A Financial Forecast: Understanding the Latest Trends in Banking, Auto, Social Media, and Energy

As we navigate the mid-year point, the dynamism of the financial world continues to unfold with an array of intriguing trends and developments in banking, auto, social media, and the energy sector.

A Streak of Bullish Trends: Understanding the Current Financial Landscape

With the S&P 500 index soaring by 14.85% year-to-date and the 10-year-yield inching closer to the 4% mark, the world of finance continues to keep us on our toes. As the earnings season commences, eyes are keenly set on the forthcoming CPI inflation data. Speculations about potential rate hikes by the Federal Reserve only add to the thrill.

Raising the Safety Net: New Capital Rules for Large Banks

The banking landscape is on the brink of a significant change. Michael Barr, the Fed’s lead banking regulator, has proposed a new rule that could compel banks holding more than $100 billion in assets to adopt more stringent capital requirements. This implies an additional holding of $2 per $100 of risk-weighted assets and mandates to disclose the potential impact of losses on capital levels.

A Dip in the Used Car Market: Signs of Relief

Contrary to rising inflation, the used car market has experienced a price drop for the third consecutive month. The notable 4.2% decrease in June marks the most significant fall since the peak of the pandemic in April 2020. This dip in prices, according to a model that tracks used car auction prices, is predicted to be followed by a further 9% drop in the upcoming summer and fall seasons.

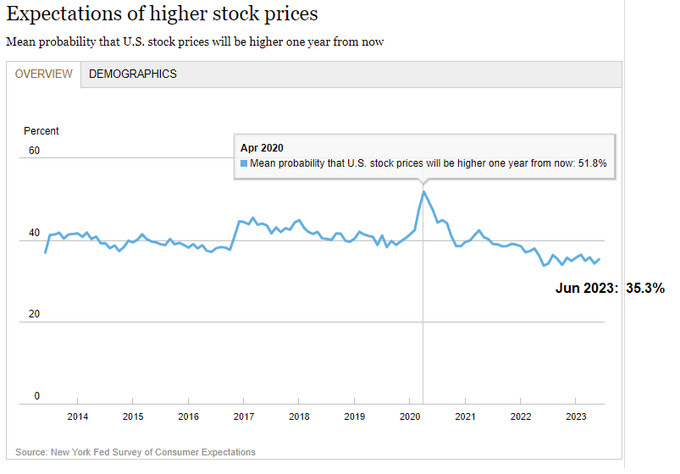

Consumer Expectations: The Outlook Seems Positive

The latest Survey of Consumer Expectations published by the New York Fed reveals intriguing trends. One-year inflation expectations have reached their lowest since April 2021 at 3.8%. In contrast, earnings growth expectations have shown a positive trend, with a drop in expectations for higher unemployment and household spending plans.

The Fed’s Messaging: Navigating Interest Rates

In recent statements, three Fed officials – Barr, Daly, and Mester – echoed Chairman Powell’s messaging about the necessity for persistent high rates. Conversely, Raphael Bostic, Atlanta Fed President, seems to favor a more patient approach. With a 25 basis point increase almost certain for July, the odds of a pause in September stand at around 74%.

Social Media Shifts: Meta’s Threads Expected to Outperform

Facebook’s CEO, Mark Zuckerberg, has had a remarkable week. Evercore ISI predicts that Meta’s Threads will witness an expansion, doubling over the next two years to approximately 200 million daily active users. This new platform is anticipated to generate around $8 billion in annual revenue. Meanwhile, Twitter appears to be experiencing a steady decline in traffic.

