Global Markets Stir: From Oil Surges to Evergrande’s Ascent

Amidst global economic tremors, three major events have taken center stage: the surge in oil prices due to OPEC+ decisions, Evergrande’s staggering ascent in China’s real estate market, and the Federal Reserve’s optimistic GDP projections for 2023.

Oil Shockwaves Reverberate Globally

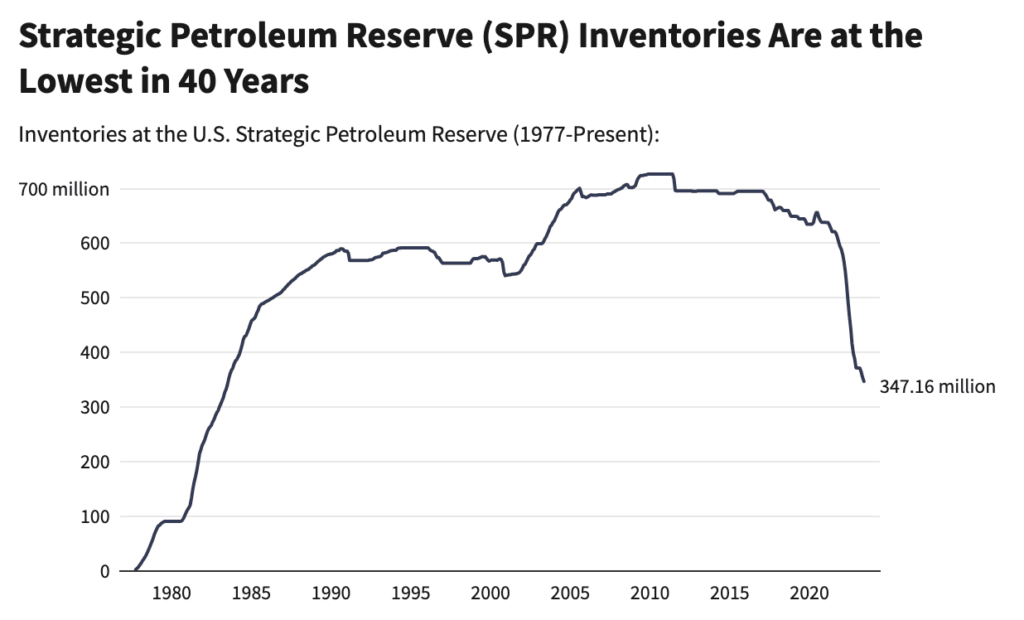

The world witnessed a surprising surge in oil prices, with it touching a staggering $90/barrel. This upward trajectory is due to the OPEC+ leaders, predominantly Saudi Arabia and Russia, opting to sustain their supply cuts. Consequently, the market will be short of an extra million barrels daily for another quarter. Summer’s overwhelming global oil demand, stimulated by air travel and China’s appetite, makes this timing inopportune. With the U.S. oil reserves plummeting to a 40-year nadir, there seems to be no swift remedy in sight.

