Celebrating Economic Recovery: GDP Soars and Equity Demand Surges

Economic tremors are afoot, painting a vivid tapestry of growth, challenges, and opportunities as we delve into Q2 2023’s financial landscape.

A Gleaming Uptick in GDP

Pop open the champagne as we dive into the day with fantastic news. The U.S. GDP has made a remarkable leap to 2.4% in Q2 2023, a steady climb from 2% in Q1. The anticipated recession, which was once a grim prospect, has miraculously dissipated like a trick from a magician’s hat.

An Unexpected Dip in Home Sales

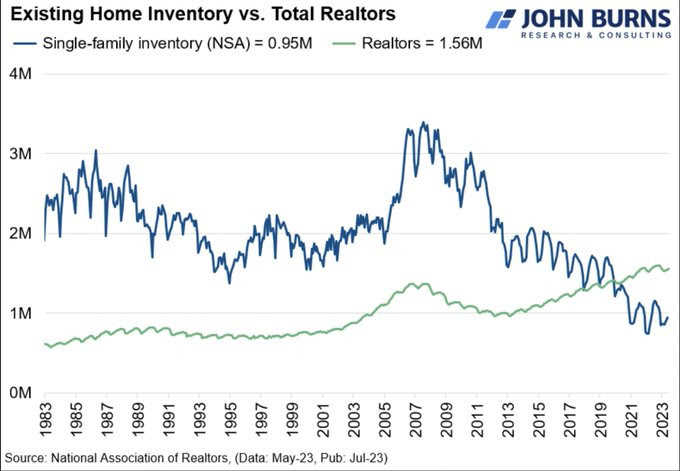

As of 4 pm EST on July 26, 2023, it’s time to assess the housing market. A noticeable drop in sales of new single-family homes in the US has been reported, with a 2.5% decrease in June to 697k. Coupled with this, the previous month’s sales were significantly revised down from 763k to 715k. The median sales price has witnessed a 4% YoY fall to $415,400. An inventory shortage is maintaining market tightness, emphasized by the astonishing fact shared by John Burns that the US now has 600k more realtors than there are homes for sale.

Federal Reserve Raises Interest Rates

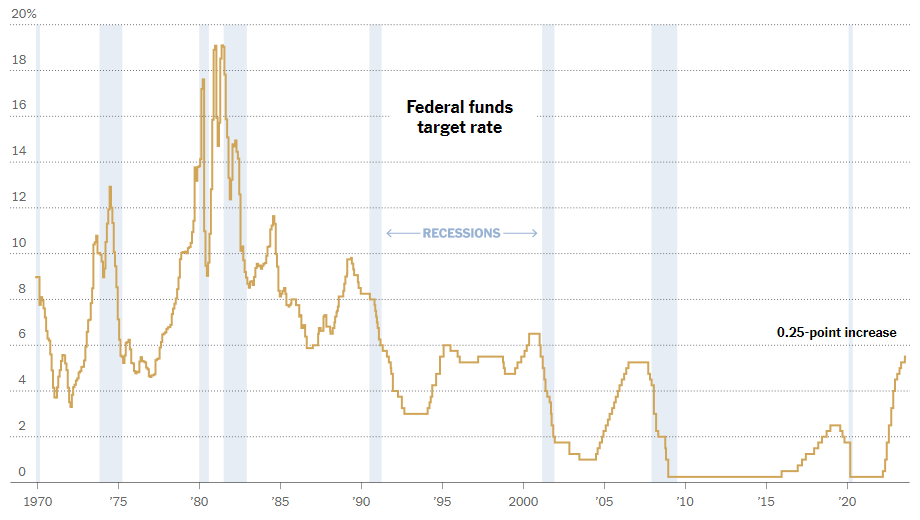

In a historic move, the Federal Reserve raised interest rates yesterday to the highest in 21 years. The FOMC officials unanimously voted to hike by 25bps to 5.25-5.50. This wasn’t a shocker to the market, as Jerome Powell, at the press conference, stressed that future meetings would be ‘live’ (i.e., decisions are yet to be made). He also proposed that the target inflation rate (2%) wouldn’t be achieved until 2025 at the earliest and that a recession is no longer predicted by the staff.