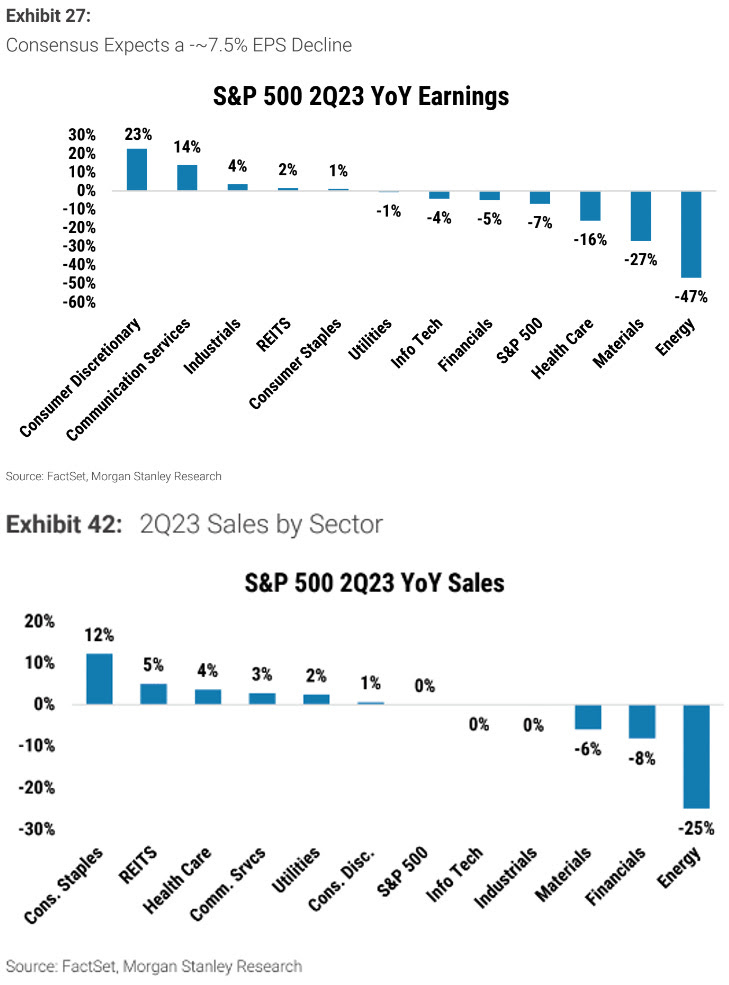

Earnings Season: A Peek into Projections

As the Q2 earnings season unfolds, sector-level forecasts from Morgan Stanley indicate promising trends. Sectors like Discretionary, Communications, and Industrials are expected to exhibit the largest Year-on-Year earnings gains. In contrast, Energy and Materials profits may decline. Staples and REITs are predicted to lead in sales growth, with Energy lagging.

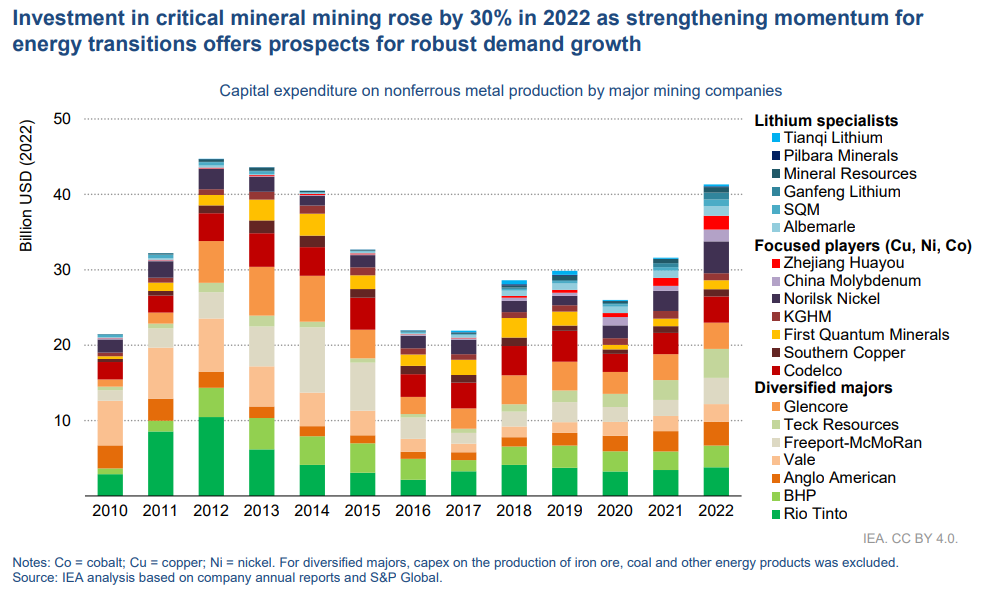

The Energy Transition: A Surge in Critical Mineral Investment

The path to clean energy involves an array of critical minerals. The International Energy Agency (IEA) suggests that we might have enough of these minerals to meet demand by 2030, given the 30% rise in critical mineral mining investment last year. This increase, along with new projects in the pipeline, implies significant progress in the energy transition.

Safe Trading

Team of Elite CurrenSea

Leave a Reply