Huawei’s 5G Leap & Financial Tremors: What’s Shaking the Market

In a rapidly changing global landscape, Huawei’s latest tech foray into 5G signals a shift in power dynamics, while risky bets in the bond market and fluctuating economic predictions prompt a re-evaluation of our financial futures.

Huawei Challenges Sanctions with New 5G Chip

Huawei’s recent unveiling of the Mate 60 Pro smartphone, boasting potential 5G capabilities, has raised eyebrows worldwide. Its bold defiance of U.S. sanctions could signal shifting dynamics in the tech race, especially with China being a crucial market for competitors like Apple.

Historically, Huawei faced mounting challenges from the U.S., which flagged the tech giant as a potential national security risk. This stemmed from Huawei’s alleged affiliations with China’s government and military. These allegations culminated in 2019 sanctions that severely hampered Huawei’s access to essential 5G chips and Google’s proprietary software.

Fast forward to today, and it seems Huawei may have found a way to navigate these hurdles. Though it remains unconfirmed, emerging reviews hint that the Mate 60 Pro can indeed reach 5G download speeds. Its chipset, crafted by China’s leading contract chipmaker SMIC, has surprised U.S. experts, as its creation was thought impossible without a particular ASML machine – a machine forbidden for sale to China.

Analysis: With Apple grappling with its challenges, such as the Chinese ban on iPhones for governmental personnel, a strong comeback from Huawei could be a game-changer. As Huawei rides on both technological prowess and national pride, the upcoming months could spell intense competition and potential shifts in the tech world.

Hedge Funds’ Risky Play in the Bond Market

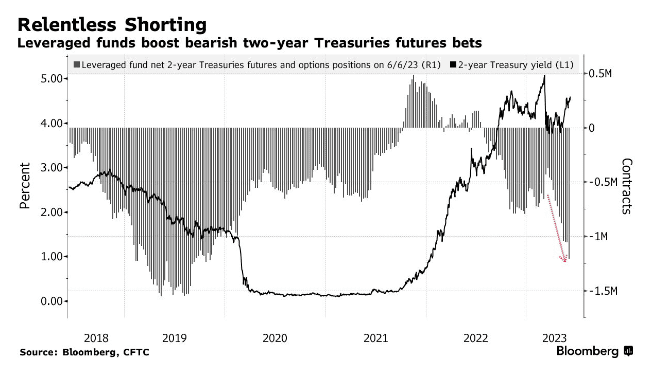

In the vast expanse of the $25 trillion bond market, hedge funds seem to be taking increasingly precarious positions. Current data reveals record-high “short” bets on specific Treasury bonds, with the cumulative amount touching approximately $600 billion, as per the Bank for International Settlements (BIS).

The BIS report shines a spotlight on the rising popularity of the “basis trade” strategy among hedge funds. This technique capitalizes on minimal price variances between Treasury bonds and their corresponding futures contracts. The principal concern revolves around the excessive borrowed capital (or “margin”) that these funds use to amplify potential gains – a strategy fraught with risk.

Analysis: If history is any indication, these high-stake bets can precipitate market upheavals, as witnessed during the initial stages of the COVID-19 pandemic. As hedge funds tread this razor-thin line, financial markets worldwide will undoubtedly be monitoring the situation closely.

Global Economic Pulse: Upbeat Now, Caution Ahead

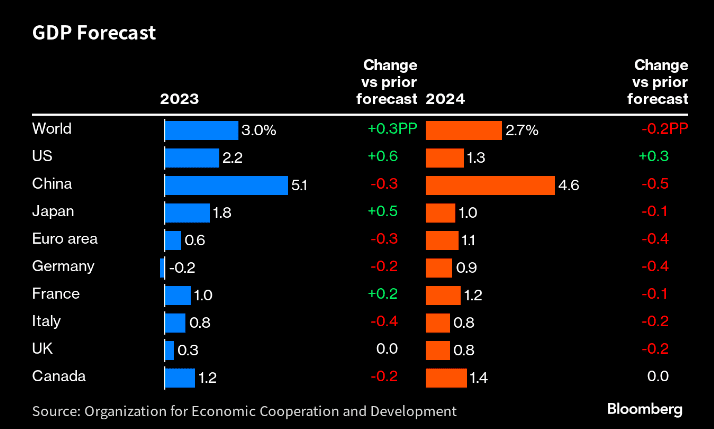

The OECD’s latest projections paint a mixed picture for global economic health. While the immediate future, specifically 2023, appears promising with a 3% rise in global GDP, caution looms with a predicted drop to 2.7% in 2024, largely attributable to the rapid rate hikes seen in recent times.

However, predictions are not cast in stone. With variables like the recent 25% spike in oil prices influencing inflation and growth rates, the future remains unpredictable.

Analysis: While one might be tempted to take economic predictions at face value, it’s prudent to consider the myriad of influencing factors at play. From surging oil prices to geopolitical developments, the financial landscape remains ever-evolving.

What’s Next in the Financial Calendar

- Today: Key events to watch include Housing Starts, Building Permits, and earnings from AutoZone.

- Wednesday: Anticipate the FED rate decision and earnings from giants like FedEx and General Mills.

- Thursday: A significant day with the Bank of England’s rate decision on the horizon.

- Friday: Keep an eye out for the Bank of Japan’s rate decision.

Safe Trading

Team of Elite CurrenSea

Leave a Reply