A Global Tug-of-War: Deutsche Bank’s Crypto Leap, Blinken’s Beijing Visit and More

The world of finance is experiencing a seismic shift as Deutsche Bank, the European banking behemoth commanding a robust portfolio of $1.4 trillion, ventures into the uncharted territories of digital assets. The banking giant has lodged an application for regulatory approval to provide a crypto custody service, signaling the mainstream acceptance of cryptocurrencies. As big banks embrace digital assets, it’s interesting to note the challenges faced by independent players like Coinbase, currently embroiled in a legal battle with the SEC.

Blinken’s Beijing Visit: A Diplomatic Milestone

Moving from the financial arena to geopolitical landscape, after months of delays, US Secretary of State, Anthony Blinken, successfully undertook his highly anticipated visit to Beijing. This diplomatic exchange, the first of such stature in five years, aimed to bridge the communication gap and mitigate potential conflicts between the two global powers. Following constructive talks with Chinese President Xi Jinping, there’s optimistic anticipation for a prospective summit between Presidents Biden and Xi later this year.

Corporate America Braces for Economic Headwinds

Contrary to the diplomatic advances, corporate America is navigating economic turbulence as Fed Chairman Powell’s announcement forecloses immediate rate cuts. With about $260 billion corporate debt maturing within a year, the risk of defaults and distressed exchanges looms large as the money supply tightens.

Consumer Confidence Surges Amid Inflation Expectations

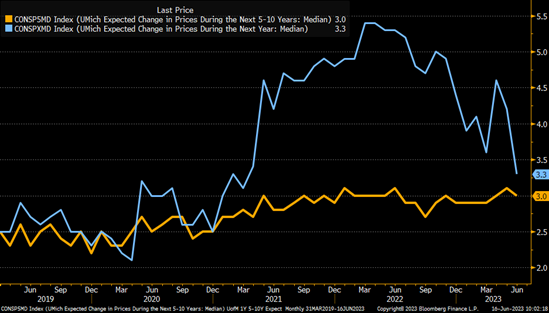

On the domestic front, June saw an unexpected rise in consumer sentiment, hitting its highest level in four months.

The optimism extended to both the current conditions index and consumer expectations. Furthermore, expectations for year-ahead inflation observed a decline for the second consecutive month, although long-term inflation expectations remain high.

US-China Tech Tussle Intensifies

The ongoing tension between the US and China found another flashpoint with China’s ban on companies handling critical data from buying chips manufactured by US-based Micron, citing cybersecurity concerns. Interestingly, despite the blacklisting, Micron plans a significant $600 million investment to expand its Chinese operations.

Big Pharma Takes on the Biden Administration

In healthcare developments, Bristol Myers Squibb has sued the Biden administration over new Medicare powers to negotiate drug prices. The pharma giant contends that the government is overstepping its boundaries, thereby forcing it to sell drugs at a discounted price.

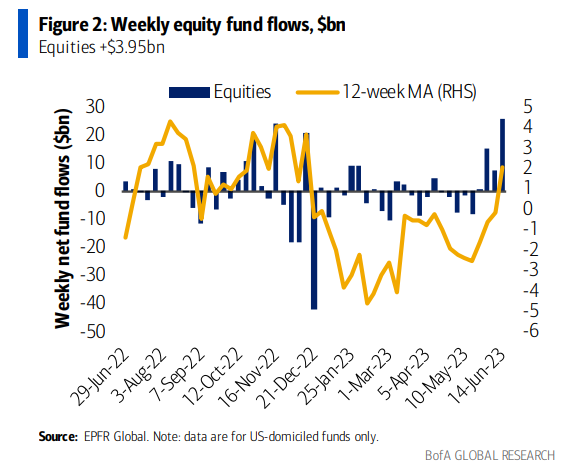

Market Optimism Fuels Equity Inflows

As the S&P 500 attempts to extend its longest weekly winning streak since 2021, investors seem to be increasingly optimistic.

