Bridging the Gap Between Rest and Investments: The Week Ahead

After a refreshing break, it’s time to swap the beach towel for a business suit and dive back into the high-octane world of finance. As we shake off the leisurely air of our summer vacations, we are faced with an exciting week ahead: the S&P 500 being tantalizingly close to its record peak, an anticipated Federal Reserve (Fed) rate hike on the horizon, and tech titans revealing their Q2 earnings. These currents promise to make the week an exhilarating ride, so grab your coffee and let’s navigate these financial waters together!

USD’s Bearish Undercurrents

Institutional investors are navigating bearish currents when it comes to the US dollar, with net short positions surging by 18% in the past week. This sentiment is buoyed by consistent advancements in inflation control, which potentially means a less aggressive Fed and presents a significant obstacle for the dollar. As such, the market’s gaze is firmly fixed on the Fed’s forthcoming steps.

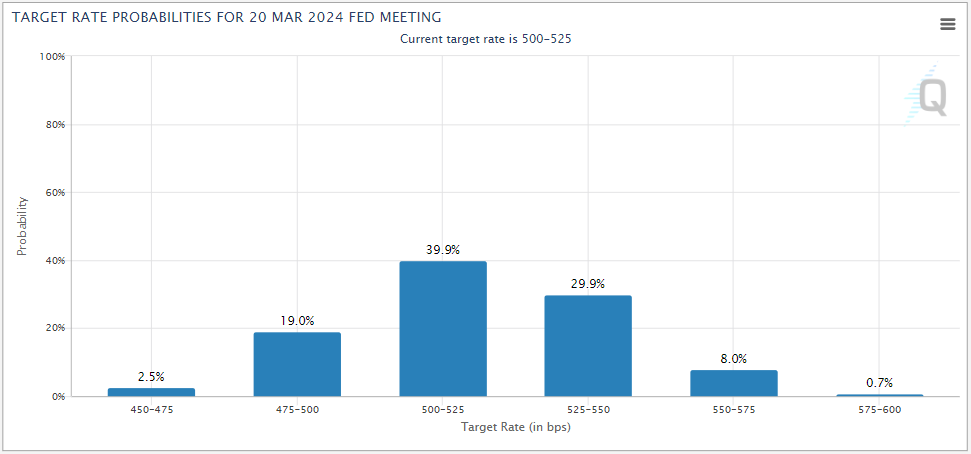

Deciphering the Fed’s Compass

The Federal Reserve will announce its decision on interest rates this Wednesday, and with the market predicting a near-certain 25bps rate hike, every investor will be sifting through Fed Chair Powell’s words for hints of future policy direction. Post-hike, market projections anticipate the Fed funds rate will hold steady at 5.25-5.50% until Q1 2024, with the first reduction seen occurring in March.

