Fed’s Rate Hike: A Double-Edged Sword for the Economy

The Federal Reserve’s latest rate hike – the 10th within a year – seems to have cooled down inflation, but it may have opened Pandora’s box for other macroeconomic problems. The central bank, whose main mandates are price stability and stable employment, is now facing a potential banking crisis and a looming recession. The question arises: did the Fed make the right call?

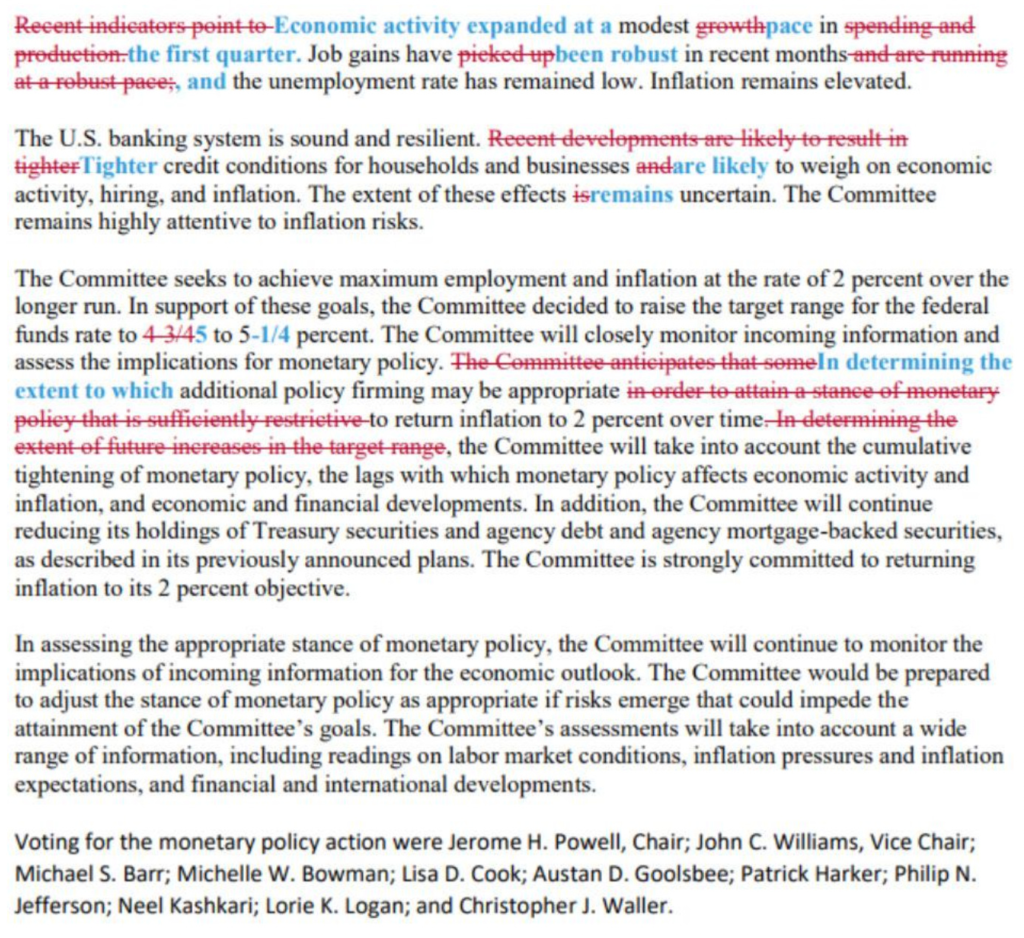

In recent weeks, the Federal Open Market Committee (FOMC) has shifted its narrative from “transitory” to “cooling” and now to “credit”. This shift is not without cause, as concerns are mounting around the regional banking sector.

Rate Hike: A Solution or a Catalyst?

