Fed’s Rate Hold Triggers Pause or Skip Conundrum: An In-depth Analysis

FOMC has spoken last week, lets take a look why market hasn’t really budged and what it tells us about H2 2023 key metrics to look at when trying to predict recession.

The FOMC Meeting Aftermath – Unchanged Rates Stir Debate

The recent FOMC meeting has left the financial world pondering the Fed’s strategy as rates remained unchanged, triggering the age-old ‘Pause’ or ‘Skip’ dilemma.

Despite significant data from CPI and FOMC, the market’s response was largely tepid, perhaps symptomatic of traders preparing for summer hiatus.

With inflation cooling down and a halt to the rate-hiking trajectory, a recession watch has come into focus. Earnings growth will be paramount in H2 as the Fed attempts a delicate balancing act.

Will Federal Reserve Chair, Jerome Powell, pull off a Maverick-esque manoeuvre? Can we anticipate a coveted “soft landing”? Only time holds the answer.

CPI Prints: In-depth Analysis

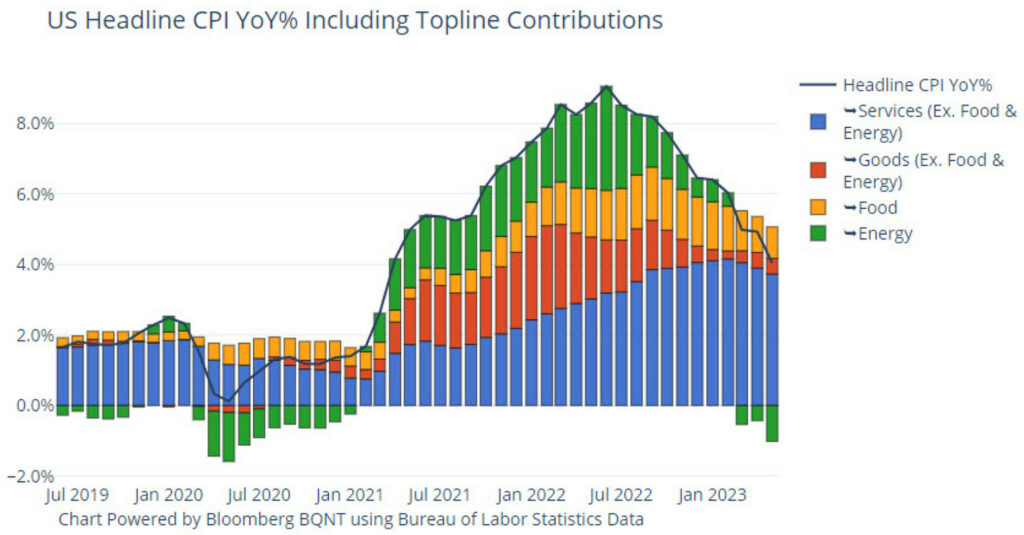

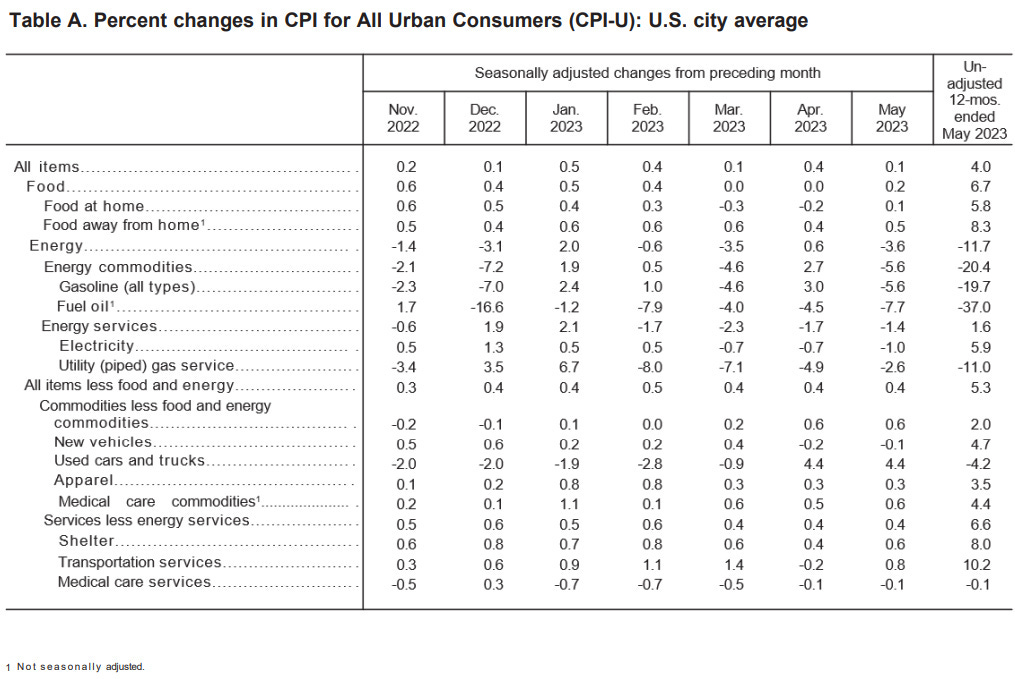

May witnessed a 0.1% rise in the CPI, bringing the YoY increase from 4.9% in April to 4.0% in May, a figure lower than expected.

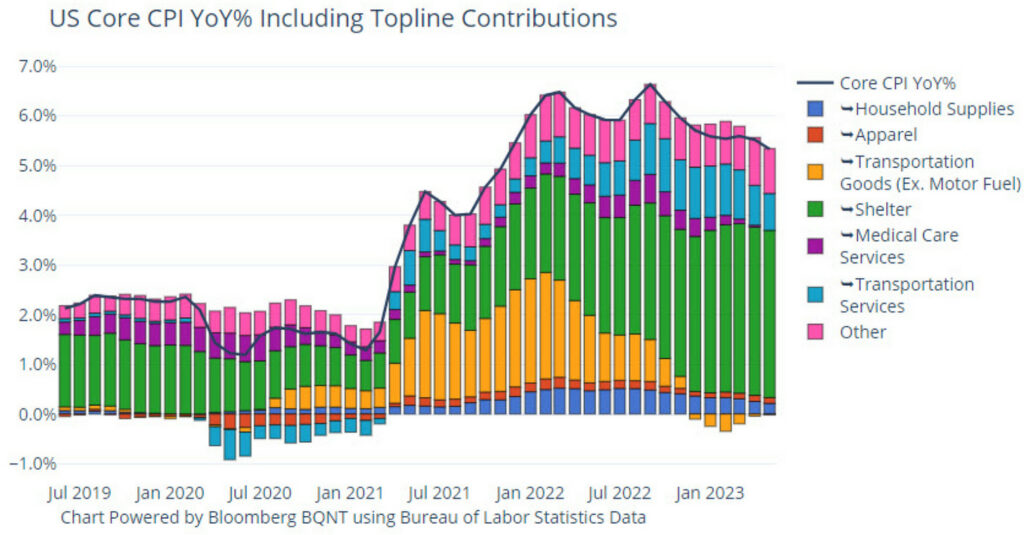

However, Core CPI displayed an uptick of 0.43%, pushing the YoY figure from 5.5% in April to 5.3% in May.

These numbers didn’t dramatically influence the Fed’s stance, which appears to have remained steady.

A closer inspection reveals a number of key trends, from a 5.6% decline in gas prices to a 0.2% rise in food prices, and significant increases in used car and core goods prices.

