July Resilience: Markets, Tech Rivalries and Trade Wars Amid Independence Day Celebrations

As the fireworks of Independence Day light up the North American skies, the global markets and technology landscapes are ablaze with their own dynamics, resonating with resilience, rivalry, and strategic chess moves.

Unyielding Strength of the Markets

The Independence Day and Canada Day long weekend was an opportunity to pause and reflect on an astounding first half of the year. The stock market, with its uncanny resilience, remained unshaken in the face of adversity. The NASDAQ, for instance, recorded the strongest first half-year performance since the early 1980s. So, what does the future hold for the next six months?

The AI Trade Chess Match: US vs China

Just a week after the Biden administration announced plans for new restrictions on AI chip exports to China, it appears the stakes are being raised. The White House now aims to limit Chinese company access to US cloud-computing services using advanced AI chips, requiring US companies to get government approval before serving Chinese clients. Not to be outdone, China introduced its own export restrictions, including on minerals and metals essential for semiconductors, missile systems, and solar cells production.

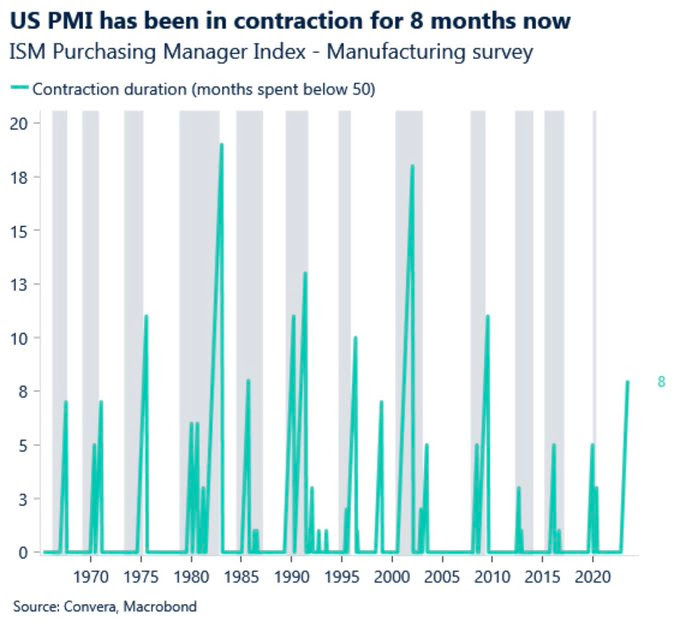

A Dip in US Manufacturing Activity

Manufacturing activity in the US has seen its longest streak of contractions in 14 years, with the ISM Manufacturing PMI reaching its lowest level since May 2020. Despite this, there is a silver lining: prices paid have contracted for the second consecutive month, which could spell good news for inflation.

The Battle of Titans: Musk vs. Zuck

This week, the rivalry between Musk and Zuckerberg takes a thrilling turn with the release of Meta’s Twitter competitor, Threads. Will this new platform, built on Instagram’s vast user base, pose a significant challenge to Twitter or end up like its predecessors, Mastodon, Truth Social, and others?

Noteworthy Market Movements

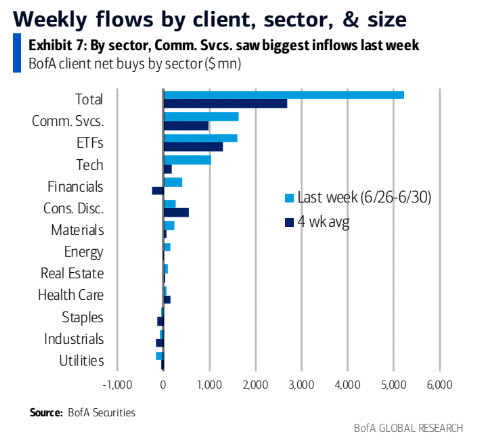

Last week saw Bank of America clients—including institutions, hedge funds, and wealthy individuals—purchase more US equities than any other week since October 2022. In contrast, the recent production cuts by Saudi Arabia and Russia have not had the expected impact due to weak demand, particularly from China, and fears over higher interest rates.

Snapshot of Current Developments

From S&P 500 CEOs’ median pay to travel advisories and EV deliveries, the first half of the year has been a whirlwind of activity. In the realm of digital assets, Bitcoin’s correlation with US equities is at a two-year low, and Monster’s acquisition of Bang Energy from bankruptcy signals a shift in the energy drinks market.

Safe Trading

Team of Elite CurrenSea

Leave a Reply