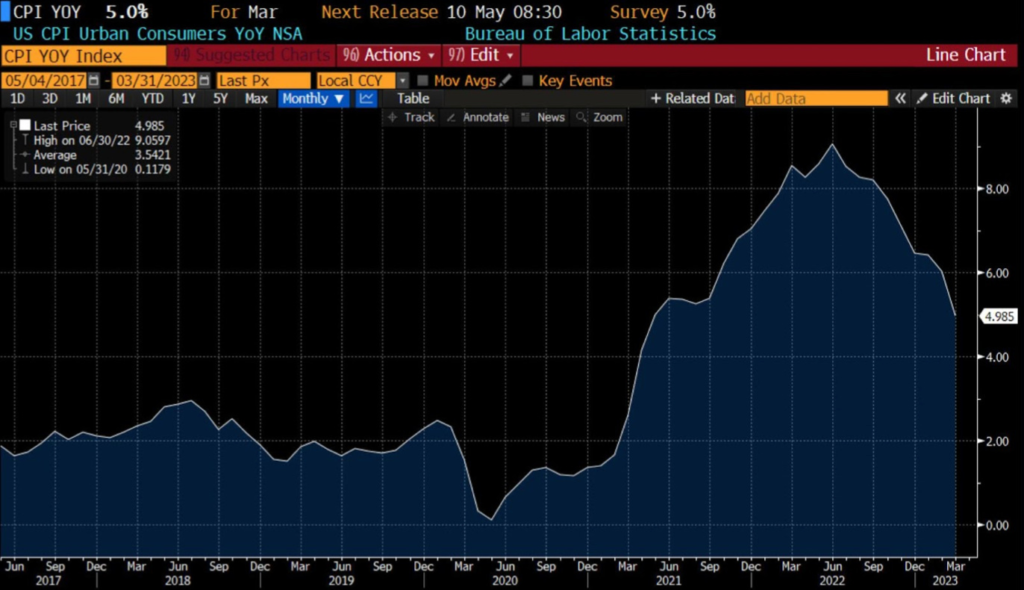

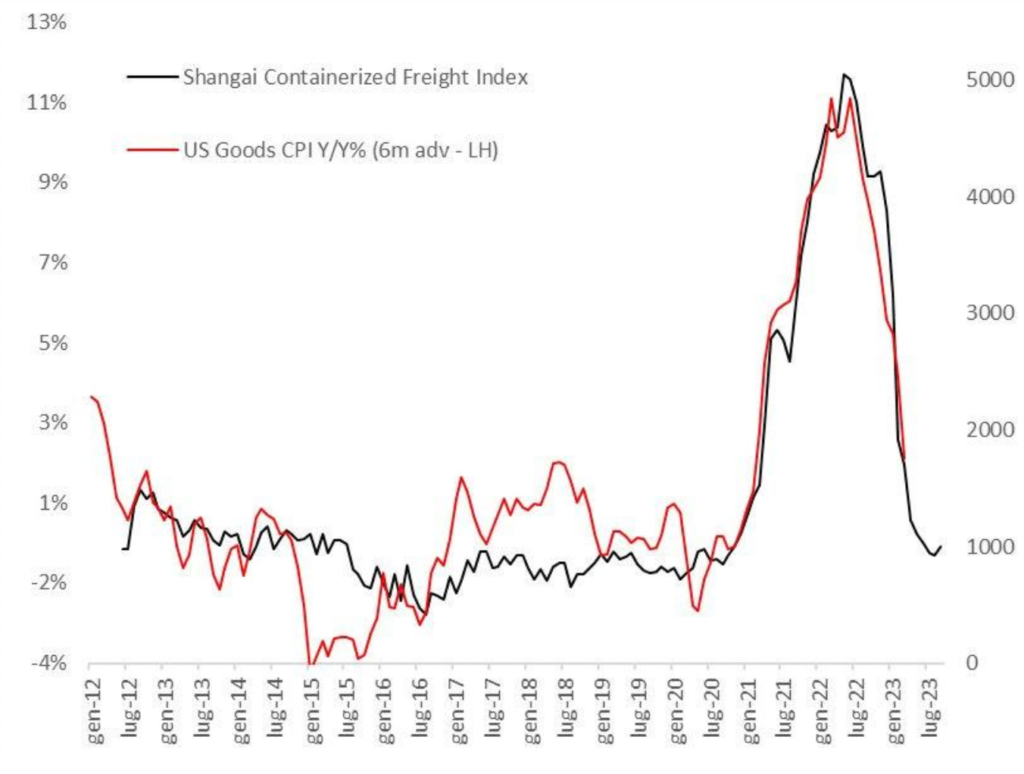

The rate hikes have certainly played a role in cooling inflation, particularly in the goods market. However, the services side, especially housing, still shows stubborn inflation, which is expected to recede over the coming months.

