Financial Markets Weekly Performance Analysis: Athena EA vs Flagship

In this week’s analysis, we are going to discuss the following markets

- Indices – S&P, Nasdaq, FTSE 100, DAX

- Cryptos – BTC, ETH, BNB, XRP, ADA

- Commodities – Gold, Silver

- Forex majors – EURUSD, GBPUSD, USDJPY

Indices have Faced a Challenging Week for 19-23 June 2023

The trend switched from bullish to bearish for indices this week. The S&P 500, and Nasdaq Composite indexes experienced a slight decline, while the FTSE 100 and DAX showed a more significant decrease. Nasdaq Composite had the worst weekly performance since April due to traders cashing in the previous week’s profits. Let’s analyze indices markets in more detail.

USA Indices

Nasdaq Composite Index fell by 1.45% mainly caused by investors cashing in after a previous week’s rally. The Fed chair Powell indicated that further interest rate hikes could be imminent as another round of battle against inflation could be starting soon. A.I.-related stocks experienced a decline in enthusiasm, further contributing to the index’s bearish sentiment. Amazon stocks fell 0.8%, Nvidia which was up nearly 200% slid 1.7%, and Google-parent Alphabet and Netflix were each down by more than 2%. All this affected the Nasdaq, changing its trend to bearish.

The S&P 500 experienced a small drop, mostly due to the unchanged interest rates in the USA. Last week seemed positive with a bullish trend, but things changed when the Federal Reserve hinted at potential interest rate hikes. This announcement weakened investors’ optimism and led to bearish sentiment in the stock market for two consecutive days. Since Amazon, Google, Netflix, and Nvidia are also part of the S&P 500, This drop of 0.6% becomes obvious.

EU and UK indices

FTSE 100 was down by 1.84% indicating the negative effects of London’s central bank interest rates hikes. The bank increased interest rates to 5%. Bearish German Manufacturing PMI also affected FTSE 100. The Brent Crude price fell, and energy companies such as BP and Shell experienced losses. This further worsened the FTSE 100 as energy companies are significant components of the index. Shares of Audioboom, an AIM-listed podcast marker, plummeted after it issued a profit warning due to “challenging” advertising markets. Poor ad sales raise concerns about the overall health of the advertising industry, potentially impacting investor sentiment in related sectors, which can indirectly affect the FTSE 100.

DAX was mainly influenced by the bearish data from Germany. The German Manufacturing PMI was lower-than-expected, decreasing the index’s value. The profit warnings from companies such as Sartorius, Lanxess, and Siemens Energy have a direct effect on the German stock market index. Profit warnings indicate that the companies are experiencing challenges and may not meet their financial targets. All these fundamental events made the DAX experience a 2.51% decline last week.

Indices technical weekly performance numbers (USD)

| Monday Open Price | Friday Open Price | % Change | |

| S&P500 | 4396.11 | 4370.38 | -0.59 |

| Nasdaq Composite | 13642.29 | 13443.41 | -1.45 |

| FTSE 100 | 7642.72 | 7502.03 | -1.84 |

| DAX | 16272.21 | 15862.79 | -2.51 |

Crypto Market Thrives in 19-23 June 2023

Despite last week’s overall bearish crypto sentiment, several bullish news emerged, flipping the market into bullish territory. BNB was an exception and we have found the reasons.

BTC was in a downtrend last week, but its price rose to 30k. Investment firm BlackRock is going to create a Bitcoin ETF. Now, investors will be capable of buying BTC in the form of an ETF from standard brokerage accounts. BlackRock is managing around 9 trillion dollars, which makes this news super bullish. Investors appear to believe that BlackRock’s filing for a Bitcoin ETF is a positive sign. Binance is about to integrate Bitcoin Lightning Network for deposits and withdrawals, adding to the bullish sentiment in investor perception.

