From Crisis to Opportunity: The Unexpected Heroes of the Financial Market

1. Rising from the Ashes: The Resilient S&P 500

As the economic storm raged on with a jaw-dropping ten rate hikes in a year, a record 9.1% inflation, and an unprecedented banking crisis, the S&P 500 stood firm.

Remarkably, it obliterated all losses since the Fed’s rate increase inception, exemplifying unmatched market resilience.

Today, it hovers a mere 8% from its all-time high, sporting a handsome 20% gain over the year. Indeed, the current market landscape is among the sturdiest I’ve ever seen in my trading career.

2. Economic Recovery: China’s Struggles and Strategies

Five months ago, China’s President Xi Jinping declared victory over Covid, raising hopes for a rapid economic revival. Yet, the anticipated bounce-back remains a far-off reality.

Now, following its central bank’s series of interest rate cuts, Beijing contemplates fiscal stimulus measures to boost its sluggish economy. These might encompass increased infrastructure spending, consumption incentives, and easing rules around the property sector to foster investment.

3. The U.S. Economy: Juggling Inflation, Jobless Claims, and Retail Sales

Yesterday, U.S. markets trudged through a barrage of economic data releases. While regional manufacturing metrics from New York and Philadelphia presented mixed sentiments, they also carried hints of optimism.

Slowing factory production hinted at caution amid weak global demand and spending, whereas falling import costs bode well for inflation. However, initial jobless claims remained at the highest level in 18 months, unchanged from last week.

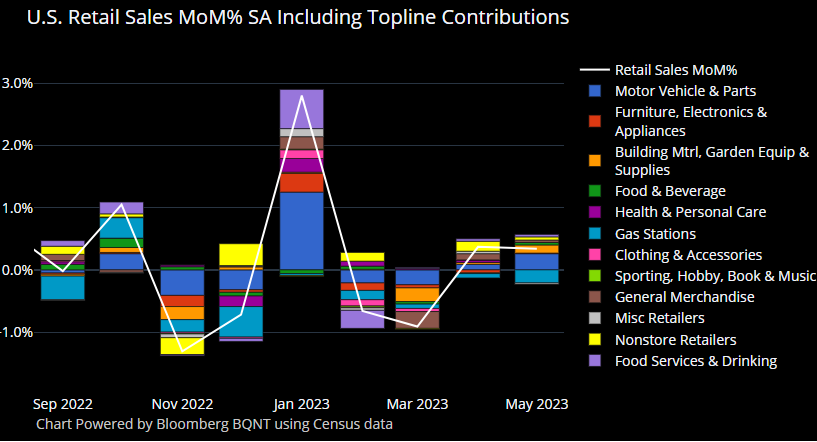

Retail sales unexpectedly climbed by 0.3% in May, a sign of consumer spending resilience in the face of uncertainty. The spending spree, reflected in most sectors, poses a puzzle for the Fed as it tries to restrain inflation by cooling down the economy.

4. Microsoft Soars: A New Milestone in Tech Stocks

Tech giant Microsoft reached new heights, closing at an all-time high yesterday. The stock has advanced for six consecutive sessions, marking its longest winning streak since January.

With Microsoft joining the league of Apple and Nvidia, it becomes the third mega-cap tech company to touch new highs this year. Its staggering 45% YTD performance has contributed to a whopping $800 billion increase in its market value.

5. Cava Ignites the IPO Market: A Sizzling Stock Market Debut

Mediterranean restaurant chain Cava exploded onto the stock market with its shares almost doubling from the $22 listing price to close the day at $43.78.

The company now boasts a market value of $4.9 billion, significantly surpassing the initial $2.45 billion valuation. Cava’s stellar performance marks the best debut since July 2022, breathing life back into a historically sluggish IPO market.