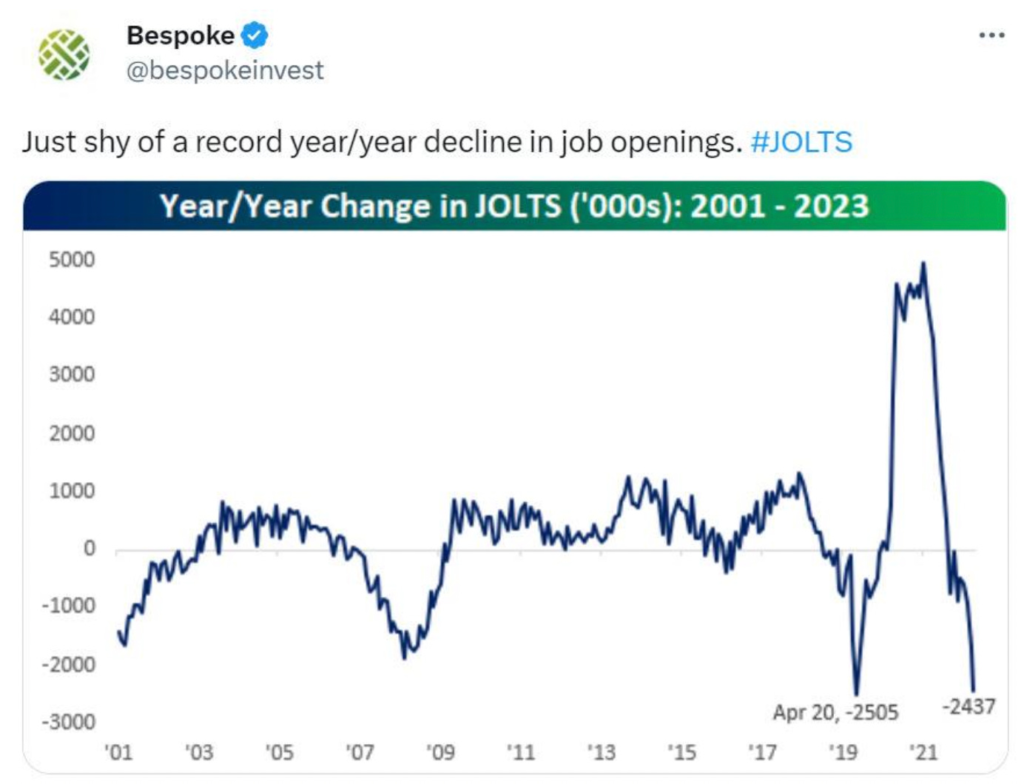

On the employment front, while JOLTS data signals a tightening labor market, the stronger-than-expected nonfarm payrolls of 253k, against the forecast of 185k, hints at the persistence of inflation, keeping hopes for lower rates at bay.

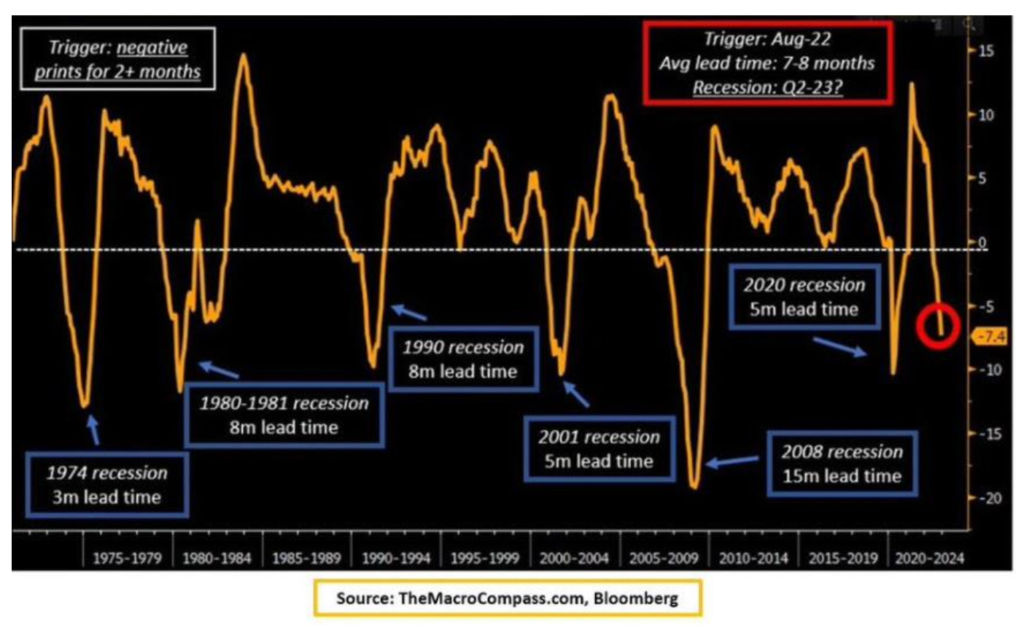

Bank of America’s skepticism about the Leading Economic Indicator Index (LEI) adds another layer of complexity to the narrative. Although each recession has unique traits, the recent drop in LEI has reached a point that it can no longer be ignored. Historical data suggests that a recession could be on the horizon within the next 3 to 15 months.

Banking Sector: Navigating Troubled Waters

The regional banking sector has been showing signs of distress. JPMorgan Chase & Co. recently put a floor for the beleaguered First Republic Bank in a government-led deal, cushioning the blow to the FDIC’s guarantee fund. Despite Jamie Dimon’s premature sentiment that “this part of the crisis is over,” more banks are likely to stumble.

TD’s decision to back off from a $13 billion takeover deal with First Horizon has sent ripples through the sector. With the fate of PacWest and Western Alliance hanging in the balance, the banking sector appears to be on thin ice.

