Decoding Financial Nuances: China’s Default, Goldman’s Outlook, and Real Estate’s Future

In today’s rapidly changing financial landscape, understanding key players and pivotal events becomes paramount. From China’s precarious real estate market to Goldman Sachs’ unique recession predictions, and the looming real estate conundrum, we break down the essential highlights that every informed individual should know.

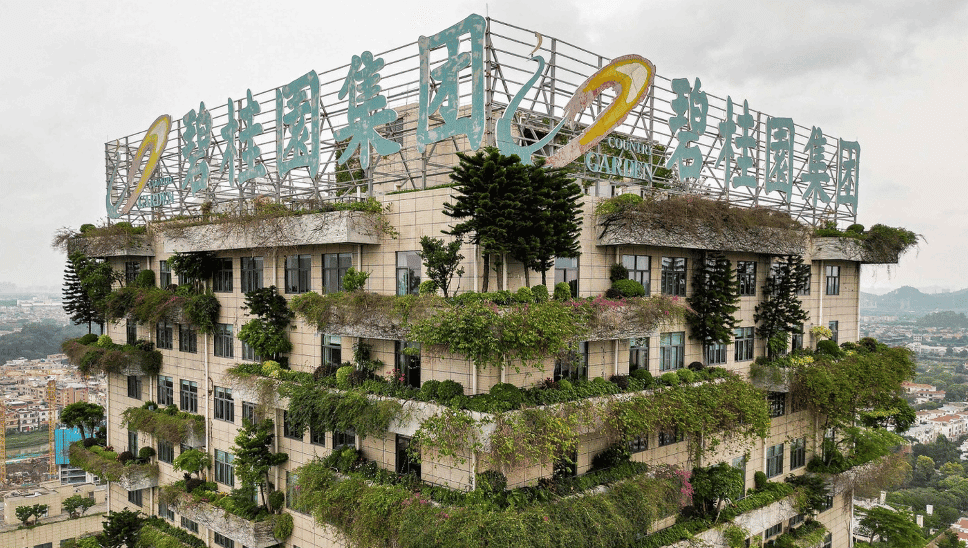

China’s Economic Deceleration

Country Garden, a major player in the Chinese real estate market, has recently managed to deflect a potential default by settling a hefty $22.5 million in interest on two bonds. However, with a looming debt of $187 billion and a commitment to repay $2 billion by year-end, its future remains uncertain. Adding to the concern is the company’s stock resemblance to penny stocks and China’s services sector growth, which is currently at its lowest this year.

Perspective: The Chinese economy is treading on thin ice. Be it spending, borrowing, or investing, all are experiencing a downturn. Recent projections even state that the Chinese economy won’t overtake the U.S until 2040. With a significant retreat from Chinese stocks by global investors, caution seems prudent.

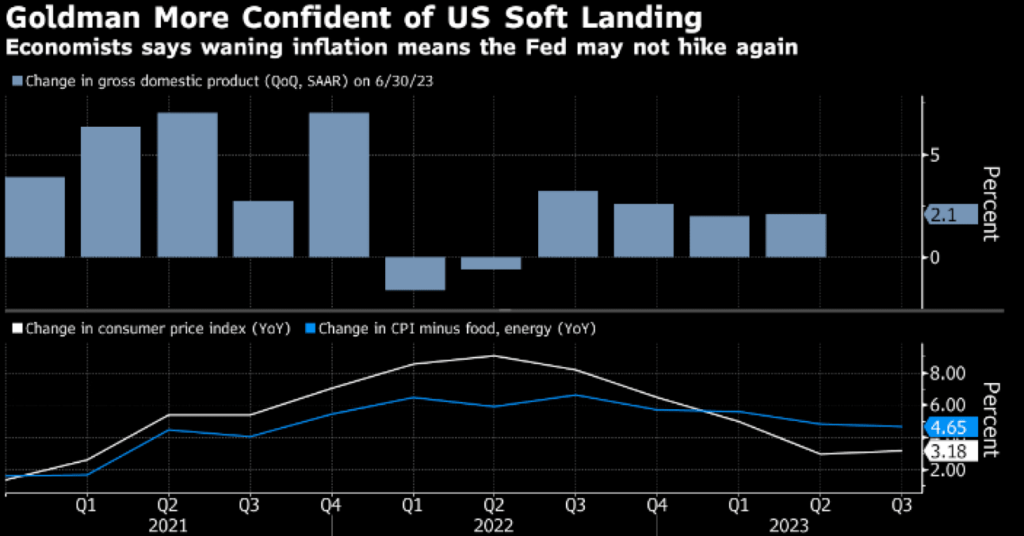

Goldman’s Revised Recession Prediction

While many anticipate a U.S recession, Goldman Sachs presents a rosier picture, slashing its odds from 20% to a mere 15%. The esteemed institution believes that there might not be a need to increase rates, especially if inflation begins to subside. Their predictions hinge on a bolstered job market by 2024.

Perspective: While Goldman is optimistic, other indicators raise concerns. The near depletion of U.S consumers’ pandemic savings, surging credit card debts, and unprecedented late payments suggest a more bearish outlook on the recession odds.

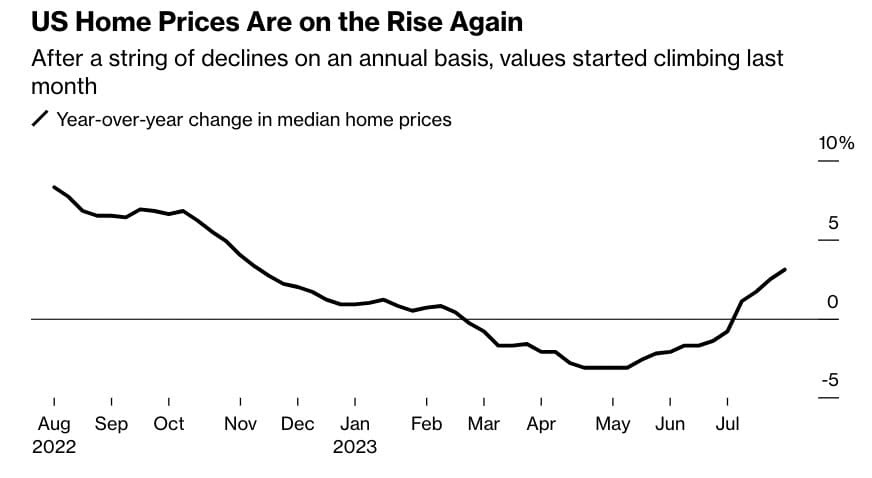

The Real Estate Conundrum: $1.3 Trillion at Stake

The post-pandemic scenario brings to light a startling statistic: one-third of global office desks are vacant. Current data indicates that office usage is merely half of pre-COVID levels. While many industry leaders advocate for physical collaboration, a majority of office spaces are still dedicated to solo work.

Perspective: The trajectory of office spaces in the coming years remains unpredictable. Analysts suggest that there could be a $1.3T reduction in urban real estate’s value by 2030. However, recent trends show a 25% surge in office property indices since its nadir earlier this year.

Safe Trading

Team of Elite CurrenSea

Leave a Reply