A Decisive Day for the U.S. Economy: Awaiting the CPI Data Release

Good morning everyone! Today is a pivotal moment for the U.S. economy as we await the Consumer Price Index (CPI) report, which is due out at 8:30 am. This data is highly significant as it could influence the Federal Reserve’s interest rate decisions in the coming months. Major banks’ estimates are floating between 4.9% and 5.1%, painting a clear picture of the anticipation surrounding this release.

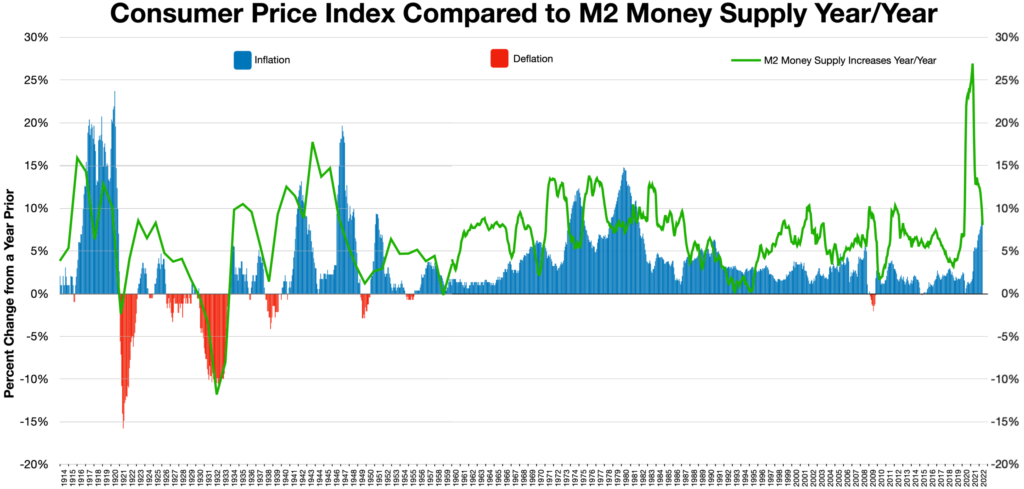

The Inflation Situation

Inflation has been front and center in the minds of economists and investors alike. Today’s CPI data will further inform this ongoing narrative.

If price pressure accelerates, it might suggest the Federal Reserve’s rate hike cycle hasn’t been assertive enough, potentially triggering a shift towards safer assets among investors.

A Billionaire’s Recession Warning

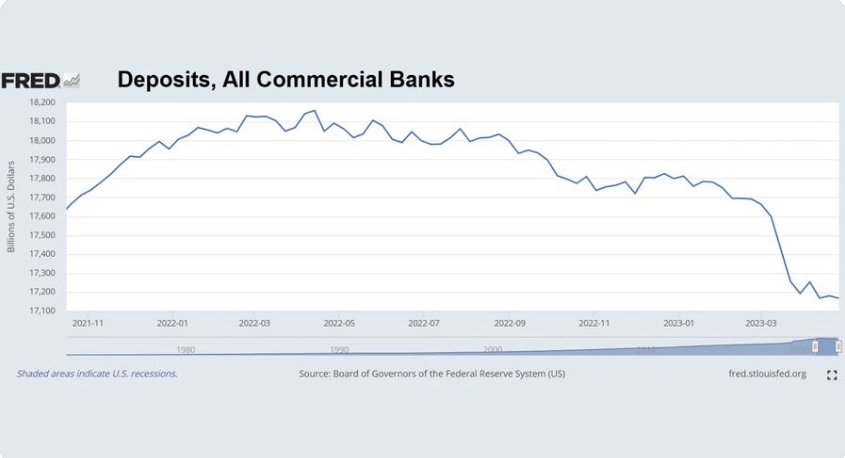

Stanley Druckenmiller, the billionaire investor, isn’t painting a rosy picture. Speaking at the Sohn Conference, he suggested factors such as a decline in retail sales and instability in regional banks could spur a recession.

But it’s not all doom and gloom according to Druckenmiller; he sees potential opportunities arising from such downturns. His advice? Preserve your capital until these opportunities present themselves. Some other thoughts by legendary fund manager:

- “I am not predicting something worse than 2008, it’s just naive not to be open-minded to something really, really bad happening.”

- He defined a hard landing as unemployment exceeding 5%, corporate profits slumping at least 20% and rising bankruptcies.

- “You’re going to have unbelievable opportunities in the next couple of years,” he said. “There’s a lot of dispersion within industries, and just make sure to preserve your capital until they present themselves.”

Debt Ceiling: An Unresolved Issue

The debt ceiling remains a sticking point between President Biden and congressional Republicans. While current market sentiment doesn’t suggest panic, the 2011 debt ceiling saga serves as a stark reminder of how financial market pressures could catalyze an agreement.

Airbnb’s Forecast Blues

Over in the corporate sector, Airbnb’s shares are feeling the heat. Following a less than enthusiastic Q2 revenue forecast, the company’s stock plunged by 12% in aftermarket trading. The report indicated that bookings, revenue, room nights, and EBITDA were all either in line with or below Wall Street’s expectations.

Mixed Earnings Season

Earnings season continues to surprise, with a mix of hits and misses. Out of the 454 S&P 500 companies that have reported Q1 results to date, we’re seeing an average sales growth of +4.3%, but earnings are down by 2.4%. This trend puts overall sales growth on pace for +4.0% and earnings at -2.4%.

Banking News: First Citizens BancShares Beats Estimates

Finally, in the banking sector, First Citizens BancShares Inc. reported Q1 deposits of $140.05 billion, significantly surpassing analyst estimates of $119 billion.

This comes in the wake of their rescue deal for Silicon Valley Bank.

Stay tuned as we continue to bring you the latest updates and analyses on these developing stories.

Safe Trading

Team of Elite CurrenSea

Leave a Reply