Five Hot Stocks to Bet on China With

Hi Traders,

Searching for ways to make money off of the much-anticipated revival of China’s economy that don’t involve the expected Chinese stocks (cough, cough Alibaba and Tencent)? I’ve got five ideas, all within easy reach.

One of them has already experienced a 13% jump just within the last few days, after a stellar earnings report.

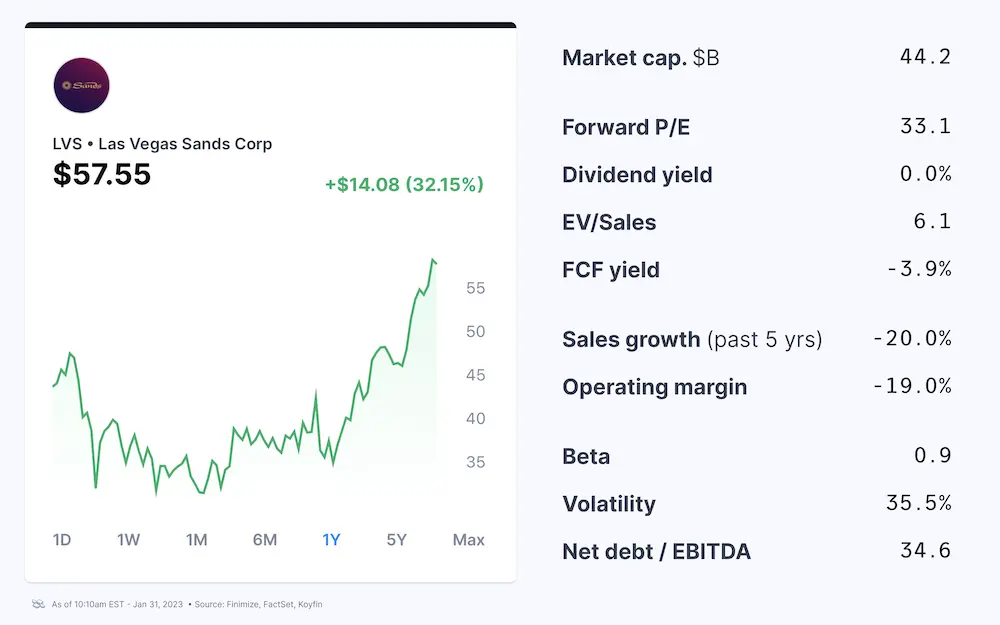

#LVS Las Vegas Sands Corp

Forget the name: since 2021, LVS has no more US presence following its $6.3 billion sale of its US properties. The firm now owns the world-renowned Marina Bay Sands in Singapore and holds a 69% stake in Sands China, operating five integrated resorts in Macao.

Unlike Vegas, where having fun and gambling go hand in hand, the majority of revenue in these places comes from gaming. Gambling is hugely popular in China, where luck is deeply entrenched in the culture – and a big business opportunity.

The devastating impact of Covid-19 on the tourism industry left Las Vegas Sands’ super casinos practically shuttered for two years; in 2018, their EBITDA totalled over $5 billion, but by 2022 had dwindled to a meager $260 million.

Yet, with restrictions now largely lifted, the path to recovery has opened up for LVS and the potential to thrive again is within reach. For the future, the Chinese government’s tourism ambitions create an opportunity for them to capitalize on their standing as one of only a few firms licensed to operate mega casinos and integrated resorts in Macao.

Take heed: LVS stocks have escalated to nearly double what they were last summer in the hope of China’s reopening. Thus, any deviation could be a bane for them. What’s more, the colossal debt the firm accrued to stay afloat in the last few years is enough to give one shudders.

The construction of casinos is a costly endeavor and while that’s a tangible edge, gaming is a highly-unstable industry where shocks, such as the one we just experienced, can jar investors as profits take a dive while debt still remains. In a word, LVS isn’t for the faint of heart.