The Fed’s Stance: A Pause or a Prolonged Halt?

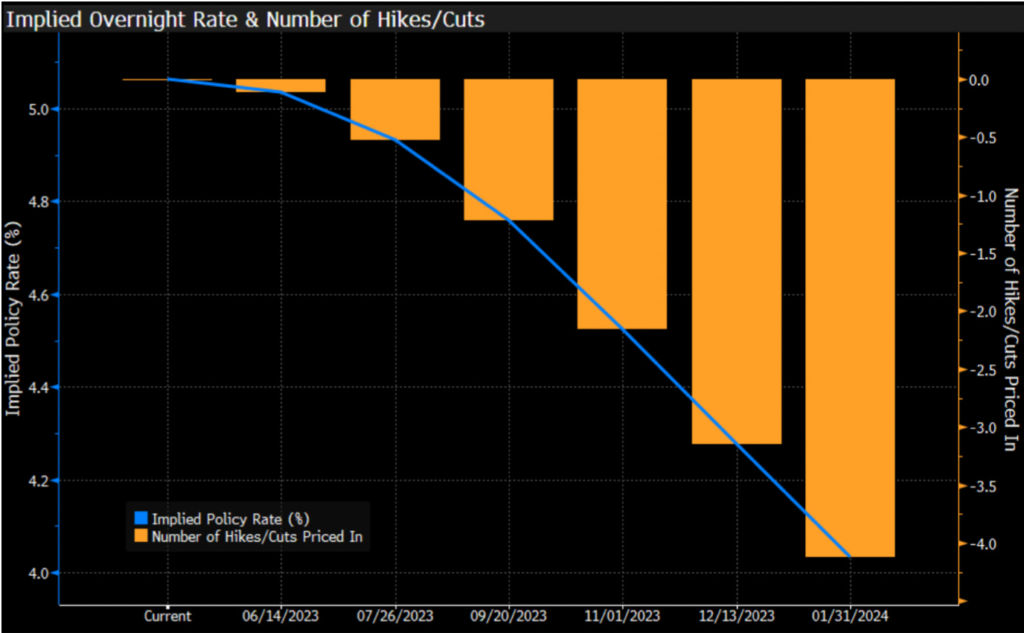

The latest 25 basis points hike, pushing interest rates above 5% for the first time since 2007, has sparked speculation about the Fed’s future monetary policy. The absence of a clear promise of a pause in the FOMC statement has led many to believe that the Fed has hit the end of its tightening cycle.

Despite the tightening credit conditions, the Fed seems to be leaning towards an elongated pause, ready to reassess the situation once the dust from the banking crisis settles and the shape of the impending recession becomes clearer.

The Bond Market: Betting on a Downturn

Contrary to the Fed’s optimistic outlook, the bond market is bracing for a downturn. The market is pricing in more than three rate cuts by the end of the year. Swap contracts linked to Fed meeting dates have collapsed, with the July rate briefly falling to 4.82%, a quarter point below where the effective Fed funds is likely to settle as a result of the recent rate hike.

Equity markets, particularly tech stocks, have been rallying, but the rally appears narrow with a high concentration.

The Balancing Act: Inflation, Jobs, and Credit

The Fed’s strategy to slow inflation and stimulate job growth comes with its own set of challenges. On one hand, the rate hikes are a much-needed measure to keep inflation in check; on the other, they put a strain on the banking sector and tighten credit conditions.

The battle now lies between Fed Chair Powell’s guidance, job market trends, and banking sector stress. While controlling prices and maintaining employment stability are noble goals, they don’t come without costs. The risk of bank failures leading to a recession is a systemic threat that could be challenging to overcome.

The term “credit” has now become a part of the Fed’s main narrative, a shift that underscores the growing concerns about the health of the banking sector. With each successive rate hike, the potential for cracks in the system increases.

Tightening credit conditions could provide a counterbalance against inflation, but this also constricts the economy’s liquidity, potentially leading to an economic slowdown.

As we move forward, the Fed will need to continue monitoring inflation trends and the labor market while keeping a close eye on the health of the banking sector. As of March, annual inflation remains at around 5%, significantly above the 2% target. Although Powell seems encouraged by the current state of the labor market, there’s an undeniable cloud of concern hanging over the credit market.

In conclusion, the Fed’s rate hikes may have started to cool inflation, but they’ve also stirred up concerns about the health of the banking sector and the potential for a recession. The Fed now has the delicate task of navigating the fine line between achieving its dual mandate and avoiding a full-blown financial crisis. In the face of this uncertainty, one thing is clear – maintaining a balanced and responsive approach will be crucial in the days ahead.

Safe Trading

Team of Elite CurrenSea

Leave a Reply