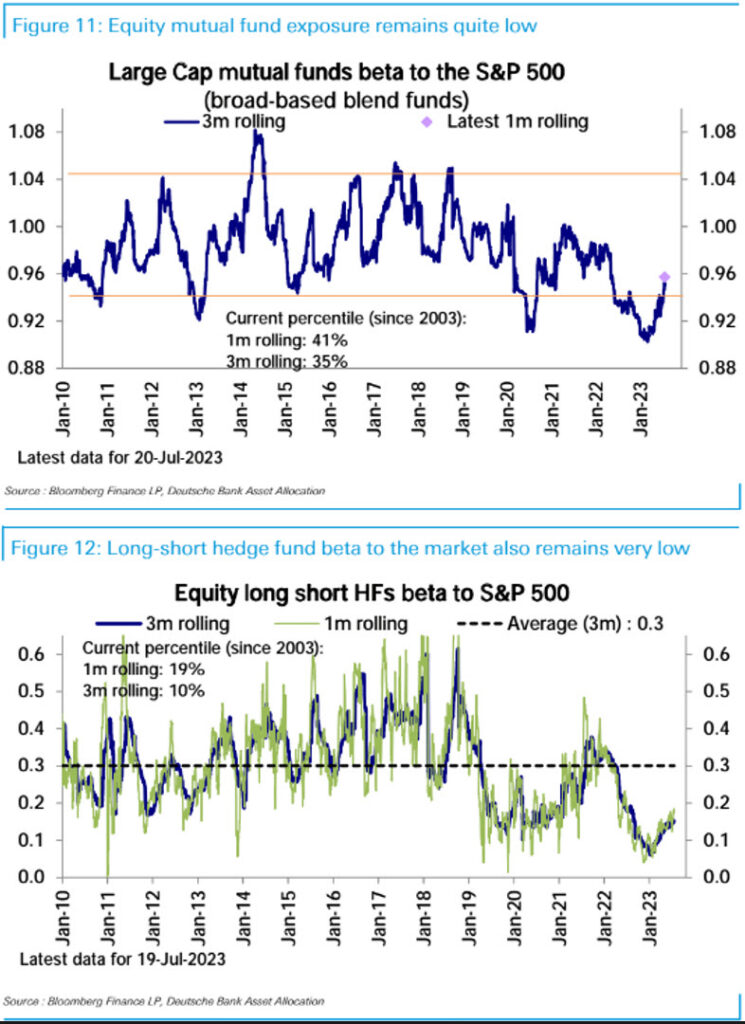

The Equity Funds Ebb and Flow

After three consecutive weeks of inflows, US equity funds experienced a $2.3 billion outflow last week. However, capital still flowed towards Tech, Financials, and Consumer Goods sectors. Presently, investors are favorably positioning themselves in Staples, Tech, and Telecom, with aggregate equities positioning in the 82nd percentile, according to Deutsche Bank. Interestingly, hedge funds and mutual funds are still behind in exposure.

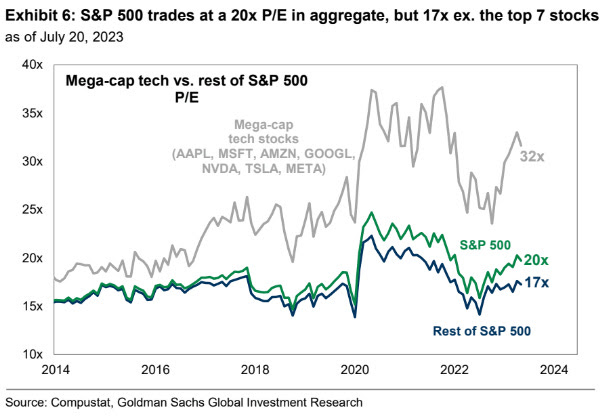

The Narrow Rally: A Hidden Treasure?

With the current rally exhibiting the narrowest leadership in three decades, it’s narrower than the Dotcom Bubble, as reported by JPMorgan. However, this limited breadth may be concealing hidden gems. Goldman Sachs calculated the aggregate forward P/E of the “Magnificent 7” at 32x, pulling the overall index at 20x. Meanwhile, the trailing 493 have a 17x multiple. The question now is, can the underperformers bridge the gap?

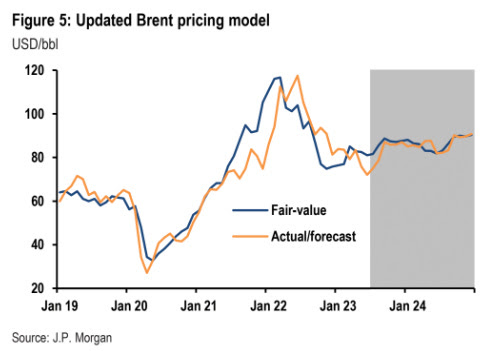

Predicted Oil Price Surge

Both Goldman Sachs and JPMorgan forecast climbing oil prices in the near future. Goldman Sachs anticipates demand reaching all-time highs and a significant deficit in the latter half of the year, with both banks predicting Brent crude to close the year at $86 a barrel.

Safe Trading

Safe Trading

Team of Elite CurrenSea

Leave a Reply