Economic Trends: Inflation Cooling Amid Financial Instability

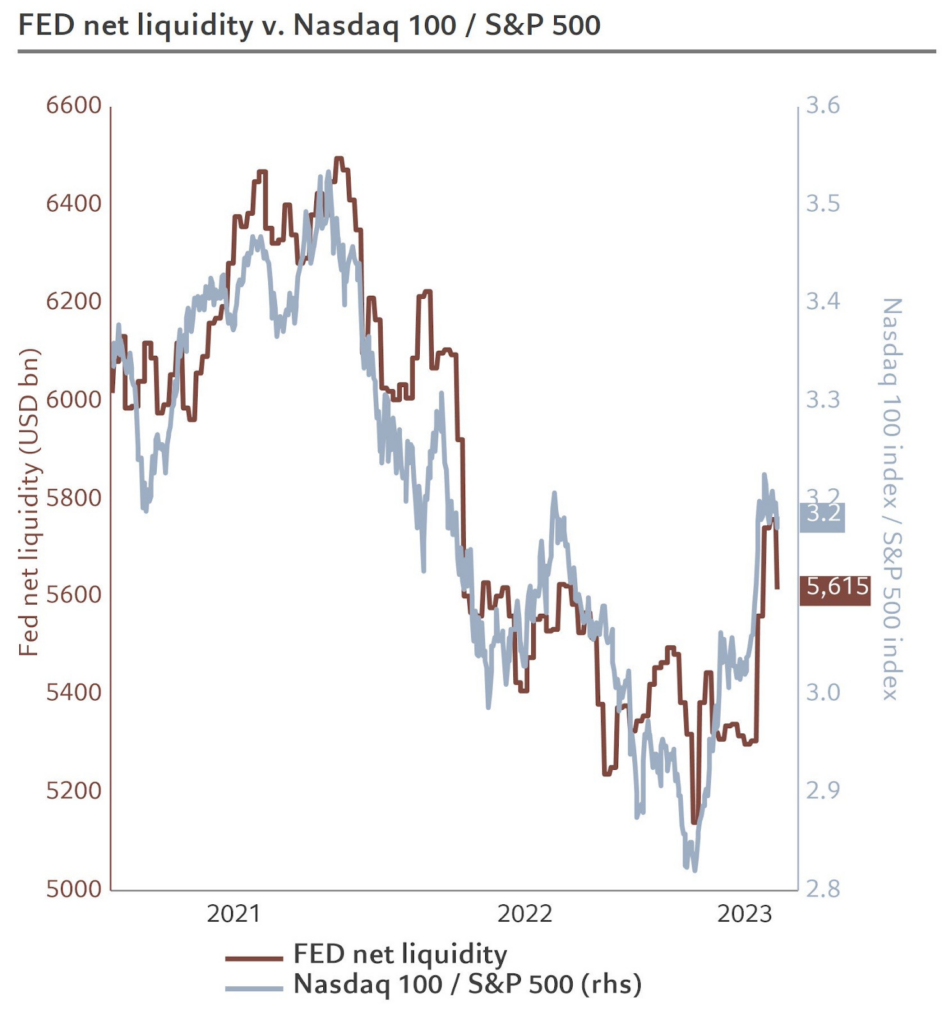

1. Shifting Focus of the Fed: From Inflation to Banking System Stability

In the aftermath of the recent FOMC meeting, the Federal Reserve’s focus has pivoted from inflation to the stability of our banking system. Here’s what you need to know:

- A series of regional bank collapses and persistent concerns about commercial real estate have rocked investor confidence.

- Despite these challenges, mega-cap tech stocks like Apple and Microsoft continue to surge, pushing indices higher.

- Market participants anticipate over three rate cuts by the year’s end, although Fed Chair Jerome Powell (JPOW) seems to be leaning towards an extended pause.