6. The Tesla Saga: Bullish Streak or a Bubble?

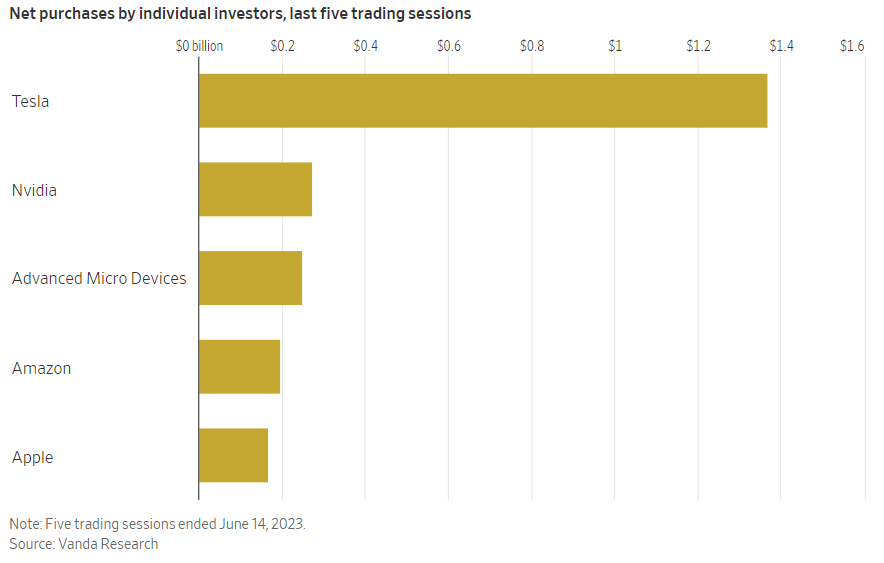

As Tesla celebrates a record 13-day winning streak, investor opinions are split. While BofA analysts anticipate a decline in Tesla’s US electric vehicle market share, their counterparts at RBC Capital predict a sunny future buoyed by robotaxis, full-self driving tech, and expanding margins.

Retail investors, however, demonstrated their faith, purchasing more Tesla shares than any other company for the past two weeks.

7. European Gas Benchmark TTF: A Volatile Swing

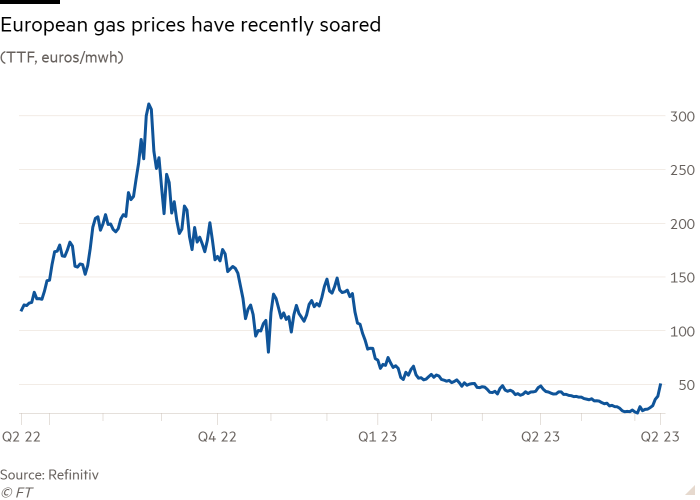

In the energy sector, the European gas benchmark TTF made a dramatic recovery, doubling its price from a two-year low at the start of June.

This surge comes despite record-high storage levels for this time of year and mirrors the market’s renewed fear of supply disruptions.

The sudden hike is also a response to the need to replace Russian supplies, which previously met 40% of the EU’s demand prior to the invasion of Ukraine.

Wrapping Things Up

With all these events taken together, the past year has been a testament to the resilience and dynamism of global financial markets.

Despite the tumultuous backdrop of rate hikes, high inflation, and a banking crisis, the market has not just survived but thrived, indicating a robustness that continues to amaze both seasoned and novice investors alike.

As we move forward, it’s vital to remember that while the journey of investment might be filled with ups and downs, the reward often lies in the ability to navigate through these uncertainties.

You can catch trading based on the way market unravel by investing in Portfolio Flaghsip, a managed account that targets 110% returns (nett of fees) and under 25% drawdown (DD).

Safe Trading

Team of Elite CurrenSea

Leave a Reply