A Preview of the Week Ahead: Earnings Season, Inflation Data, and More

As we embark on a thrilling week, buckle up for key economic revelations and market-moving events, including the start of earnings season with a focus on banks and the release of the Consumer Price Index (CPI) inflation data.

Secretary Yellen’s Diplomatic Sojourn

Janet Yellen, the US Treasury Secretary, has concluded her strategic visit to China, casting a revealing light on the complexities of international diplomacy. The relationship between these two economic giants is undeniably delicate, with Yellen stressing the protective nature of US restrictions and refuting any intentions to cause harm to China.

During her visit, she addressed an array of critical concerns, from perceived intimidation of American businesses to the existential threat of climate change. China, in turn, sought alleviation of economic sanctions and containment strategies. Though fraught with issues, Yellen branded the visit “constructive”, hinting at possible future developments.

Labor Market Pains

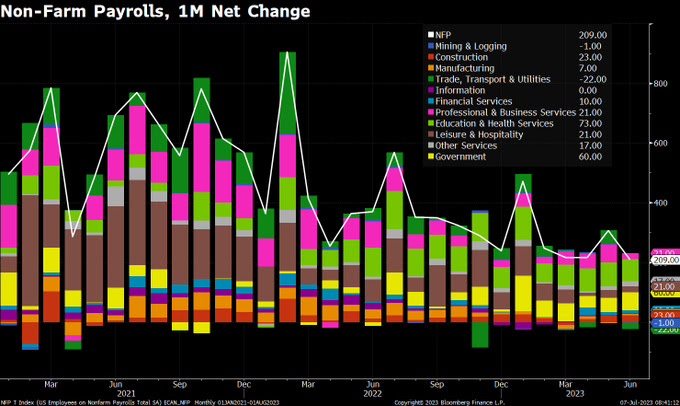

The job market has hit a stumbling block, with June’s employment figures showing the lowest rise since December 2020. Non-farm payrolls grew only by 209k, notably falling short of the estimated 225k and the previous month’s 306k. This marked the first such disappointment in over a year.

While a slowing pace of job creation indicates a normalizing labor market, wage pressures persist with a 0.4% increase in average hourly earnings in June, amounting to a 4.4% YoY rise. Such continual wage growth represents a significant hurdle for the Federal Reserve in its mission to combat inflation.

Threads App: The Speedy Success

Mark Zuckerberg’s latest venture, the Threads app, has achieved an astonishing feat. If you predicted another application would break ChatGPT download records, take a bow. Surprisingly, it amassed 100 million downloads within just four days.

To put this in perspective, Twitter took approximately three years to achieve what Threads managed in a single day. With Twitter’s lead quickly eroding due to Threads’ rapid userbase growth, a shift in the social media landscape seems imminent.

The Banking Sector’s Earnings Season

Three financial heavyweights – JPMorgan, Wells Fargo, and Citigroup – are all set to kick-start the Q2 earnings season on Friday. Recent estimate revisions show a more favorable outlook for JPMorgan, while Wells Fargo and Citigroup have seen declines.

Given that JPMorgan and Citigroup together comprise over 45% of the total earnings of the major banking sector, their performance will be crucial. Projections suggest a 14% YoY revenue growth for the banking sector this quarter.

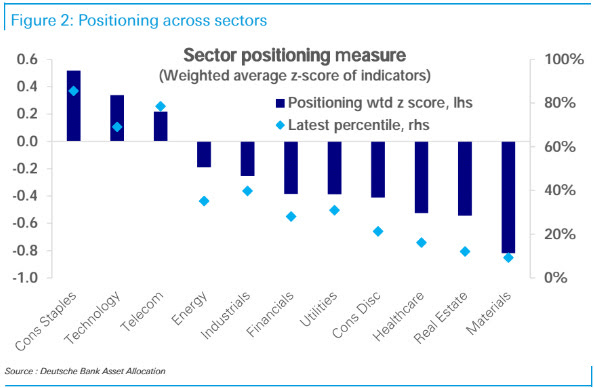

Investors’ Choice: Equities Overweight

Investor positioning in equities is overweight, as per a Deutsche Bank report, with discretionary and systematic positioning in the 58th and 78th percentiles, respectively. Sectors like Staples, Communications, and Tech have emerged as favorites, while Materials and Real Estate remain underweight.

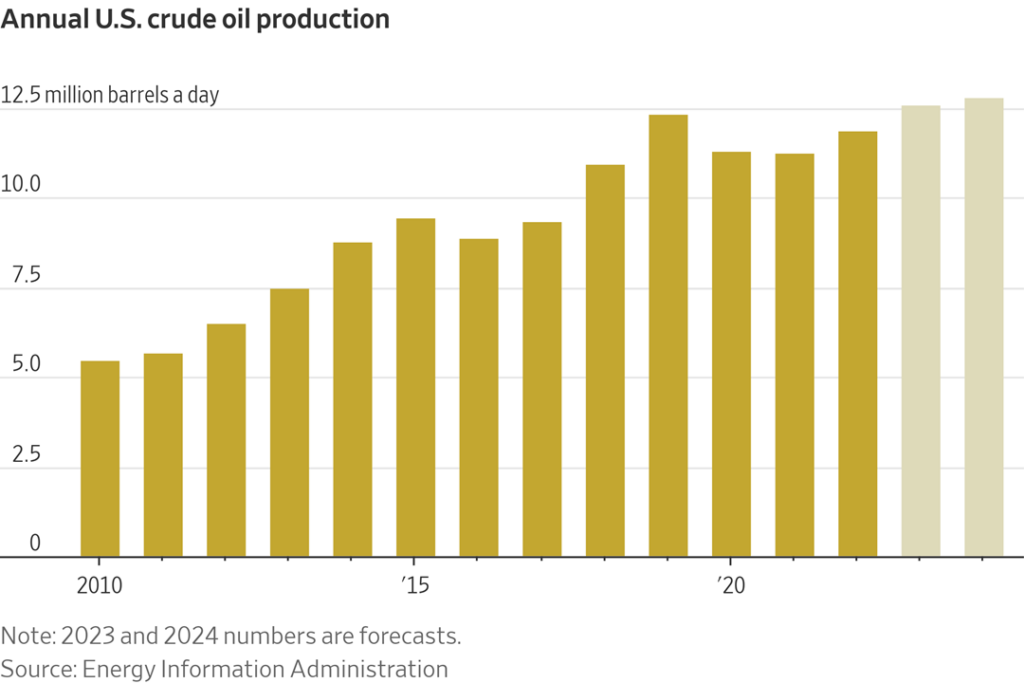

Breaking Records: US Petroleum Production

US petroleum production is expected to set new records this year, with a 9% surge in April’s crude output YoY. The country has contributed to half of annual non-OPEC+ crude oil production in 2023. This increased output could destabilize OPEC’s control over price setting through production cuts.

Safe Trading

Team of Elite CurrenSea

Leave a Reply