Heading Towards a Soft Landing: Economic Expectations and Key Insights

As we navigate the uncertain economic terrains in 2023, the latest insights suggest that we may be inching closer to a much-anticipated ‘soft landing’ in the global economy.

Global Fund Managers Eye Soft Landing

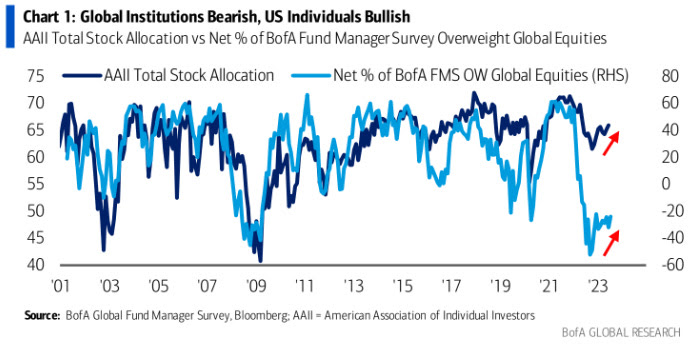

As the global economy adjusts to shifting landscapes, fund managers are increasingly optimistic about the prospect of a ‘soft landing’. Bank of America’s latest Global Fund Manager Survey reveals that despite an anticipated slowdown in global growth over the next year, only 48% of respondents predict a recession by the end of Q1 2024. In fact, a notable 68% of participants envision a soft landing as the most probable scenario in the coming year. It is, however, essential to mention that overall sentiment remains cautious.

The Fed’s Anticipated Move

The survey also highlights a significant expectation amongst investors regarding the Federal Reserve. They predict the Fed’s first cut will likely occur in Q2 2024. While the optimism for a soft landing grows, the sense of caution persists amongst investors.

A Mixed Picture for Retail Sales

June’s retail sales report presented mixed signals about the strength of consumer spending. Headline sales marginally missed expectations, but spending on the core/control group—a metric used to calculate GDP—recorded a 0.6% increase. Despite higher prices and borrowing costs, consumer spending showcased resilience in June.

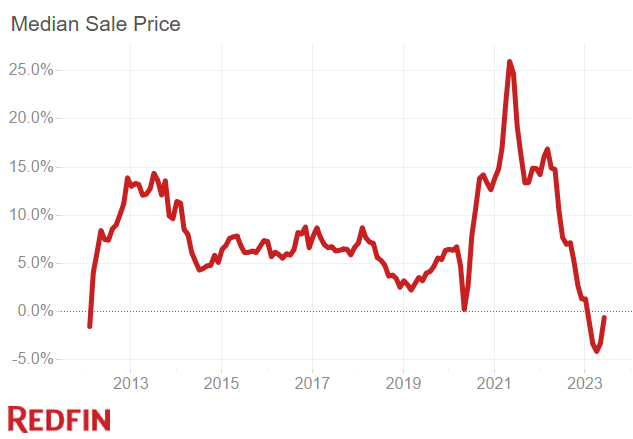

Housing Market Continues Its Uptrend

Homebuilder confidence has steadily grown for the seventh consecutive month in July, according to the NAHB Housing Market Index. A record low in home inventories continues to fuel demand. Data from Redfin suggests that the number of homes for sale fell by 15% YoY in June to an all-time low, and home prices may have bottomed, indicating signs of stabilization in the housing market.

Microsoft Shares Hit All-Time Highs

In corporate news, Microsoft shares hit record highs after the tech giant announced new AI subscriptions for Microsoft 365. Microsoft also revealed a strategic partnership with Meta, with the former becoming the preferred partner for Llama 2, the AI language model software.

Divergence in Investor Sentiment

Digging deeper into the BofA’s Global Fund Manager Survey, a stark divergence is observed between the sentiment of institutional and retail investors. While equity allocation saw an increase in July, it remains net 24% underweight. Despite a slight downturn in July, bond allocation has been overweight for seven of the last eight months.

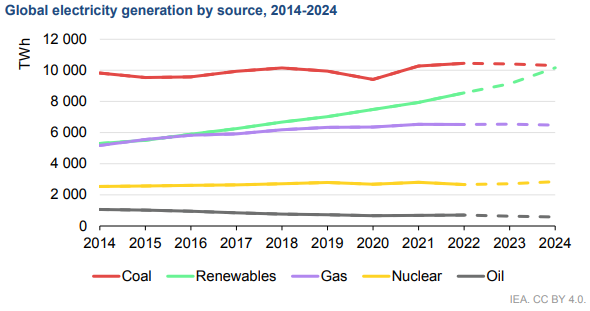

Global Power Demand Growth to Revive

According to a new International Energy Agency (IEA) report, global power demand is set to grow just under 2% this year, falling below the 5-year pre-pandemic average of 2.4%. However, growth is expected to jump to 3.3% in 2024 as economies rebound. The agency also predicts that renewable sources will account for more than a third of the total global power supply in the coming year, marking a historic shift in the energy sector.

Safe Trading

Team of Elite CurrenSea

Leave a Reply