Stock Market Reaction Post Interest Rate Hike

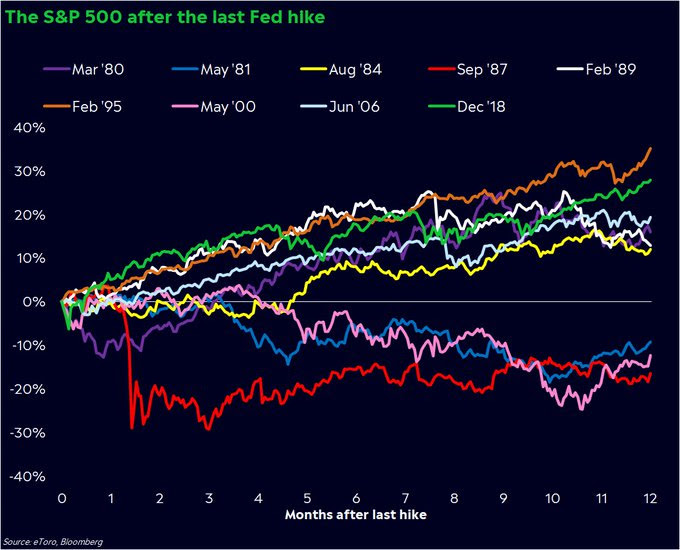

The ripple effects of the Fed’s rate increase were mostly incorporated ahead of the official decision. In the scenario that yesterday’s hike is the last for the foreseeable future, stock predictions become intriguing. History shows that the S&P has averaged a 7.6% increase in the 12 months following the end of a rate hike cycle. When broadening the perspective, the S&P has seen an average gain of 46.2% and 70.6% in the 3- and 5-year periods after the last hike.

Rekindled Interest in Global Equities

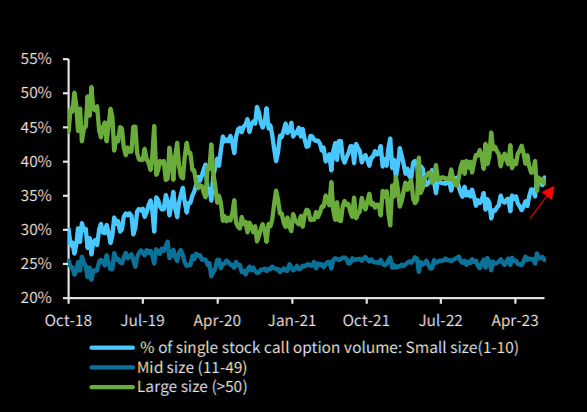

Global equities have been bathing in the limelight, with consecutive months of inflows for the first time since March 2022. Leading the pack is the Dow, boasting 13 straight sessions of gains, a streak not seen since 1987. Retail investors are also at the forefront, with their appetite for equities escalating. Retail investors are now purchasing more call options than institutions, forcing the smart money to play catch up. However, equity allocations from both retail and institutional investors, as per Barclays, remain far from excessive.

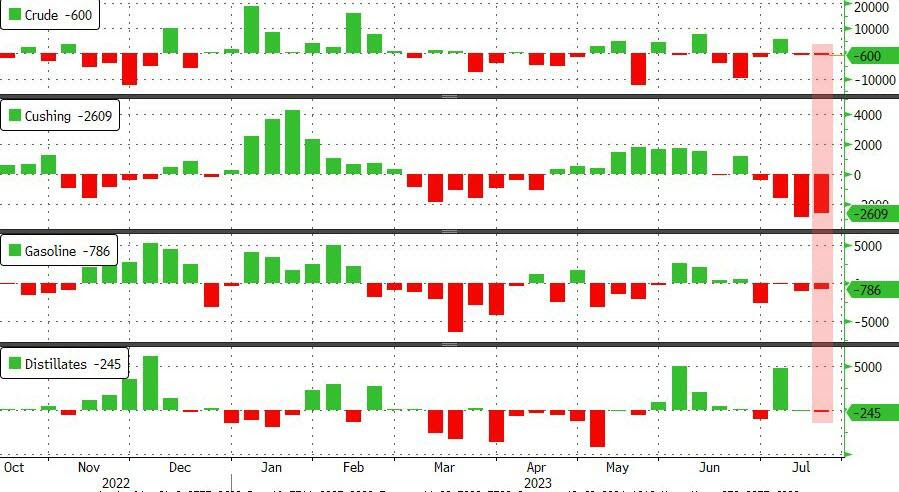

Crude Oil Bounces Back

Crude oil is experiencing a resurgence, following yesterday’s inventory draw. Crude inventories slipped by 600k barrels (compared to the expected 2.2 million), along with declines in Cushing, gasoline, and distillates stocks. Both WTI and Brent prices are at their highest since mid-April.

Safe Trading

Team of Elite CurrenSea

Leave a Reply