The Financial Titan: Carl Icahn – Successes, Failures, and Investing Philosophy

Investment holding company Icahn Enterprises has been accused of inflated unit valuations by 75%, with its last-reported indicative year-end net asset value being inflated by at least 22%, according to Hindenburg Research.

Carl Icahn is undoubtedly one of the most influential figures in the world of finance. With a career spanning more than half a century, he has earned both admiration and criticism for his aggressive and often controversial investment strategies.

Regardless of one’s opinion on his tactics, there’s no denying that his impact on the world of investing is substantial.

This article will explore the recent short against Ichan’s Icahn Enterprises L.P. We will also lay down our view on Icahn’s accomplishments, criticisms, notable trades, and his overall investing philosophy.

Yearly Performance Overview

Icahn Gets Hit Again as Bonds Fall, Lawsuits Pile Up:

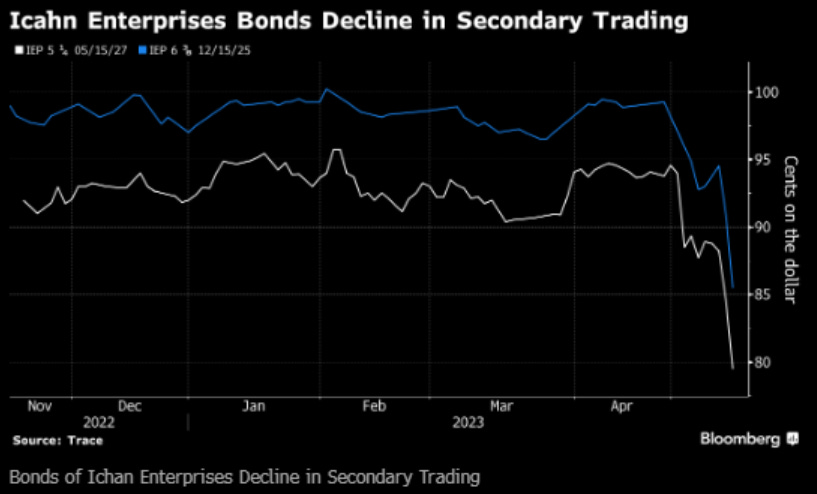

- Icahn Enterprises bonds dropped in high-yield secondary trading Thursday after Hindenburg Research issued another critical report saying it is short the firm’s debt.

- Icahn’s 5.250% bond due May 2027 declined 5 cents on the dollar to 79.5 cents as of 4:18 p.m. New York time, according to Trace data

- The company’s 6.250% bond due May 2026 fell 4.75 cents on the dollar to 85 cents

- Three other bonds also fell by at least 2.5 cents on the dollar

- Hindenburg Research said Carl Icahn’s investment firm failed to disclose enough in response to questions raised in its critical report

Hindenburg Research Short Bet

Investment holding company Icahn Enterprises has been accused of inflated unit valuations by 75%, with its last-reported indicative year-end net asset value being inflated by at least 22%, according to Hindenburg Research.

They also claim evidence of inflated valuation marks for less-liquid and private assets. Hindenburg found that IEP trades at a 218% premium to its last-reported NAV compared to other funds that trade at a discount or around NAV.

The company has come under criticism due to its unsustainable 15.8% annual dividend yield which has been maintained through open-market sales of IEP units via at-the-market offerings.

Icahn Enterprises L.P.

Icahn Enterprises L.P. is a diversified holding company owned by Carl Icahn. The company is engaged in a variety of industries including investment, automotive, energy, gaming, railcar, food packaging, metals, real estate, and home fashion. It’s worth noting that the company’s performance doesn’t directly reflect Icahn’s personal trading record, as it is one of many entities through which he invests.

Biggest Trades

Icahn Enterprises L.P. Sell Arguments

- The main issue with IEP, according to the analyst, revolves around dividends, which they believe shift the value of cash from the stock to cash separately in brokerage accounts.