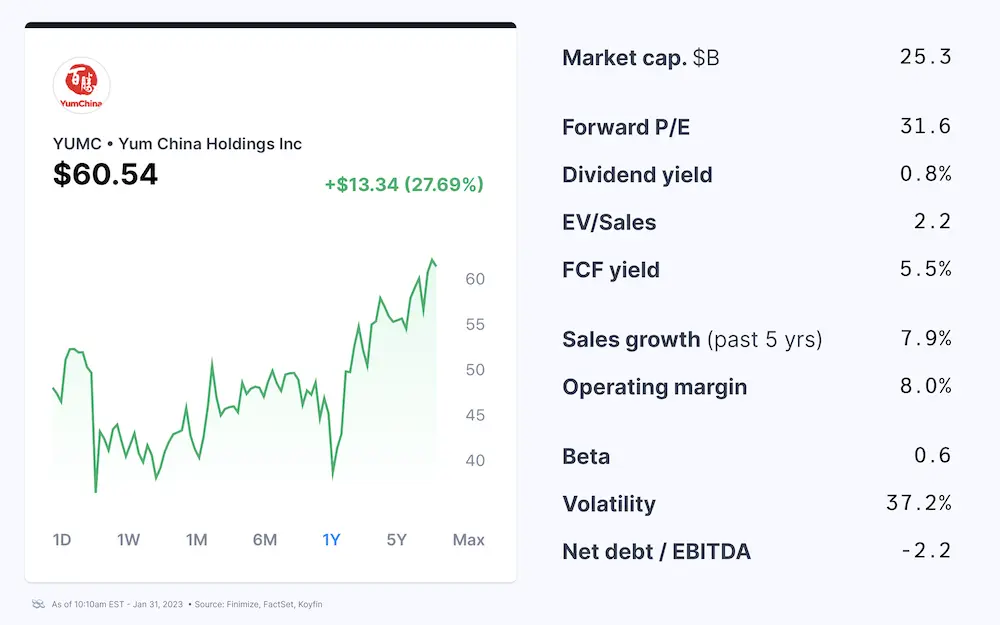

#YUMC Yum China Holdings Inc

In 2016, YumChina took flight from the Yum! Brands nest and now holds exclusive rights to operate KFC, Pizza Hut, and Taco Bell chains in China. It has created a gargantuan restaurant empire, boasting more than 12,000 locations – a whopping number compared to McDonald’s 3,500. Unlike its US namesake, YumChina forgoes franchising and instead owns and runs all its restaurants.

Thanks to digital and delivery investments, YumChina was able to maintain strong sales and profit even through the Covid lockdowns – a testament to the strength of their business and the deliciousness of their food.

Even more impressive, not only do they benefit from booming sales, but they also don’t have to pay out a “franchise fee” – they get to keep the entire finger-licking profit! This might limit the upside from an immediate reopening standpoint, but it makes it a great near and long-term option for those looking to capitalize on the growth of China.

It comes as no surprise that YumChina’s stock has skyrocketed this year, and their shares are hardly a bargain with a 32x P/E ratio. With the reopening of China facing potential hurdles and the company itself being no stranger to controversy, this could prove to be a risky venture. In the past, outbreaks of food contamination and anti-Western sentiments have had a tremendous impact on their stock prices.

#EL Estee Lauder Cos Inc

Estée’s is a belle of the prestigious beauty market, their products have seen tremendous growth due to their pricey price tags for many years. China is a major contributor to the firm’s success, bringing in roughly one-third of their total sales and a greater portion of their profit due to its high margins. Travel retail, like airports and New York’s iconic Fifth Avenue, is another major source of revenue and accounts for roughly one-third of its business.

When it comes to tourism, the affluent Chinese demonstrate remarkable spending power. In conclusion, a Chinese resurgence could see sales figures soaring. To cope with pandemic-induced closures of department stores, Estée gave its e-commerce services an extensive overhaul – think virtual consultations. Evidently, these changes will keep benefiting the brand in the long run.

Given the current eye-wateringly expensive 42x P/E stock valuation, should the US or Europe experience a recession, it would certainly dampen the demand for Estée’s pricey ‘nice-to-haves’, making much of the current success already baked into the share price. Nevertheless, for the time being, momentum is still favoring Estée.

#NKE Nike

China has been a major source of sales for Nike over the past couple of years, accounting for around 15% of its total sales before the pandemic hit. As the country was growing rapidly, its share of the Nike pie was growing and pushing up the company’s overall sales growth. Although China sales have been stagnating over the last couple of years, they have started to pick up again and grew by 6% when taking currency fluctuations into account in the most recent quarter.

