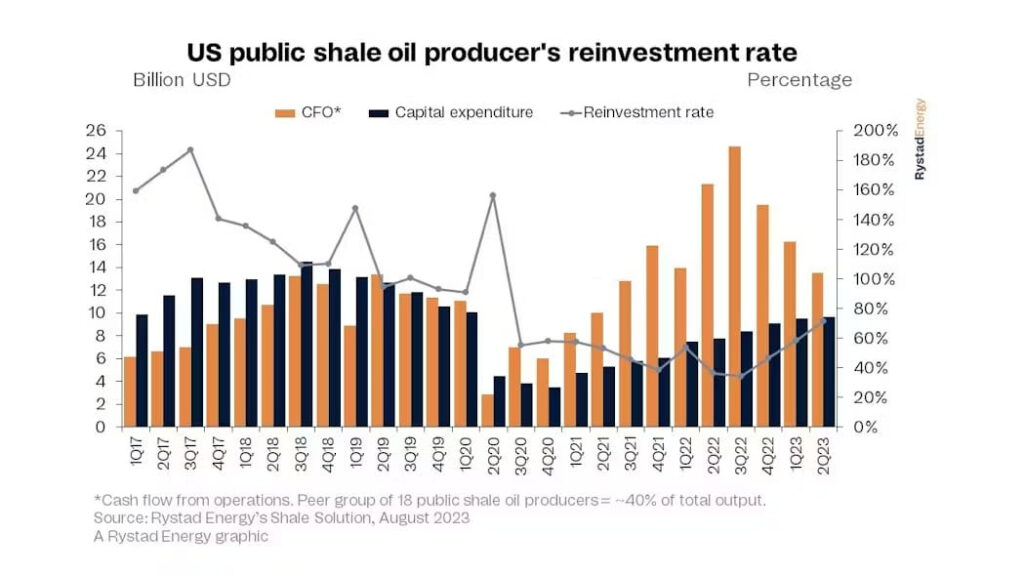

Oil Reinvestments: A Temporary Boost?

Lastly, Q2 saw a sharp increase in reinvestments in oil output growth, according to Rystad Energy. However, given the trends in rising oil prices and tightening supply, this trend is expected to reverse by year-end.

Safe Trading

Team of Elite CurrenSea

Leave a Reply