How to Bet on AI In 2023

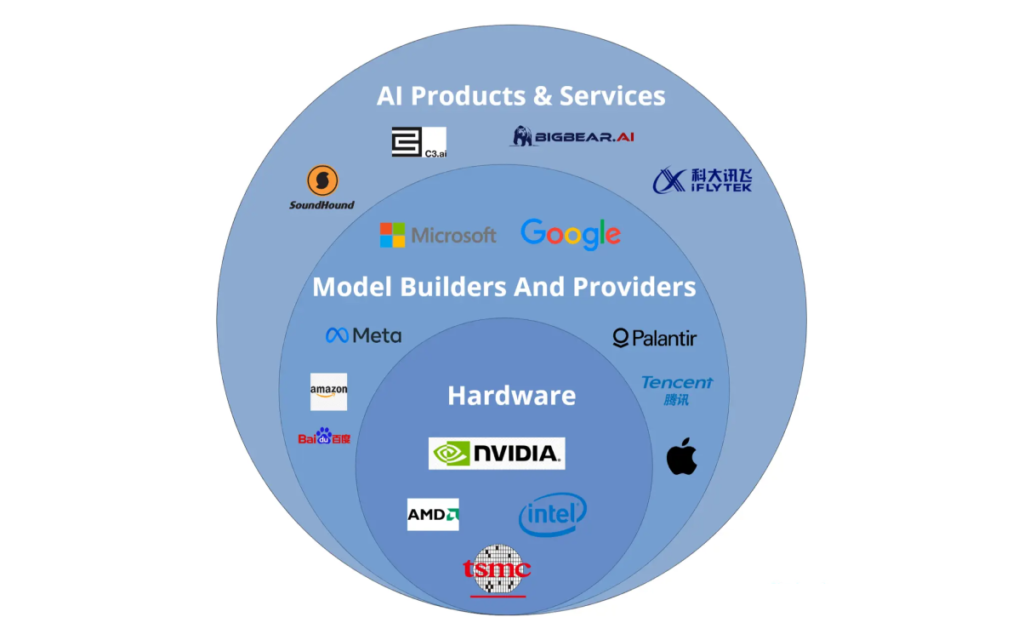

This ecosystem comprises three groups: companies that sell AI as a product or a service, companies that build AI models and develop the wider infrastructure, and companies that are building the hardware necessary for it all to function. In continuation of our article on how to invest in AI with Nvidia stock, here’s a more extensive read for the weekend.

AI products and services

If you want to invest in AI, you probably want to invest in stocks that are directly exposed to it. The good news is that there are some companies whose revenues are driven by AI. The bad news is that there is only a handful of them. And they’re very hyped.

Here are some of those “pure-play” stocks:

C3 AI helps businesses use AI to solve their problems. It provides a platform and applications that make it fast and easy to build and deploy AI solutions. And because its technology can be applied to a wide range of use cases and industries, it could lead to a ton of growth opportunities for the company.

Soundhound develops voice-enabled technologies (i.e. using your voice to talk to machines) and music discovery apps. It makes money by licensing the technologies to other brands and by offering premium features to its app users. The company has a competitive edge in voice AI and is partnering with big global brands. Thanks to a big cost-cutting program, it expects to make its first-ever profit in 2024.

BigBear.ai helps its customers collect and better understand their data, so they can make better decisions. It’s got a growing list of big-name customers across industries, including national defense, intelligence, healthcare, and manufacturing, from both the public and private sectors.

iFLYTEK is a Chinese tech company that creates voice recognition software and intelligent speech products for all kinds of companies, from industries such as education, communication, music – even intelligent toys. And it has an impressive list of clients, including Chinese giants Huawei, Xiaomi, Tencent, and Alibaba.

Of course, there are also companies out there that are less pure-play investments, but still very much have their hand in. For example, Adobe developed an AI platform that helps its users with projects such as marketing and design. Salesforce has its own AI platform, which helps users personalize product results for customers. Some stocks in the cybersecurity space, like Fortinet, CrowdStrike, and the UK’s Darktrace, are also leveraging AI to improve their work. Companies like UiPath use AI to provide software solutions for robotic process automation, while Dynatrace uses it for cloud-based solutions.

