Interpreting NFP (Non Farm Payroll)

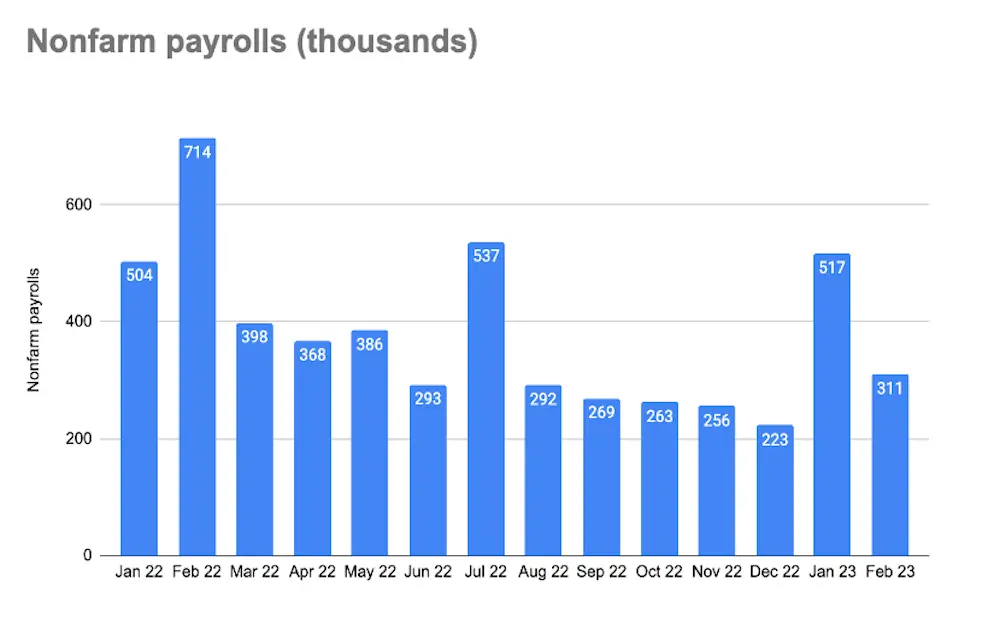

The US job market remains robust according to the latest jobs report released on Friday. The economy added 311,000 jobs in February, surpassing most economists’ expectations. However, the report also revealed some signs of softness in the labor market.

The unemployment rate edged up slightly to 3.6% from 3.4% in January. Average hourly earnings also rose at a slower pace, increasing by 0.2% month-over-month compared to a higher increase the previous month.

Despite these weak spots, the job market remains strong overall and inflation seems to be cooling. If these trends continue, the US may achieve the ideal scenario of a strong job market along with lower inflation. While this outcome seems optimistic, the US did experience many years of low inflation and a strong job market before the pandemic.

The Federal Reserve is still concerned that a tight labor market could lead to substantial wage increases, higher consumer spending, and runaway inflation.

The latest jobs data is unlikely to change the Fed’s view. As such, the Fed is likely to raise interest rates by 0.5 percentage points in March. Investors should remain cautious about interest-sensitive investments like growth stocks.

Safe Trading

Team of Elite CurrenSea 🇺🇦❤️

Leave a Reply