This bullish sentiment is reflected in substantial inflows into US equities, the most significant since March 2022.

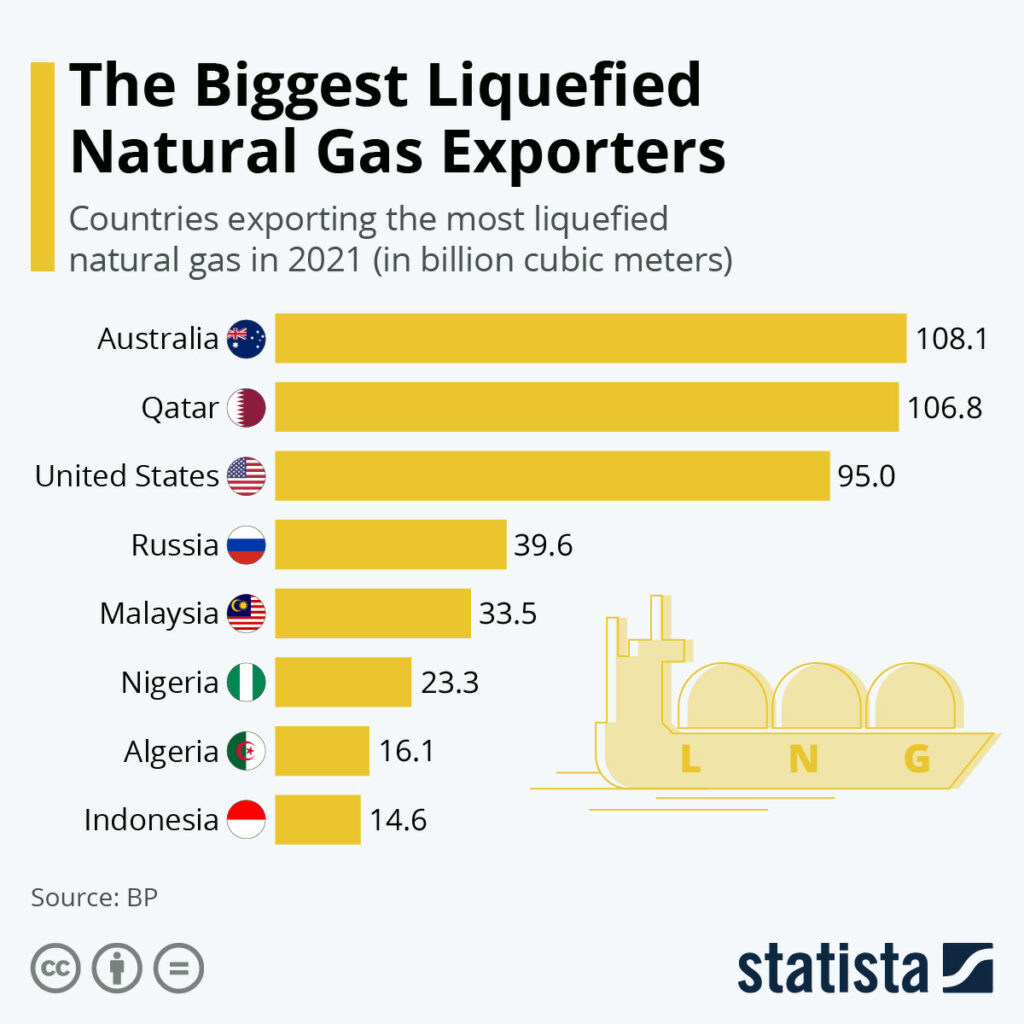

Qatar-China LNG Deal: A Power Move in the Energy Sector

Finally, in the energy sector, Qatar and China are poised to sign their second extensive liquid natural gas (LNG) supply agreement within a year, further strengthening their symbiotic relationship and altering global energy trade dynamics.

You can benefit from news trading too, take a look at Portfolio Flagship a new latency managed account where we target 110%+ yearly for our clients.

Safe Trading

Team of Elite CurrenSea

Leave a Reply