Goldman Sachs’ Report on Top Hedge Funds Stock Picks in 2023

Hedge funds’ favorite stocks are beating the market.

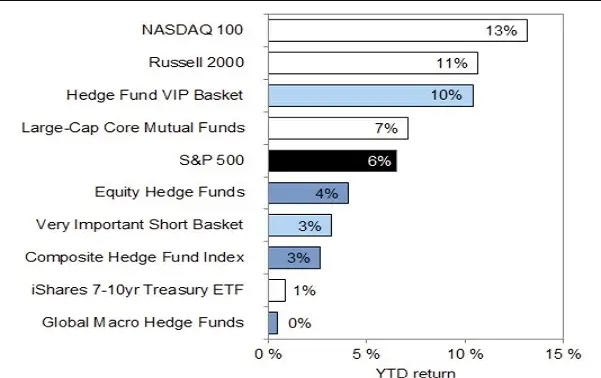

Goldman analyzed 758 hedge funds managing $2.3 trillion in stocks – $1.5 trillion long and $727 billion short. The “Hedge Fund VIP List” of the 50 most popular stocks returned 10% in the first 6 weeks of the year, double the S&P 500’s 6%.

Last year, hedge funds fell just 4% while the S&P dropped 18%. But hedge funds trading macro trends came in flat so far this year as the market’s become more micro-driven, steered by company-specifics.

Year-to-date returns of various assets. Sources: HFR, FactSet, and Goldman Sachs Global Investment Research.

Hedge funds are betting big on tech stocks.

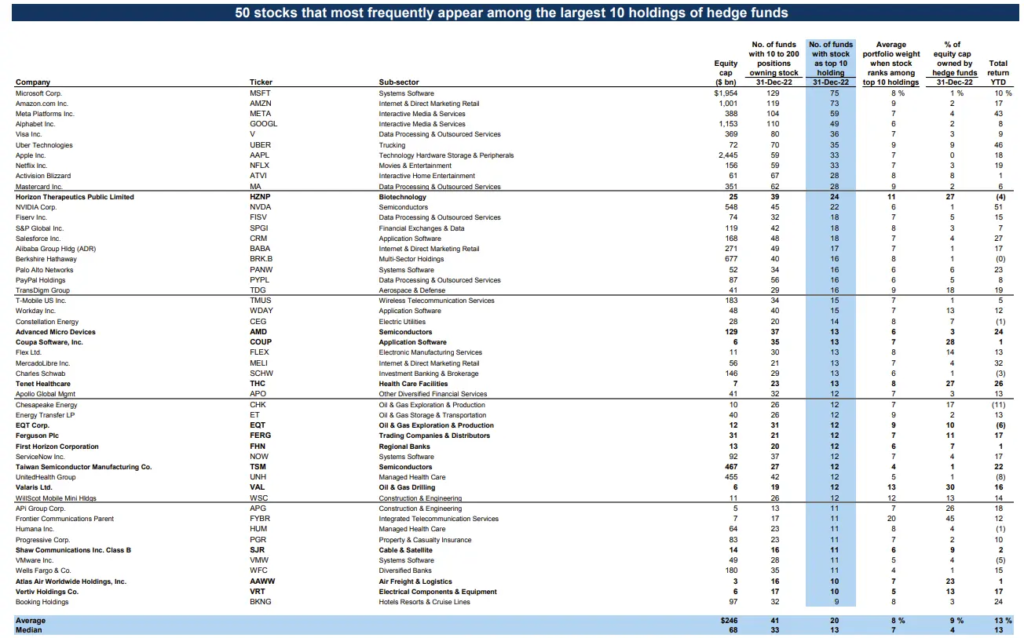

Let’s see which stocks hedge funds are picking. Microsoft tops the VIP List, edging out e-commerce giant Amazon. Facebook parent Meta takes third, falling from the top 5 last quarter for the first time since 2014. Google parent Alphabet is fourth and Visa fifth.