The pros: The available revenue opportunity for these firms is massive and growing, and they have room to expand quickly, both by selling current products to new clients and by developing new products. Each of these companies has also developed some competitive edge in some niche. What’s more, with so few companies out there that offer direct exposure to AI, these firms are also more likely to benefit from money flowing into the investing theme.

The cons: Competition in the AI space is getting hot and is coming not just from Big Tech, but also from innovative startups. Many of those pure plays are young, have a limited track record, and are difficult to value. With technology evolving so quickly, not all of those firms are likely to still exist a decade from now. And at current stock valuations, I’m not sure you’d be adequately compensated for those risks.

Big tech model builders and providers

Developing AI models requires deep pockets, huge datasets, and specialized know-how: three things that Big Tech has plenty of (or can easily acquire). Those tech giants aren’t just developing models, but they’re also building the infrastructure around them and leveraging the technology across a range of use cases.

Microsoft is in a prime position to be a leading AI model developer through its exclusive partnership with OpenAI and its cloud service. This is about more than just bringing new revenue: Microsoft is gaining crucial expertise and is investing big in the infrastructure of the future. By integrating OpenAI’s ChatGPT into its search engine Bing and its productivity apps, Microsoft could also gain market share and boost its profits in the not-so-distant future.

Alphabet is mostly ahead of the game, having integrated AI and automation into virtually every aspect of its business, including ad pricing, content promotion, and Gmail spam filters. The Google parent owns AI software subsidiary DeepMind and autonomous vehicle company Waymo, and is conducting cutting-edge research in robotics, EVs, and quantum computing. It’s also finally launched Bard, a direct competitor to ChatGPT. And sure, a ChatGPT-powered search engine could pose a threat to search advertising, Google’s primary revenue source. But if there’s one firm that’s unlikely to be made redundant by AI, it’s Alphabet. This company invented the transformer, the key technology behind the latest AI models, after all.

Meta could also be a winner. It’s invested big bucks into an AI lab and it may soon pay off. In fact, the Facebook parent has just released a slick AI model designed to help researchers make new discoveries. Meta also plans to create more products from AI, especially in augmented reality and virtual reality, which are part of its vision for the metaverse. But it could benefit most from investing in personalization and customized content. Indeed, it could even reach a point where it creates personalized content from scratch.

Other Big Tech companies might benefit indirectly. Apple has snapped up several AI companies and could use the tech to augment what it does. One interesting use case is how it used the image creation open-source software Stable Diffusion, adding it into Apple devices and making it easy for small independent app makers to build new businesses.

Amazon has also integrated AI across its business, including in its personalized product recommendations, e-commerce search algorithms, virtual assistant (Alexa), its warehouse robotic arm (Sparrow), and its cloud computing service (AWS).

Palantir is a top AI-powered data analytics software company that helps customers analyze huge amounts of data, make better decisions, and solve complex problems.

And of course, Tesla’s working on a humanoid robot, self-driving cars, and the possibility of an Airbnb– and Uber-like robot taxi service

While arguably a year or two behind in terms of leveraging AI technology, China has also some strong players. Tencent is expected to benefit from AI, in part by improving gaming algorithms, enhancing medical diagnosis, promoting industry cooperation, and creating AI breakthroughs for enterprises. Alibaba and Baidu (which is expected to launch a ChatGPT-like product this month) are both well-positioned in the space.

Pros: Deep pockets, top talent, and huge datasets put tech giants in a great position to develop advanced AI technologies that could be used in all kinds of ways by all kinds of companies. By providing the base-layer infrastructure, they’ll allow other companies to build their own specialized applications on top of it, giving these giants an even bigger slice of the pie. I mean, let’s face it, if AI does proliferate across all industries – as it’s widely expected to – then Big Tech is likely to benefit massively. If AI needs a platform, Big Tech will provide it. If AI can disrupt industries, Big Tech will facilitate it.

Cons: It may take some time before AI represents a big chunk of Big Tech’s revenues, and it’s unclear whether AI will ever become a true game-changer for those businesses. Plus, with the costs of developing an AI infrastructure already falling fast, Big Tech’s giants are also likely to face increasing pressure from competitors. And things can change very quickly in this space.

