Fiscal Forecasts: A Deep Dive into Current Economic Indicators

Esteemed financial analyst, Jim Cramer, reaffirmed this week his confidence in the robustness of the US economy, boldly stating that he doesn’t foresee a recession on the horizon.

Impact of Fed Hikes: A Delayed Echo

According to TD, the effects of Federal Reserve hikes have a delayed impact, with the peak effect on GDP visible around four quarters later, and a more pronounced impact on inflation manifesting approximately six quarters later. Hence, the economic scenarios we’re witnessing now are largely influenced by the policy rates instituted in mid-2022, implying that the zenith of rate hikes’ effects is yet to be experienced.

A Shadow Over Credit Conditions

Apollo’s Torsen Sløk anticipates that this delay will likely instigate further deterioration in credit conditions and lending growth, painting a potentially gloomy picture for the US economy.

Corporate Bond Spreads: The Underlying Message

Corporate bond spreads have been acting as an effective gauge of macro-economic apprehension among bond investors. Despite a brief surge in March, presumably linked to the banking crisis, spreads have been on a decline since October 2022. Their current low levels mirror the pre-crisis period, indicating investors’ diminished concern over macroeconomic headwinds affecting future earnings.

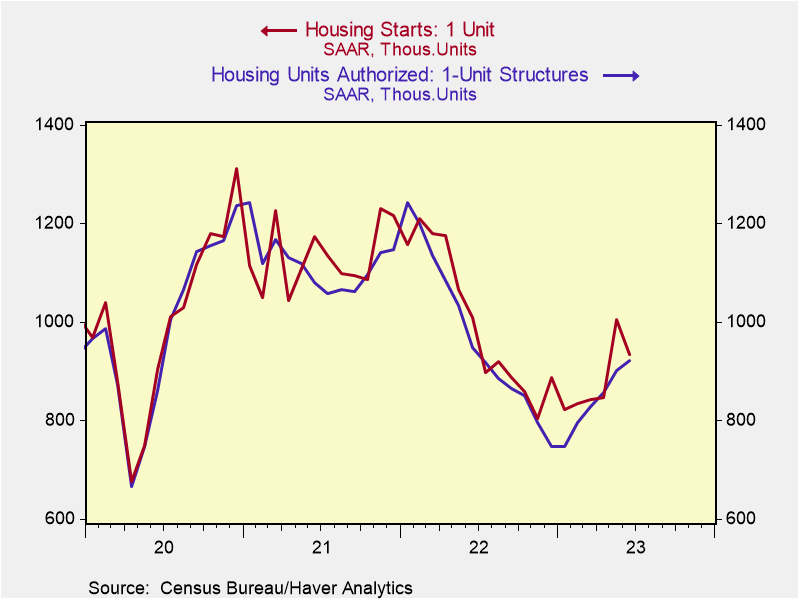

A Stumble in US Housing Sector

June marked a more pronounced slump in US housing starts than initially expected. Additionally, building permits saw a surprising downturn against the forecasted modest increase. However, the 2.2% increment in permits for single-family homes paints a promising picture, suggesting a potential resurgence in the offing.

Apple Dives into AI Competition

In the realm of artificial intelligence, Apple is stepping up its game to compete with tech giants Microsoft and Google. Through its innovative ‘Ajax’ framework, designed to build large language models (LLMs), and an internal AI chatbot known as “Apple GPT,” Apple is looking to make a significant splash in AI by next year.

Carvana: The Ten-bagger of the Year

For those who placed their bets on Carvana at the start of the year, the rewards have been substantial, with shares catapulting by over 1000% year-to-date. This dramatic ascent was bolstered by a recently announced deal poised to reduce the company’s outstanding debt by more than $1.2 billion.

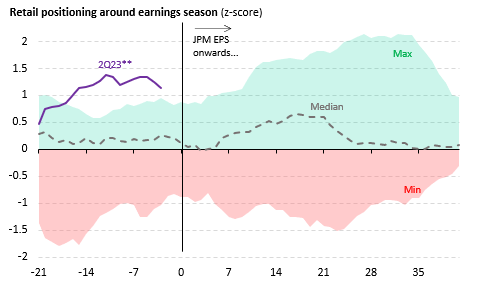

Retail Investors: Bold and Bullish

Retail investors are striking a notably bullish pose as we approach the earnings season, with aggressive positioning unseen in previous years. This bullish sentiment has been corroborated by the AAII Bull/Bear Ratio, which tipped over 50% for the first time in over two years.

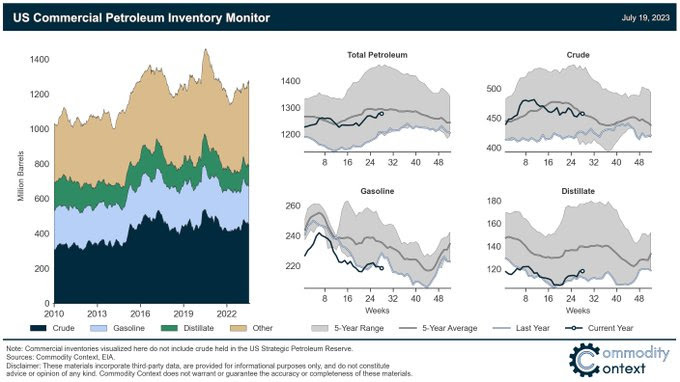

Petroleum Inventories: A Dipping Trend

Lastly, in the energy sector, total US petroleum inventories experienced a decline of 1.1 million barrels last week, following an impressive 17 million barrel surge in the previous week. These fluctuations in the crude oil landscape suggest potential volatility in the energy markets in the coming months.

Safe Trading

Team of Elite CurrenSea

Leave a Reply