China has been a major source of Nike merchandise, yet supply disruptions caused by the pandemic have been a major obstacle to the company’s inventory. As a result, Nike’s costs have risen when booming online sales (more profitable than in-person sales) could have otherwise lifted profit margins. In short, an optimally functioning supply chain and further developed online sales could potentially bring Nike to a new level of profitability.

The risks accompanying the opportunities may be akin to looking in a mirror. Should any supply issues arise, Nike’s profit margins and sales growth would be stifled; particularly as the stock is currently valued at a lofty 34x P/E ratio. A recession in either the United States or Europe could further impede the demand for their products. On the other hand, fans of the stock can attest that these possibilities are only temporary, and if Nike has been able to persevere the past few years, they can make it through any other challenge.

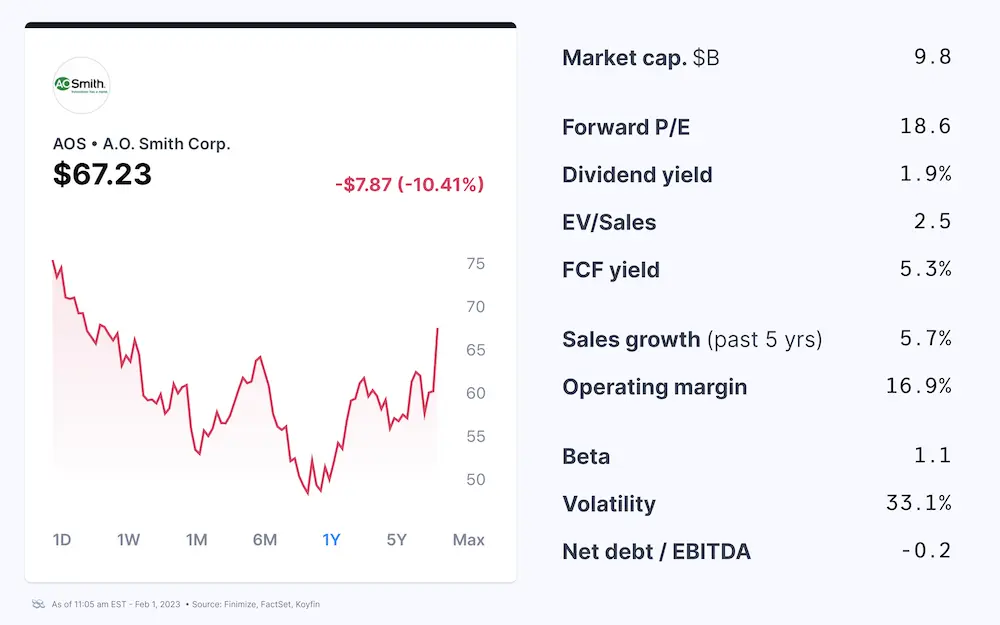

#AOS A.O. Smith Corp

AOSmith, originally based in the US, provides both water heaters and water treatment devices (including the under-the-kitchen-sink filter type) to homeowners and business owners. By 2016, Chinese markets had made up more than 35% of the company’s total sales; however, the economic slowdown in China as a result of the escalating US-China trade tensions caused AOSmith to become overstocked.

When Covid-19 struck, the firm’s Chinese revenues plummeted, now standing at only 20% of the overall and continuing to dwindle. AOSmith’s share price has recently seen an upswing, although it had been at its lowest point in September, trading at a mere 13x P/E. Investors seem to have lost faith in the company’s prospects in China.

The potential in China beckons investors – should demand there increase, the stock valuation could soar. But in the United States, recession looms, and investors are watching the housing market closely; fewer new homes equate to weaker demand for water appliances. Yet there’s a silver lining – with nearly 90% of water heaters being bought to replace broken ones, nobody has to worry about cold showers!

Should speedy Chinese recovery is something you still find hard to believe, or you are looking at other markets, take a look at ECS Live Telegram channel, where we share signals that also go to ECS Algo (a mix of indexes, commodities, and currencies trade by several different Expert Advisors).

Should you have any questions about the current market climate as we see it, feel free to reach out.

Safe Trading

Team of Elite CurrenSea 🇺🇦❤️

Leave a Reply