Housing and Economic Trends: A Deep Dive into Current Market Dynamics

In the dynamic landscape of 2023, the U.S. housing market and economy present a tapestry of contradictions, challenges, and opportunities that investors and observers cannot afford to overlook.

The Great Housing Paradox

U.S. housing affordability has plummeted to a 40-year low, with the average 30-year fixed mortgage rate skyrocketing to 7.5%. Yet, in a surprising twist, the housing market valuation has reached an astonishing $47 trillion. The reason? Limited supply. This year has seen only 1% of homes sold change owners, marking a decade low, as revealed by Redfin’s recent data.

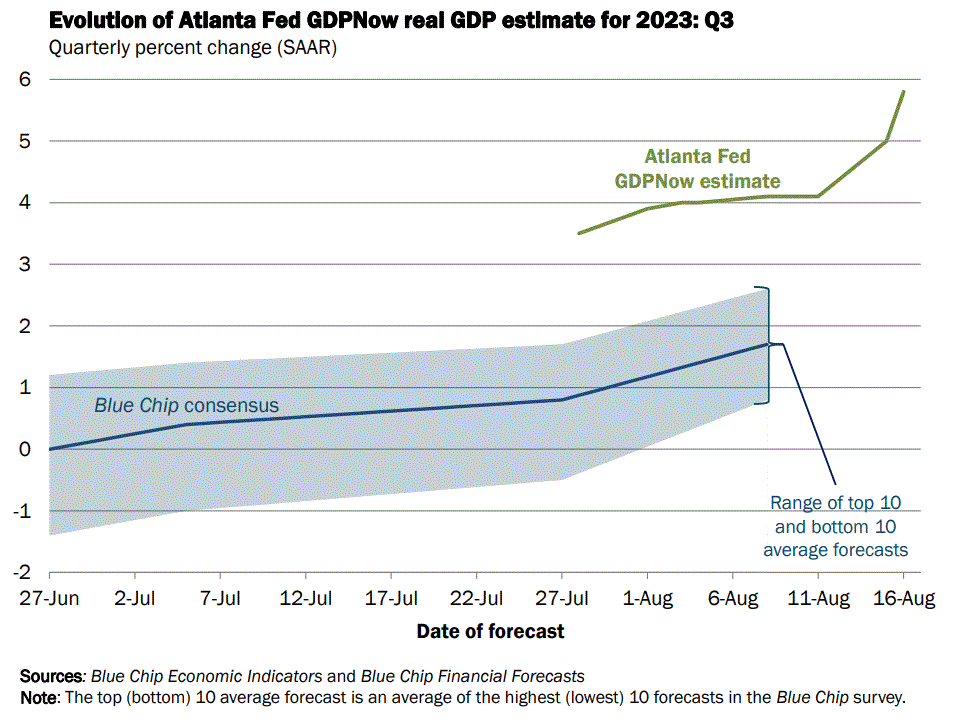

Atlanta Fed’s Bullish Outlook

Despite the housing market’s strains, there’s a silver lining on the horizon. The Atlanta Fed’s GDPNow model projects an impressive 5.8% GDP growth for Q3. This optimistic prediction follows a series of upbeat economic indicators, most notably July’s industrial production figures which exceeded market expectations. Manufacturing production, showing a marked improvement from its recent slump, further supports this upbeat forecast. Though the official Q3 GDP growth estimate is months away, it seems the U.S. economy is gearing up to prove the naysayers wrong.

Fed’s Take on the Recession Odds

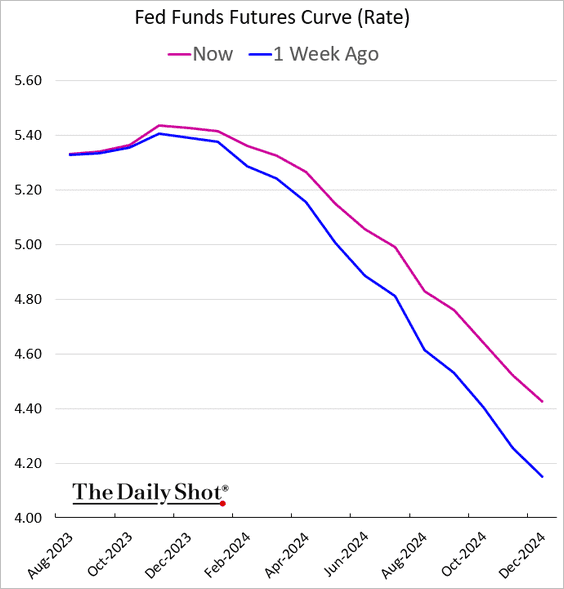

The Federal Reserve has recently joined the chorus of voices ruling out a U.S. recession. July’s FOMC minutes reflect this sentiment. While there’s unanimous agreement on the recent 25bps rate hike, the consensus on further hikes seems to be wavering. Market expectations, as presented by CME Group, remain consistent, anticipating rates to remain unchanged through December. However, any future cuts for 2024 now seem less likely.

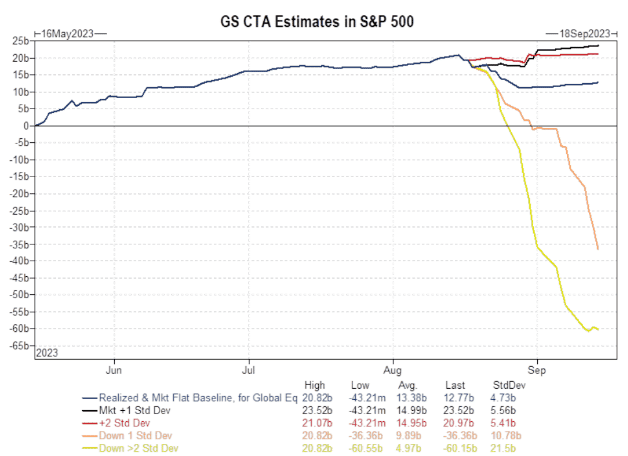

Goldman Sachs Deciphers the Stock Market Dip

What’s causing the recent stock market downturn? Goldman Sachs points out two culprits. Firstly, the extreme positions of systematic strategies, which might lead to nearly $80 billion in sales in the event of a downturn. Secondly, the increased trading of zero-day-to-expiration (0DTE) options, especially during August.

Bond Market’s Crucial Role

The bond market has been sending strong signals lately. The yield on the 10-year note recently touched its highest since 2008, suggesting the U.S. economy is not on a recessionary path. Adjusted for inflation, the 10-year TIPS yield has climbed to its highest since 2009. Given the declining inflation and the steady Fed funds rate, rising real rates might further amplify bond yields, potentially slowing equities’ momentum.

The Inflation Reduction Act’s Windfall

A year ago, President Biden ratified the Inflation Reduction Act (IRA), which included a tax-credit initiative to encourage clean energy projects. This week, Bank of America inked the first deal under this initiative, committing to purchasing $580 million in wind-energy tax credits. With numerous similar deals in the pipeline, the IRA’s green subsidies are poised to cross $370 billion over the next decade.

Safe Trading

Team of Elite CurrenSea

Leave a Reply