Hardware (i.e. picks and shovels)

During the gold rush, the best business model wasn’t to search for gold yourself. It was to sell picks and shovels to hopeful prospectors. As providers of the hardware that is necessary to train and run AI, semiconductors, hardware, and networking-infrastructure firms are the “picks and shovels” of AI.

Nvidia is a prime example and it’s likely to be one of the biggest winners in AI. The company specializes in designing essential hardware like graphics processing units. Known as “GPUs”, these are specialized computer chips that help computers process and display graphics quickly and efficiently – and they’re essential to training and running deep-learning models. And Nvidia doesn’t just design better chips. It also has one of the best AI ecosystems and it keeps improving it. In fact, most of the tools available to developers in the AI field are likely to involve Nvidia’s software and hardware platform in one way or another.

Of course, it’s not all alone in this field: Advanced Micro Devices and Intel are also key players here. They’re just not as exposed to AI.

Another potential big winner is the Taiwan-based TSMC, which is the primary manufacturer of high-end chips worldwide, including those from the companies mentioned above.

Pros: For such an early-stage technology, betting on the picks and shovel seems safer than betting on the end-use cases. Generative AI is creating a huge new market and building strong demand for these companies’ products. And because major semiconductor firms already have a well-established business, their stocks are less speculative than some direct plays would be.

Cons: Although an important source of growth, AI still doesn’t drive most of those firms’ revenues. Also, don’t forget these businesses are cyclical and would be highly exposed to a possible economic recession. They could also have less upside compared to pure plays or Big Tech stocks, even though they’re facing similarly intense pressures from competition or rapid tech changes.

ETFs

Since there are so few “direct-play” companies, it’s probably not a surprise that there aren’t any ETFs that focus purely on AI. But if you don’t mind holding some robotics companies and a mix of firms that are (in some cases loosely) linked to AI, you do have a few options.

For a diversified bet, you might consider the iShares Robotics and Artificial Intelligence ETF (ticker: IRBO; expense ratio: 0.47%). It holds shares in more than 100 companies and has significant exposure to smaller, international firms.

If you prefer a more concentrated alternative, the Global X Robotics & Artificial Intelligence ETF (BOTZ; 0.68%) holds 37 stocks, with its top five (Upstart Holdings, Nvidia, Intuitive Surgical, Keyence, and ABB) accounting for about 40% of the fund’s assets.

If you’re willing to wait a few weeks, VanEck plans to launch a Conversational AI, AI and Innovation ETF (CHAT), which will be actively managed and target “conversational” AI similar to ChatGPT.

In the meantime, if you want a more actively managed approach, you might look into the ARK Next Generation Internet ETF (ARKW; 0.88%) and the ARK Autonomous Technology and Robotics ETF (ARKQ; 0.75%). Although in our view, the broader **ARK

ARK Next Generation Internet ETF (ARKW; 0.88%) and the ARK Autonomous Technology and Robotics ETF (ARKQ; 0.75%) may be a bit too broad and speculative for many investors’ tastes.

Pros: ETFs offer instant diversification in an early-stage, high-risk space. They also provide exposure to smaller companies and international players that would otherwise be difficult to access. And by investing in a basket of stocks rather than individual companies, ETFs reduce the risk of picking losers.

Cons: ETFs also dilute your exposure to potential winners. And given how fast technology is evolving, an ETF’s holdings could quickly become outdated if it’s not actively managed. Fees tend to be higher for actively managed funds. What’s more, even actively managed ETFs may struggle to keep up with the pace of change in AI.

Challenges of Investing in AI

AI is unlikely to prove temporary, but technological, regulatory, and even ethical challenges could hamper its progress relative to the expectations of many.

More vitally, even if AI as a technology fulfills its promise, AI as an investment might not.

First, an appealing narrative doesn’t always produce an appealing investment. To generate attractive returns, you must buy a solid business and obtain it at a good price. The issue is that price is heavily influenced by narratives, which can be misleading and can lead investors to overlook important factors (valuation, for example, or business quality). The more widely a narrative is accepted, the more likely prices are to diverge from fundamentals, and the more likely returns are to disappoint.