Chinese Property Titans’ Unexpected Ascent

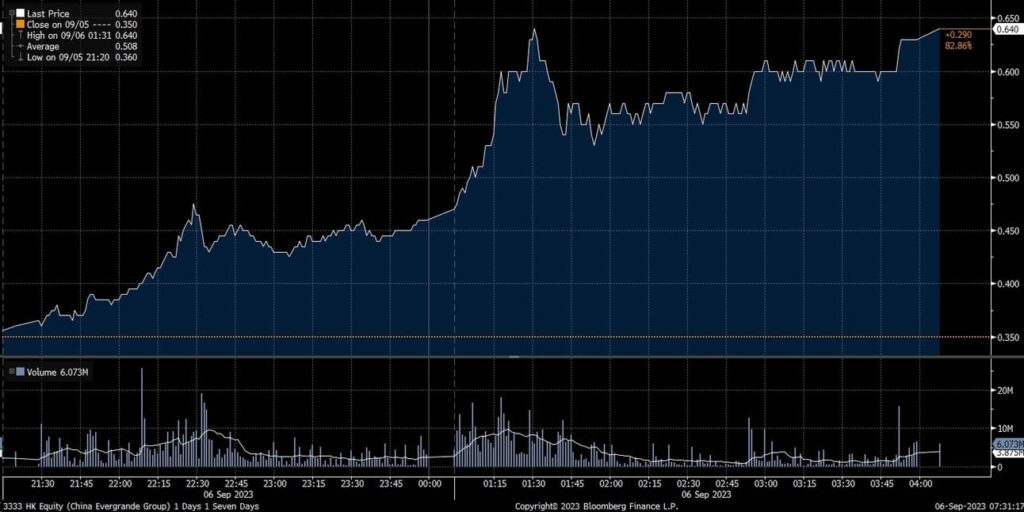

Chinese builders experienced an unforeseen rally, jumping by about 10%. This optimism stems from the speculation that governmental interventions might help stabilize this debt-ridden domain. The highlight? Evergrande’s stock value soared by an incredible 83%. This growth is its most impressive since 2009. Yet, market analysts predict this surge might be a short-lived one.

Federal Reserve’s Optimistic GDP Forecast for 2023

The financial spheres are buzzing with Bloomberg’s revelation about the Federal Reserve’s plans to double its GDP growth forecast for 2023. Reasons? A thriving economy, substantial spending, flourishing retail sales, and a booming housing market. Just a quarter ago, after two satisfactory GDP quarters, there were apprehensions. But now, with the Atlanta FED’s Q3 growth projection of a whopping 5.6%, there’s palpable optimism.

Three Charts Steering the Financial Dialogue

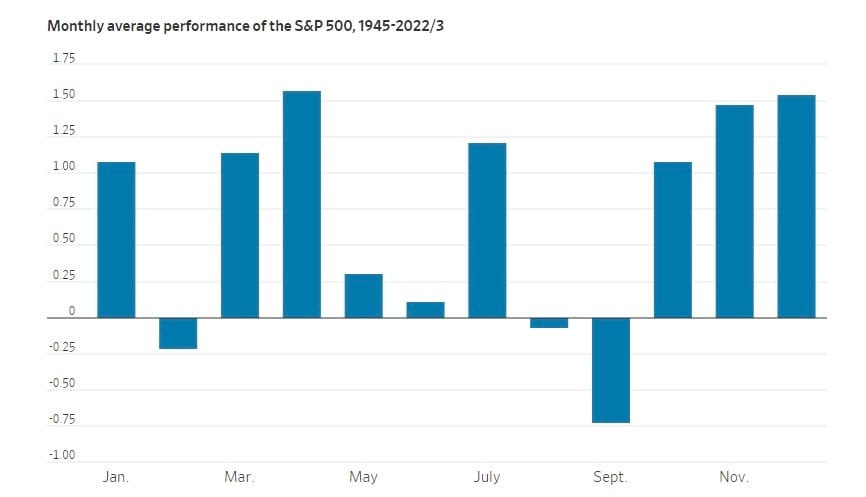

- S&P 500’s Monthly Dance: Based on data from CFRA, the monthly average performance of the S&P 500 indicates that September historically stands as the most challenging month for the market.

