Investing Like Warren Buffett in Q1 2023

Retail investors may be pouring their money into the stock market right now, but with so many uncertain signals in the market, it might be wise to spread our investments around to other assets. To see what some of the biggest names in investing have been doing, we took a look at the latest 13F filings from Elliott Investment Management, Soros Fund Management, and Warren Buffett’s Berkshire Hathaway. Here’s what we found…

So, what were Elliott and Soros investing in?

Regulatory filings only track US-listed stocks and ETFs, so they don’t tell the whole story. But they do give an indication of where the big money has moved over a given quarter.

Elliott and Soros both disclosed new positions in corporate bond ETFs. That makes sense, considering that higher interest rates have made the yield on these assets much more attractive.

The Soros fund bought about $255 million worth of the iShares iBoxx $ Investment Grade Corporate Bond ETF (ticker: LQD; expense ratio: 0.14%) in the last three months of 2022. Elliott, which already owned about $234 million in the ETF (around 2.7% of its US portfolio), invested roughly $500 million in the iShares iBoxx High Yield Corporate Bond ETF (ticker: HYG; expense ratio: 0.48%).

iShares iBoxx $ Investment Grade Corporate Bond ETF (white line) and the iShares iBoxx High Yield Corporate Bond ETF (blue line). Source: Bloomberg.

Both ETFs have seen gains from their fourth-quarter lows, as expectations rose for low inflation, a peak in interest rates, and a soft landing. But more recent economic data in the US has shifted the outlook again, with investors now expecting inflation to be more stubborn and the Federal Reserve raising rates further. That’s caused a dip in the prices of both ETFs. LQD offers a 5.46% annual yield, while HYG yields 8.5%, but we should be careful – higher interest rates can push these ETFs lower.

So, how can we take advantage?

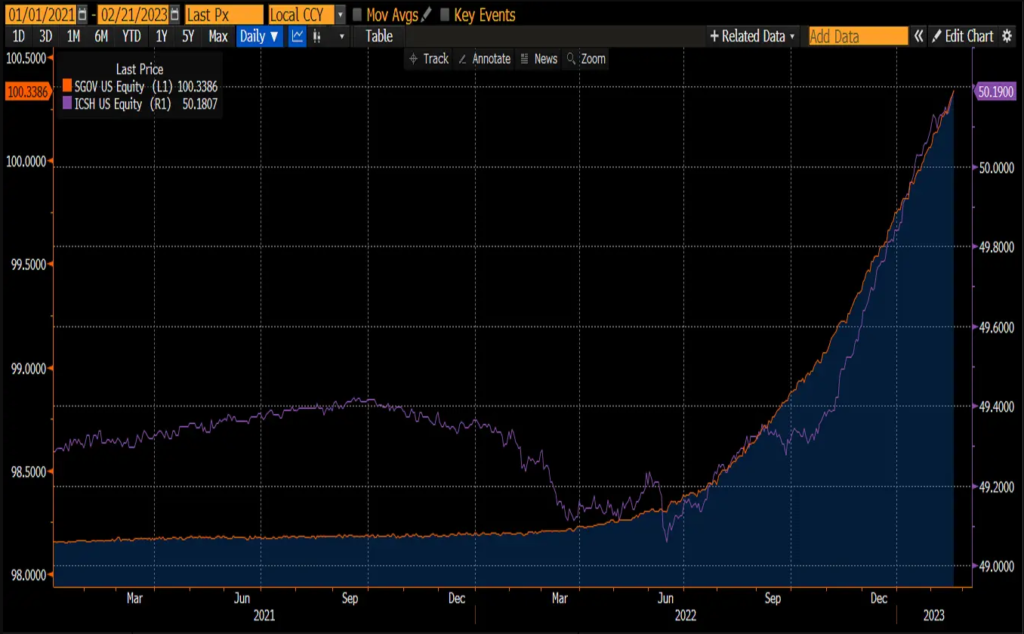

If we think interest rates will rise (or at least stay up for longer), we might want to look at very short-term bond ETFs instead. The Blackrock Ultra Short-Term Bond ETF (ticker: ICSH; expense ratio: 0.08%) invests in bonds with an average maturity of less than six months, while the iShares 0-3 Month Treasury Bond ETF (ticker: SGOV; expense ratio: 0.05%) only holds US Treasury bonds with a maturity of less than three months. Both offer a 4.7% annual yield – not bad, and much better than the 4% we’d get from the most generous savings accounts.

The iShares 0-3 Month Treasury Bond ETF (orange line) and Blackrock Ultra Short-Term Bond ETF (purple line). Source: Bloomberg.

The 13F filings don’t show us whether Soros, Elliott, or anyone else is investing in individual bonds. But we could consider adding them to our portfolio. Fidelity, for example, offers a wide variety of individual bonds that allow us to choose the maturity date that suits our needs, potentially reducing our risk.

OK, but what did Warren Buffett do last quarter?

Buffett’s moves are always worth examining. Berkshire Hathaway’s 13F shows it had a relatively quiet quarter, after buying $66 billion in stocks in the first nine months of the year. It increased its positions in Apple, Louisiana Pacific, and Paramount Global, while decreasing its holdings in some financial stocks, including US Bancorp and Bank of New York Mellon. The real surprise was that it sold around 80% of its position in Taiwan Semiconductor Manufacturing Company (TSMC), which it had only just bought in the previous quarter.

So, how can we take advantage?

We think Berkshire’s activity in late 2022 sends a clear message: be wary when others are greedy, and be ready to take advantage when they’re fearful. If Buffett’s team didn’t see fit to add to its holdings last quarter, that could be a signal to be more cautious. If we see investors getting a bit greedy, it could be worth looking into corporate bonds – or Berkshire Hathaway’s stock.

Safe Trading

Team of Elite CurrenSea 🇺🇦❤️

Leave a Reply