ETH developers consider raising the max validator limit from 32 to 2,048 ETH. This is bullish news for ETH, as the proposal to raise the maximum validator balance while maintaining a minimum validator balance of 32 ETH suggests a potentially positive development for Ethereum’s staking ecosystem. This should increase the Ethereum network’s efficiency and security, and promote a more stable staking environment.

BNB was in the red because Binance canceled registration in the UK’s FCA. Also, Binance’s executives could be called to testify in Brazil. This bearish news decided the fate of BNB this week. Hence, we saw a 1.21% decline in its value against USD.

XRP’s price was increased by 1.5% last week. Ripple’s Singapore subsidiary Ripple Markets APAC PTE Ltd acquired the license from the major Singaporean payments institute, giving the project a chance to create payment products in Singapore. This is super bullish for the XRP, while the SEC failed to gain ground in a legal battle against Ripple.

ADA was up by a staggering 11% last week. The crypto project’s ADA coin saw a sudden surge in whales’ interest, propelling its price to almost $0.30. Whales accumulating on the coin only indicates that major holders are buying more ADA. 6% of this price gain was shown in the last 24 hours of the week.

Crypto technicals weekly performance numbers (USD)

| Asset | Monday Open Price | Friday Open Price | % Change |

| BTC | 26,335.44 | 29,918.89 | 13.61 |

| ETH | 1,720.51 | 1,874.98 | 8.98 |

| BNB | 244.09 | 241.13 | -1.21 |

| XRP (Ripple) | 0.487572 | 0.494908 | 1.50 |

| ADA (Cardano) | 0.260968 | 0.290462 | 11.30 |

Gold and Silver Face Shaky Ground: Bears Take Control for 19-23 June 2023

Gold lost almost 2.27% of its value in the last 5 days, hitting two-month lows. Since the U.S. Federal Reserve Chief Jerome Powell reiterated that additional interest rate hikes were imminent, the dollar went bullish. The overall USD sentiment was bullish, contributing to this decline in price. USD is correlated with Gold, as the latter is seen as a haven when USD is weak. Bullion prices falling also contributed to bearish Gold dynamics.

Silver was down overall by 7.6% this week following the fall in bullion prices. This was primarily caused by high-interest rates. When interest rates are high, investments that offer no yield or return, such as gold bullion, become less attractive to investors. England, following the Fed’s steps, has also increased its interest rates to 5%.

Commodities technicals weekly performance numbers (USD)

| Monday Open Price | Friday Open Price | % Change | |

| Gold | 1958.6 | 1914.13 | -2.28 |

| Silver | 24.051 | 22.224 | -7.67 |

A Boring Week in Forex for 19-23 June 2023

EUR/USD ended slightly higher due to unchanged interest rates in the US. GBPUSD had a challenging week as the Bank of England raised interest rates.USDJPY rose slightly due to a bullish sentiment toward the USD. Currency markets were influenced mainly by interest rates, economic indicators, and market sentiment.

EUR/USD ended the week slightly higher. Several major fundamentals were released last week, contributing to EURUSD’s slight movement. Interest rates remained the same in the US. Building permits were increased from 1.147M to 1.491 M which is bullish for the currency. Initial Jobless Claims were slightly higher than the forecast at 264K, which is bearish. Crude Oil Inventories were lower than the previous and forecast numbers at –3.831M instead of 7.919M, which is also bearish. All this news made EURUSD only rise 0.16% as Europe’s data was mainly bearish.

GBP/USD had a red week. The Bank of England increased the interest rates from 4.5% to 5%. Higher than the prediction of 0.25%. The Consumer Price Index (CPI) remained at 8.7%, higher than the forecast of 8.4%. The Manufacturing Purchasing Managers’ Index (PMI) was at 46.2 lower than the forecast and actual previous numbers which were bearish. Of the three major indicators, two were bullish and one bearish, but the pair still went down, mainly caused by interest rate hikes from the central Bank of England.

USD/JPY ended the week higher by 0.86% indicating the main contributor to the pair movement was the USD’s bullish sentiment. Since the Bank of Japan did not increase the interest rates, the USDJPY was affected mainly by US fundamentals this week.