Second, it’s difficult to anticipate who the biggest winners and losers will be. Netscape and AOL – the undisputed leaders in the early days of the internet – weren’t the biggest beneficiaries of the new technology. Consumer companies like Amazon and Apple were, having leveraged the power of the internet to create new markets and business models that few had anticipated. The biggest winners of AI are probably still off the radar and may come from completely different fields, like healthcare or biology.

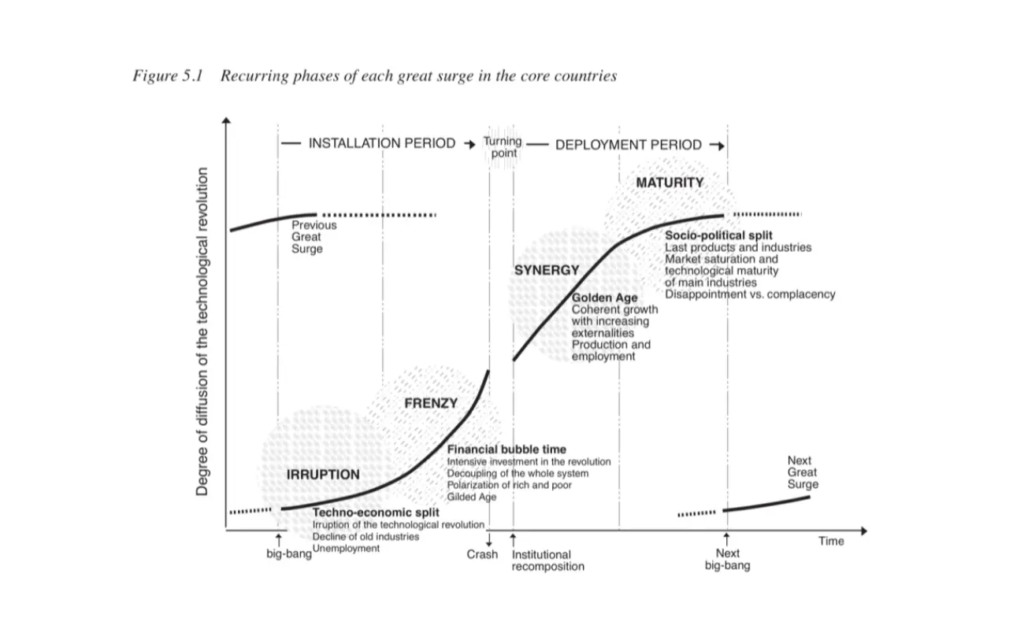

Third, technological revolutions are messy. When a new technology emerges, its success depends not only on its technical capabilities, but also on social, economic, and political factors that are tricky to predict. Economist Carlota Perez says tech revolutions typically follow four phases, with a necessary “reset” period involving a financial crash and a shift in political and societal factors. If Perez is right and we are at that turning point, we might first experience the burst of a bubble and a widely volatile period before enjoying any golden AI age.

Conclusion

AI has enormous potential and could be one of the most exciting investment themes of the decade. However, it is also an early-stage, fast-evolving space that comes with significant risks. So while the opportunities are huge, you need to tread carefully.

Our recommendations would be:

- Focus on the picks and shovels: companies providing the infrastructure, hardware, and tools necessary to develop and run AI applications. They are a safer bet and still offer plenty of upside.

- Consider the leaders in the space, especially those with a competitive advantage and broad applications: companies like Microsoft, Alphabet, Meta, and Nvidia are in pole position. But keep in mind that tech changes fast, and today’s leaders may not be tomorrow’s.

- For more diversification, ETFs can be an option. But make sure they are actively managed and can keep up with the pace of change.

- Only invest what you can afford to lose. AI is a risky space, and there is a good chance that not all of today’s hyped companies and technologies will still be around in a decade.

- Keep learning. This is a fast-evolving field, so you need to keep up to date with the latest technologies, use cases, and companies if you want to invest in AI successfully.

While I believe that AI will be hugely impactful in the coming years and represent an exciting investment opportunity, it really isn’t for everyone. If you’re looking for a “set it and forget it” type of investment or want to avoid volatility, AI probably isn’t your best bet. But if you’re willing to put in the work to research the space and accept the risks, AI could be very rewarding. Just go in with your eyes open.

Safe Trading

Team of Elite CurrenSea 🇺🇦❤️

Leave a Reply