Chip Wars, Recession Talks and the Rebalancing Act: An Overview of Current Economic Events

In a dynamic world of financial markets where retail growth, semiconductor wars, and recession talks take center stage, understanding the broader picture of the global economy is more crucial than ever.

Surging Retail Sales Amid Recession Whispers

Economic forecasters predict the release of retail sales data today to show the most significant growth since January. The retail sector seems to be humming a different tune from those heralding the onset of a recession. Clearly, consumers didn’t get the memo about an impending economic downturn!

The Chips Are Down – Implications for China and U.S. Tech Firms

China, the world’s largest consumer of semiconductors, amassed a whopping $180 billion of the $555.9 billion global semiconductor expenditure in 2022. However, the landscape may be shifting. The White House recently decided to implement restrictions on U.S. tech, including chip sales, to China. Domestic industry stakeholders have raised red flags against these actions. This led to industry leaders meeting Biden administration officials yesterday to persuade them against escalating restrictions.

Manufacturing Strides Forward, Albeit with a Mixed Bag of Indicators

July has seen manufacturing activity expand unexpectedly for two consecutive months, contradicting forecasts of contraction. Despite The Empire State Manufacturing Survey’s general business conditions index falling slightly less than anticipated to 1.1, the picture isn’t all rosy. Some key indicators like new orders and employment went up, while shipments went down. Future expectations for the coming six months also weakened. The silver lining? Inflation seems to be easing, with prices paid and received dropping to their lowest since August and July 2020, respectively.

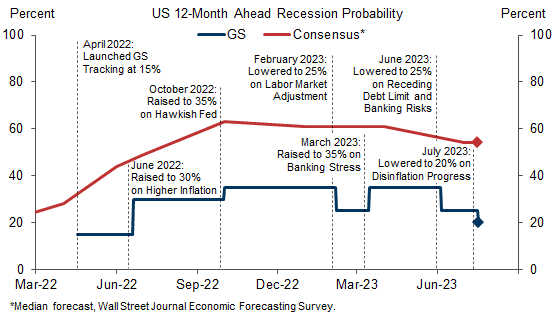

A Ray of Hope – Economists and Goldman Sachs Downplay Recession Fears

The fear of an impending recession seems to be fading. Just yesterday, Goldman Sachs reduced its 12-month recession odds from 25% to 20%. Their optimism stems from strong fundamentals and steady progress on inflation, even amid the backdrop of higher borrowing costs. Echoing this sentiment is Treasury Secretary Janet Yellen, who expressed her belief in avoiding a U.S. recession.