Forex technicals weekly performance numbers (USD)

| Monday Open Price | Friday Open Price | % Change | |

| EURUSD | 1.0942 | 1.096 | 0.16 |

| GBPUSD | 1.2834 | 1.2746 | -0.68 |

| USDJPY | 141.867 | 143.089 | 0.86 |

Performance Comparison Chart of $1000 investment

How much money would you make or lose last week if you were to invest $1000 in each of the sectors discussed above?

Let’s pick the winning asset from each sector and compare its performance with the two flagship automated trading systems from Elite CurrenSea. Elite CurrenSea offers a wide range of trading systems and portfolio management solutions, and Athena EA and Portfolio Flagship are its current bestsellers. These robots have been tested on real markets.

Athena EA has shown positive gains last week with average daily returns of 0.23% or 1.15% weekly. On a $1000 investment, this would be $11.5. The EA was a winner this week, again proving its profitability in a live markets environment.

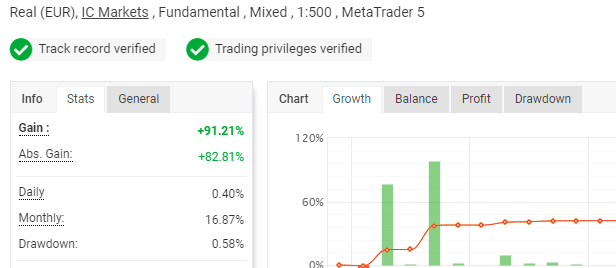

Athena EA live results 19-23 June

The above picture shows the real returns that are verified on the Myfxbook platform on the live account.

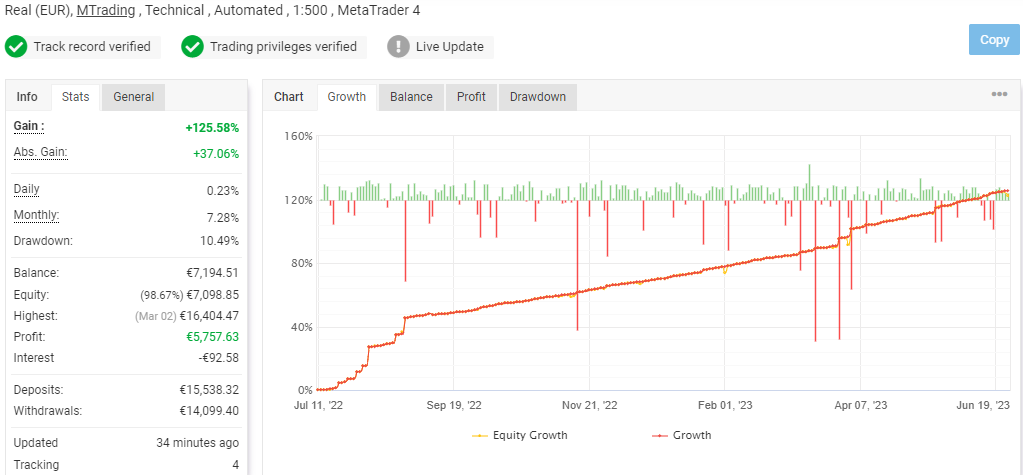

Portfolio Flagship Live Results 19-23 June

Another bestselling system from Elite CurrenSea is called Portfolio Flagship and is a solid performer with 2% gains in 5 days.

Let’s see the $1000 investment potential results for the past week.

| Crypto | Portfolio Flagship | Athena EA | Forex | indices | Commodities | |

| Growth | 13.61% | 2% | 1.15% | 0.86% | -0.59% | -2.28% |

| PnL on $1000 | $136.1 | $20 | $11.5 | $8.6 | -$5.9 | -$22.8 |

As we can see, Bitcoin is in 1st place with 13.61% returns, Portfolio Flagship, and Athena EA are in 2nd, and 3rd places.

Safe Trading

Team of Elite CurrenSea

Leave a Reply