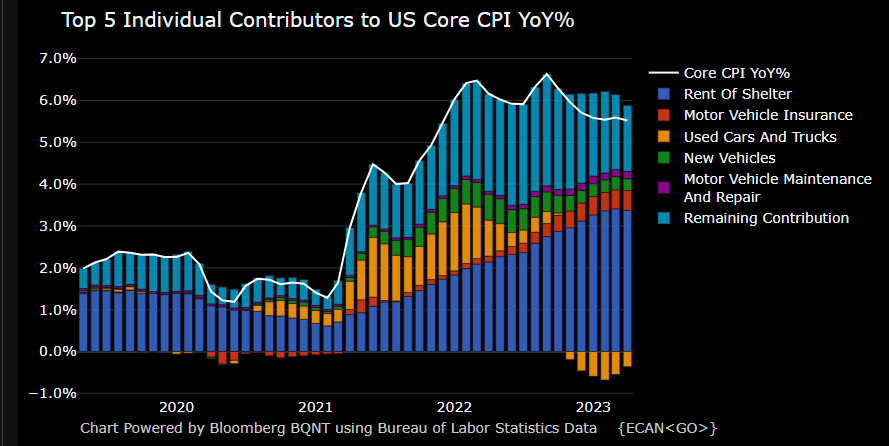

2. Breaking Down the CPI: Signs of Inflation Cooling

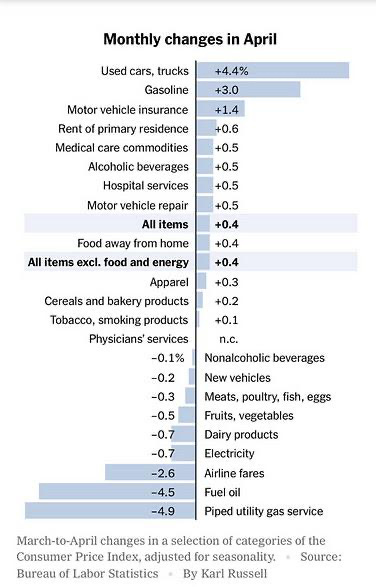

Headline CPI has consistently fallen for the ninth consecutive month, signaling a slow but steady cooling of inflation. Here are the highlights:

- Gasoline prices rose 3.0%, while natural gas rates saw a significant drop.

- Used vehicles, medical care commodities, clothing, and vehicle insurance remained high, while rent gains moderated for a second straight month.

- CPI excluding food and energy eased to 5.5% Y/Y from 5.6% Y/Y in March.

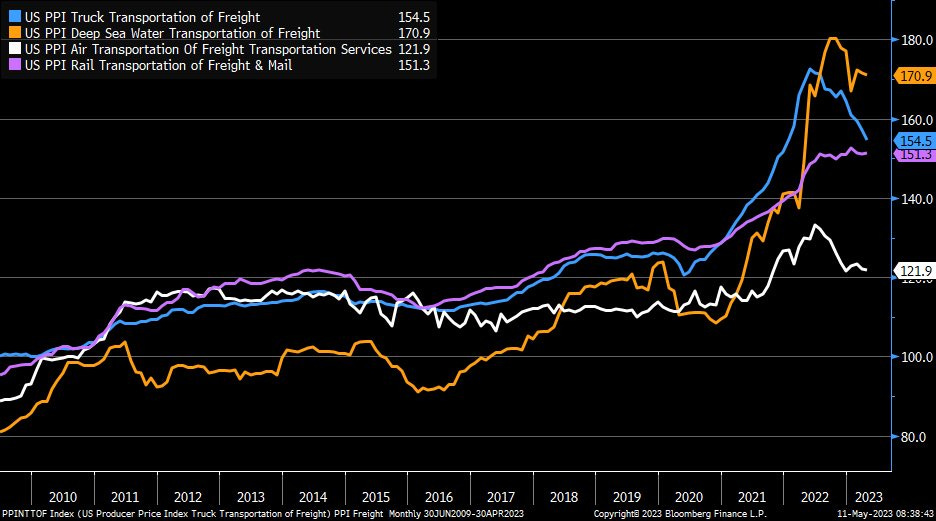

3. Other Macroeconomic Indicators: Rate Hikes and Jobless Claims

Several key indicators suggest that the economy is on the road to recovery:

- Initial jobless claims rose to 264k, indicating a tightening labor market.

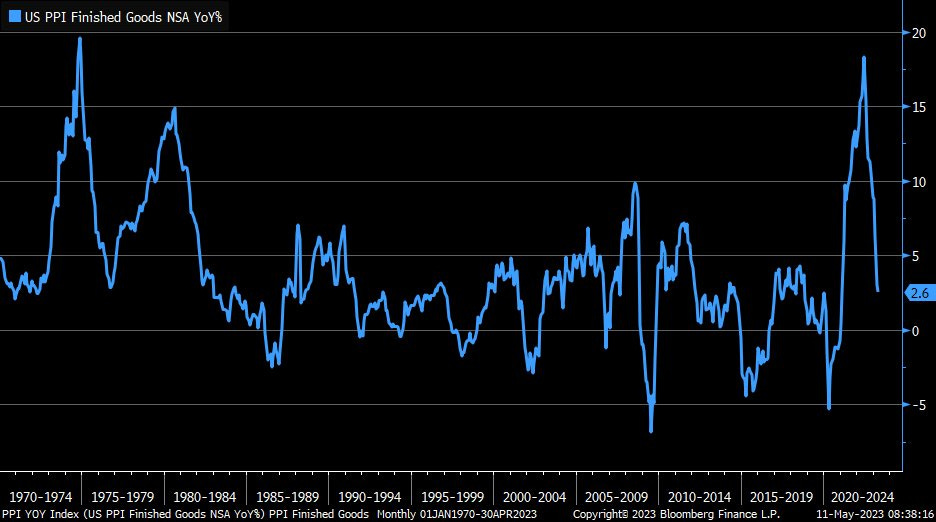

- April PPI hit +2.3% Y/Y, lower than the estimated +2.5%, indicating that supply chain problems could be easing.

- Core service prices excluding shelter are also slowing.

In conclusion, while there are clear signs of economic cooling, significant uncertainties and risks persist. The next steps for the Federal Reserve, the future of tech stocks, and the potential for more bank failures are among the issues that could influence the economy’s trajectory.

Stay tuned for more updates on this wild ride!

Safe Trading

Team of Elite CurrenSea

Leave a Reply