- Despite IEP’s maintained distribution and promises to respond to the Hindenburg report, the analyst recommends caution when considering investing in IEP due to its lack of a margin of safety.

- Hindenburg report that there is an unjustifiable premium of around 100% based on current P/E multiples.

- Despite IEP’s maintained distribution and promises to respond to the Hindenburg report, the margin of safety remains a concern

Icahn Enterprises L.P. Buy Arguments

- Although Icahn Enterprises is expected to report weak Q1’23 earnings due to its focus on cyclical businesses, any counter-disclosures to Hindenburg’s allegations could support a bullish perspective.

- Before the short seller report, IEP had a low short interest ratio and a high cash value per-unit, suggesting a relatively attractive risk profile, despite the cyclical nature of its investments.

- Overall, IEP units could be an attractive investment opportunity for those seeking a high dividend yield and potential rebound.

Icahn Enterprises L.P. Biggest Trades

| Year | Note on Investments |

|---|---|

| 2021 | In the first half of 2021, Icahn Enterprises L.P. showed interest in the pharmaceutical company Bausch Health Companies Inc. |

| 2020 | In 2020, Icahn Enterprises L.P. made a significant investment in Xerox Holdings Corporation, but the pandemic affected the business significantly. |

| 2019 | Icahn sold a portion of his stake in Herbalife Nutrition in 2019, a company he had been involved with since 2013. |

| 2018 | In 2018, Icahn Enterprises L.P. sold its controlling interest in Federal-Mogul, an auto parts company, to Tenneco. |

| 2017 | One of the significant moves in 2017 was the sale of American Railcar Industries. |

Investing Philosophy

At the core of Icahn’s investment philosophy is the belief in the importance of shareholder activism. He firmly believes that shareholders should have a say in how companies are run and that boards and management teams should be held accountable for their decisions. He often invests in companies he believes are undervalued, then pushes for changes that he believes will increase the company’s value.

Praise for Carl Icahn

Icahn is widely regarded as one of the most successful investors of his time. His impressive career has been characterized by a series of high-stakes bets that have often paid off handsomely, earning him the reputation of a savvy businessman.

He is perhaps best known for his role as an activist investor. Icahn has frequently used his stake in companies to force changes in management or strategy, arguing that these changes would increase shareholder value. His interventions have often led to significant improvements in company performance and share price.

In addition, Icahn has been praised for his ability to spot undervalued companies and turn them around. His knack for identifying such opportunities has helped him amass a fortune estimated at over $20 billion.

Criticism of Carl Icahn

Despite his successes, Icahn has not been without his critics. His aggressive tactics have earned him the nickname “corporate raider,” a term that carries negative connotations in many circles. Critics argue that his interventions often prioritize short-term gains over long-term stability and can lead to job losses and other negative impacts.

There have also been instances where Icahn’s bets have not paid off. In such cases, his detractors argue that his influence can lead to significant losses for other investors.

Icahn’s Biggest Trades

Icahn’s investment career has been marked by several high-profile trades. Here are some of the most notable:

- RJR Nabisco: In the late 1990s, Icahn made a substantial profit after buying a large stake in the tobacco and food giant and pushing for a break-up of the company.

- Yahoo: Icahn famously purchased a significant stake in Yahoo in 2008 and successfully lobbied for the company to sell itself to Microsoft. Although the deal ultimately fell through, Icahn made a profit when he sold his stake.

- Netflix: Icahn bought a 10% stake in Netflix in 2012 when the company’s shares were in a slump. He sold his shares in 2015, netting a profit of over $1.5 billion.

In conclusion, Carl Icahn is a figure who evokes admiration and controversy in equal measure. His relentless pursuit of shareholder value has redefined the landscape of corporate America, and his influence on the world of finance is undeniable.

Safe Trading

Team of Elite CurrenSea

Leave a Reply