Unpacking the FOMC Decisions

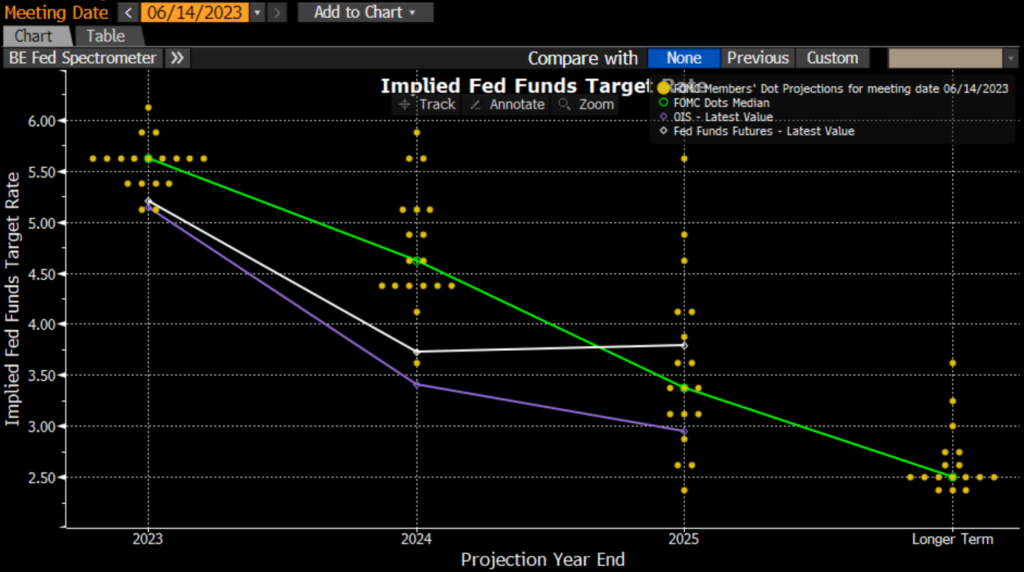

Post a streak of ten consecutive hikes, the Fed put brakes on further hikes, maintaining the policy rate at 5.0%-5.25%. However, policymakers still lean towards the necessity of more hikes this year.

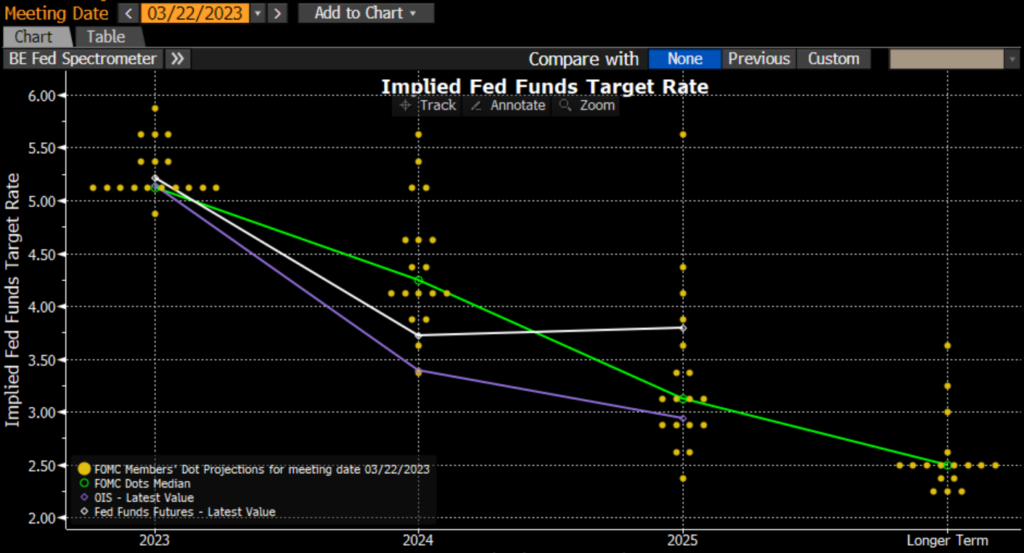

March dots

Despite the unchanged rates, JPOW voiced concerns about inflation and believes insufficient progress has been made on core PCE, his preferred indicator.

June dots

With updated “Dot Plot” predictions suggesting two more hikes before 2023 ends, it raises the question: was this decision a pause or a skip?

Gearing up for a July Hike?

Markets are already factoring in a probable 25 bps hike in July, fuelling more debates over the Fed’s next move.

Amid varying views on why the Fed didn’t hike rates now, the threshold for future hikes has been raised significantly. So, has the rate hiking cycle concluded or merely paused?

Envisioning a Soft Landing – Can the Fed Stick the Landing?

Achieving a soft landing – a moderate economic slowdown following a period of growth – is the Fed’s key objective.

The FOMC notes the economy’s strengths and weaknesses, with steady expansion, robust job gains, and low unemployment countering still-elevated inflation and anticipated negative impacts of tighter credit conditions.

The Fed’s updated economic forecast has brightened the outlook, with predictions of continued expansion in 2024 and 2025. Can they stick the landing or will there be room for policy error, just as during the initial inflation climb? Let’s wait and watch.

In the meantime consider investing in latency and news managed account – Portfolio Flagship, it targets over 100% yearly returns at under 20% DD and comfortable onboarding.

Safe Trading

Team of Elite CurrenSea

Leave a Reply