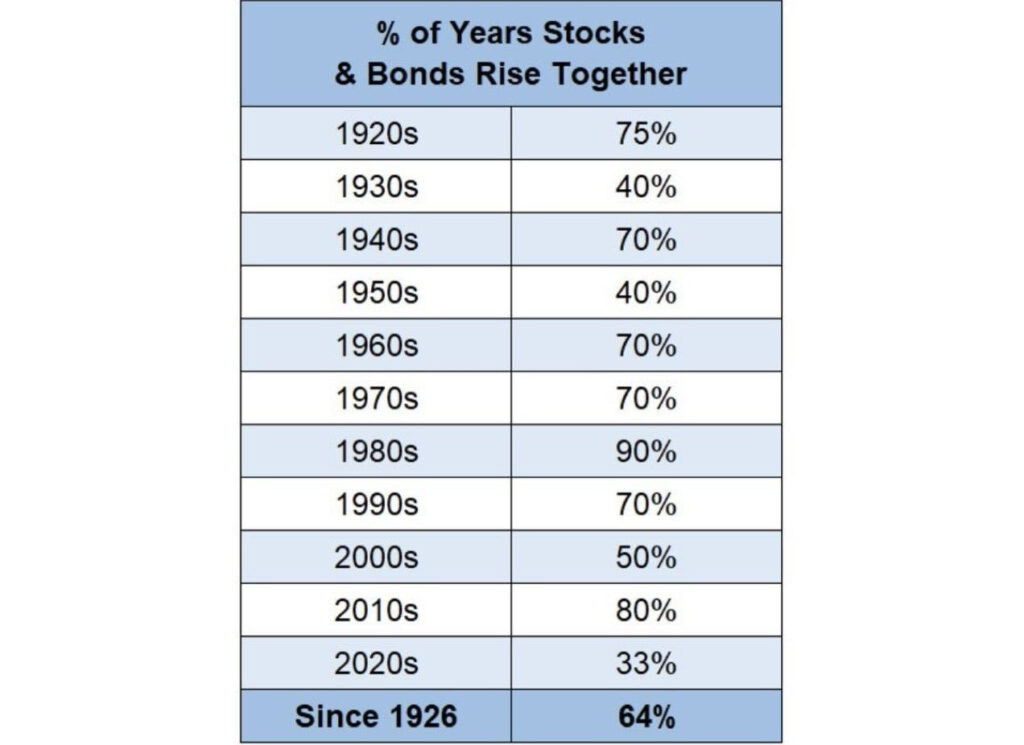

- The Symbiotic Relation of Stocks and Bonds: As per insights by Josh Brown and Ben Carlson, stocks tend to rise more frequently. However, in their absence, bonds have shown resilience and growth.

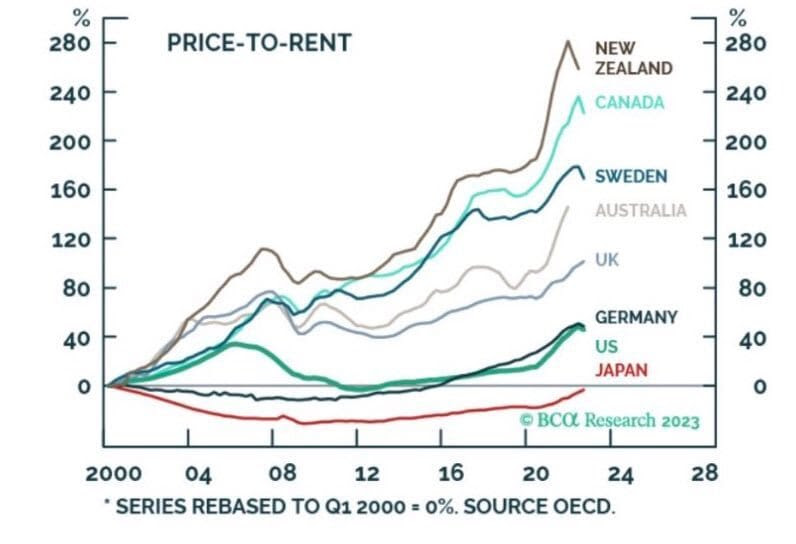

- Global Housing Dynamics – The Price-To-Rent Ratio: BCA Research highlights the changing housing landscape since the turn of the millennium. Notably, New Zealand and Canada have experienced the steepest rise in their Price-to-Rent ratios.

Safe Trading

Team of Elite CurrenSea

Leave a Reply