Netflix and Uber dropped from the top 5, and Tesla fell off the list. 12 new stocks joined the VIP club (in bold):

Hedge Fund VIP List of 50 stocks that appear most frequently among Hedge Fund top 10 stock holdings. Sources: Solactive, FactSet, and Goldman Sachs Global Investment Research.

The VIP List has beaten the S&P 500 59% of quarters since 2001, averaging 0.38 percentage points more. But in 2021-2022, it underperformed by 30 points. Still, it shows where the smart money’s going. No consumer staples, materials or real estate stocks made the cut. With so many tech stocks on top, info tech makes up 32% of the list, the heaviest sector weighting.

Hedge funds are taking on more risk.

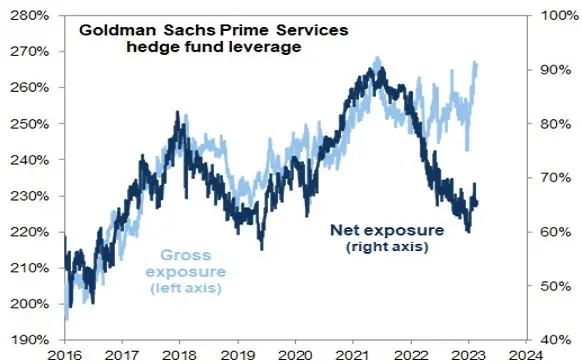

“Net leverage” shows hedge funds’ long vs short bets. The higher the leverage, the riskier their positions. Leverage rebounded from 2022 lows, levels last seen in 2019. While below recent years’, leverage is at the 24th percentile of the last 5 years and 30th of the last year. Rising leverage means hedge funds like what they see and are taking more risk.

Gross and net leverage exposure of hedge funds since 2016. Sources: Goldman Sachs Prime Services and Goldman Sachs Global Investment Research.

Hedge funds changed strategies and sector bets.

Hedge funds turned from “momentum strategies” – trading with sustained price trends – entering 2023 with the most anti-momentum bias ever, breaking from the pack.

Goldman’s long/short momentum factor fell 20% this year, one of the biggest drops since 1980, usually signaling a recession or crisis. Luckily, hedge funds favored growth over value stocks, the momentum play the last 2 years.

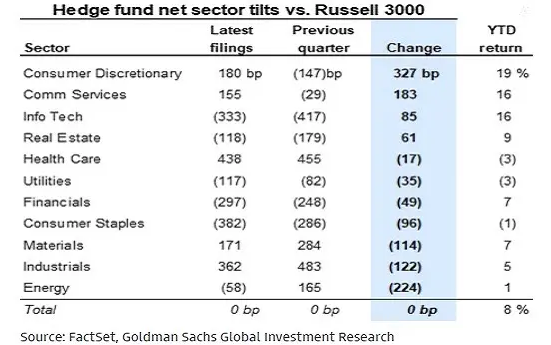

Around the start of the year, hedge funds rejigged sector bets. In January, tech was 20.9% of net exposure, underweight vs the Russell 3000’s 24.2%. Healthcare was the biggest overweight at 19.9% vs the index’s 15%.

Hedge funds added tech, communications and consumer discretionary (up 3.27 points), cutting energy, industrials and materials. Energy’s the lightest since late 2007, dropping the most from last quarter.

Sector changes from the fourth quarter of 2022, compared to now, and returns so far this year. Here, “bp” stands for basis point, and 100 basis points equals one percentage point. Sources: FactSet and Goldman Sachs Global Investment Research.

The opportunity

You’ve got two options: follow the hedge funds, or go against them. To follow, buy the Goldman Sachs Hedge Industry VIP ETF (GVIP, 0.45% fee), tracking the VIP List. Or pick stocks from the list yourself.

To follow sectors, buy the iShares S&P 500 Consumer Discretionary Sector UCITS ETF (IUCD, 0.15%) or iShares S&P 500 Communication Sector UCITS ETF (IUCM, 0.15%).

To go against hedge funds, short these. Place your bets, as well as invest in Portfolio Flagship (ex Portfolio ECS), which has returned 120% this year along already.

Safe Trading

Team of Elite CurrenSea 🇺🇦❤️

Leave a Reply