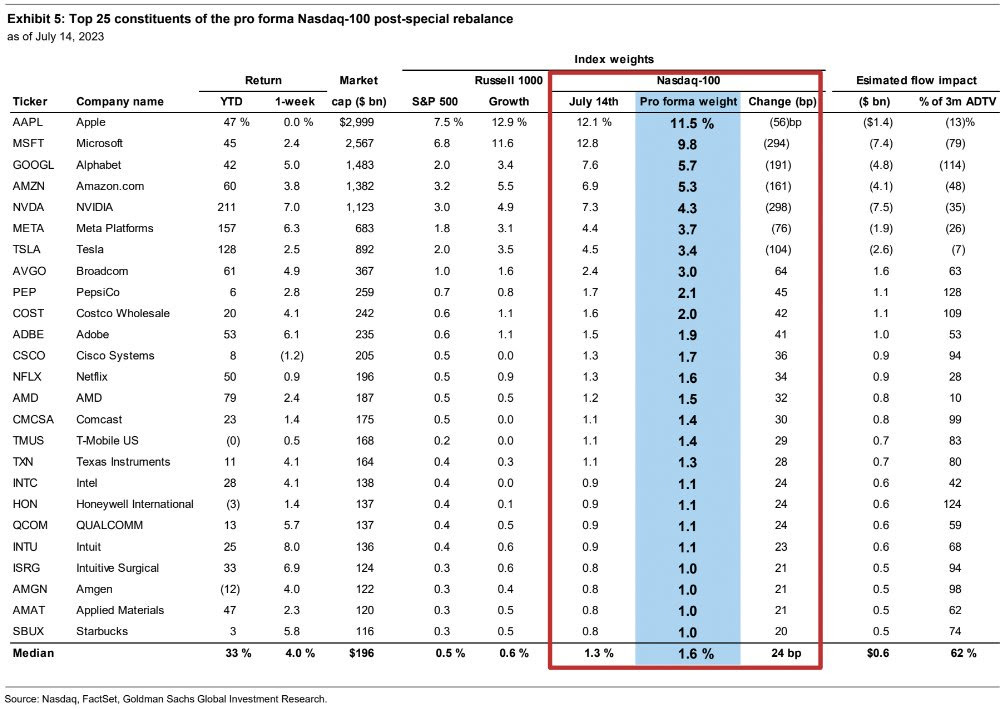

Rebalancing the Nasdaq-100: An Overdue Adjustment

The Nasdaq-100’s top seven stocks currently dominate 56% of the index, an imbalance that will be corrected after July 24, bringing their collective weight down to 44%. The most significant changes are expected for NVDA (3%), MSFT (3%), and AAPL (0.6%). This is only the second such “special rebalance” in a quarter of a century, the first one back in 2011 left no discernible impact on the affected stocks.

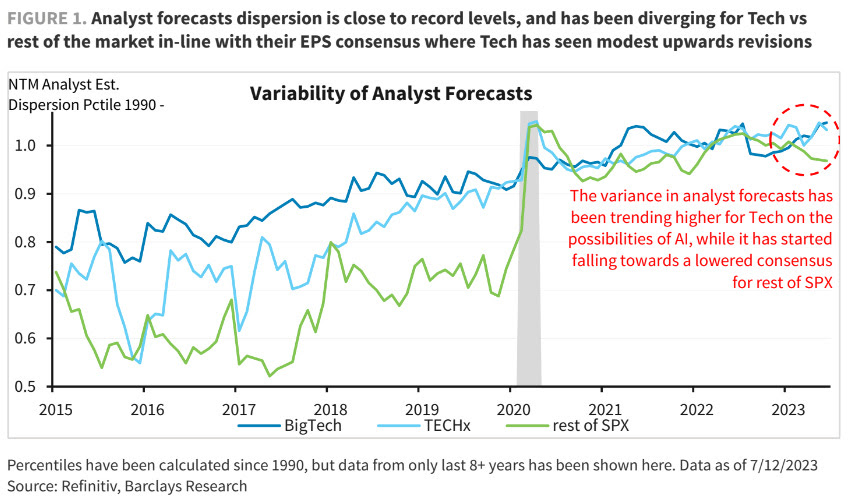

A Positive Earnings Season Ahead?

EPS estimates have seen a higher number of positive revisions than negative ones, and pre-season cuts are fewer than typical. Meanwhile, earnings uncertainty, which measures analyst forecast dispersion, is falling for the S&P 500 as a whole. The tech sector, however, is witnessing a rise in uncertainty.

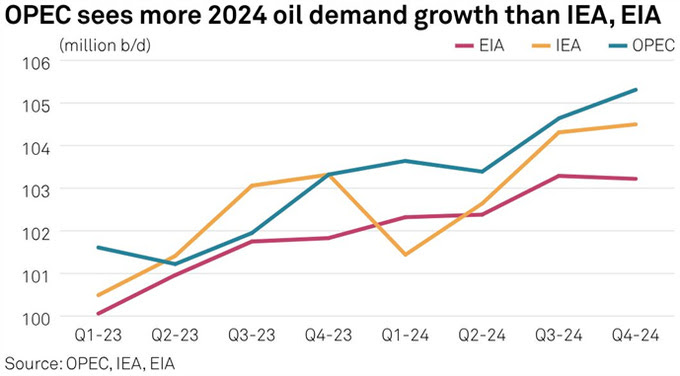

Oil Demand and Supply Dynamics: The Market Tightens

Major market observers, OPEC, IEA, and EIA, all predict a rise in oil demand for Q3 and anticipate a supply squeeze in the latter half of the year. According to Standard Chartered, the global market is already running a deficit. Despite these signals, oil traders have remained sellers, ignoring warnings of a tightening market.

Safe Trading

Team of Elite CurrenSea

Leave a Reply