How You Can Profit Trading Japanese Inflation Worries

For two decades, Japan has kept interest rates at zero in its battle against deflation. However, the Bank of Japan’s (BoJ) unexpected decision on Tuesday is a sign that the situation is beginning to shift. With this new development, Japan looks more and more intriguing (no wonder Warren Buffet has doubled down on it recently). Here’s how you can seize the opportunity!

What’s Up With Japanese Inflation Levels?

On Tuesday, the Bank of Japan caused shockwaves in the investment community when they announced they were doubling the band of their existing bond yield control policy. Yields can now fluctuate as far as 0.5% higher or -0.5% lower, compared to the former 0.25% ceiling.

In Japan, bond yields have been stagnant for over two decades – since the Bank of Japan (BoJ) set interest rates to zero in February of 1999. Despite the soaring yields in other developed nations this year, the BoJ made clear last week the importance of maintaining low borrowing costs so the government can finance the economy and help stimulate growth. Today marks the nation’s first episode of inflation in almost 23 years, and the BoJ has acted to raise rates in response. Quite a huge move indeed!

How To Interpret This?

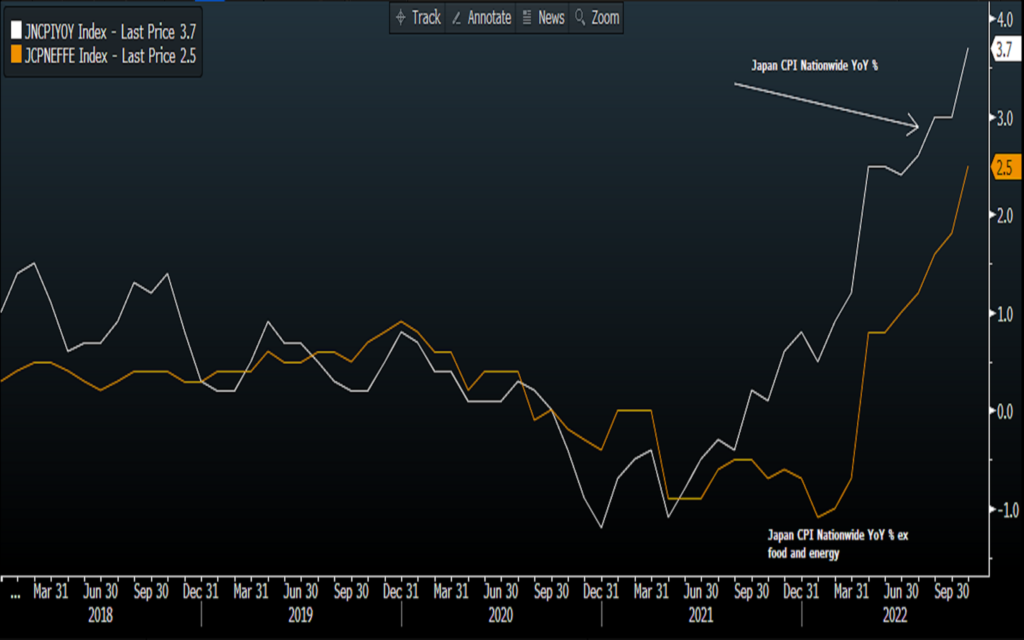

Japan’s inflation (white line) rocketed to an eye-opening 3.7% in October, compared to the year prior, far surpassing the Bank of Japan’s 2% target. On the other hand, the core measure of inflation (orange line), which excludes the more volatile food and energy prices, was recorded at 2.5% in October in comparison to the year before, and is anticipated to climb to 2.8% in November.

In comparison to the US and Europe, who have already launched rate-hiking campaigns to control their out of control inflation rates, Japan’s inflation is comparatively tame, sitting at much milder rates. This increase has still come as a surprise to the country, which has traditionally seen very minimal inflation.

On Tuesday, the Bank of Japan (BoJ) took the initial step towards a less accommodative stance on policy, which some have interpreted as a signal for higher interest rates in the future. However, BoJ Governor Haruhiko Kuroda insisted that the move was not an indication of higher rates ahead, maintaining his belief that the current yield curve control policy, even with a wider range, is maintainable in the long-term.

Reports have been swirling around suggesting that Prime Minister Fumio Kishida may seek to modify the 10-year-old agreement which compels the central bank to reach a 2% inflation target as quickly as possible. Although authorities have denied these rumors, further reports have arisen that policy revisions could possibly be taking place in 2023. The old proverb “no smoke without fire” is a sign that something is bound to change.

How This Occurrence Translates Into Market Moves?

On Tuesday, after the Bank of Japan declared their news, Japan’s 10-year yield soared to the top of the recently expanded range, concluding the trading day at 0.4%. This also sent the yen skyrocketing by approximately 3% to approximately 133 to the US dollar.

The Fed’s decision to raise interest rates since March has widened the gap between US and Japan bond yields, causing the US dollar to rise and the yen to plummet, resulting in benefits for large firms with overseas operations but creating a burden on households and domestically focused firms who must pay higher prices for imported goods. Alleviating this pressure, the BoJ could potentially provide a sense of relief.

In a rare move, the central bank intervened in the currency market twice in September and October – buying yen to prop up its value – which was the first time the Bank of Japan had done this since 2011.

How to Trade a Possible Interest Rate Hike Or/And Higher Inflation in Japan?

The Japanese yen is on the rise – and the opportunities to benefit from its recent gains are growing! BoJ’s yen-buying, a falling greenback, and higher inflation and rate-hike expectations are all contributing to the yen’s ascent. With the 10-year bond yield’s trading band doubled this week, the yen’s future is looking even brighter.

If you want to capitalize on the yen’s surge, one of the easiest ways to do so is to “get long” the yen. You can trade currencies directly with your broker, or invest in a currency-focused ETF like the Invesco CurrencyShares Japan ETF (ticker: FXY; expense ratio: 0.4%).

Considering investing in Japanese banks could be a great gift for your portfolio this holiday season! With interest rates close to zero for two decades, their returns have been lacklustre, but at a 9x price-to-earnings ratio, 0.5x price-to-book ratio and a 4% dividend yield (plus share buybacks), Mitsubishi UFJ Financial (MUFG US) could prove to be an advantageous addition.

Last time USD/JPY was reacting to the inflation worries and lower-than expected inflation numbers in US, we caught a good move on the news. You can tap into our Japanese bets (and many more) by investing in Portfolio ECS.

Safe Trading

Team of Elite CurrenSea 🇺🇦❤️

Leave a Reply