US Markets Remain Uncertain due to Lockdown and Fear of 2nd Wave

Dear traders,

the USA market is still uncertain. There is still concern about the safety after lockdown and fear for a second wave Covid 19. There is also uncertainty about the vaccine and how quick the economy could recover.

Powell, the Fed chairman, did his best to calm the markets. He said earlier this week in front of the US senate that the FED is committed to do whatever it takes to support the economy.

This article will review the S&P chart and discuss how to approach it with options.

S&R Breakout Remains Key Signal

After last week SPX pulled back to level 2766 support zone. The market recovered all the way to 2968. This is very close to an important 3000 resistance level. It also corresponds to the 200 MA, which is a critical spot. Any breakout of that level could lead to a full recovery and test the highs from end February at 3400. In that case, the price could also break for a new high.

If there is no breakout through a key level, then we should see a consolidation around 2950. One more level to watch is 14 May low at 2766. Any break to the downside could change the bullish view and bring back the bears in the market.

How can we use this market analysis to take advantage using Options?

Options Strategies in Today’s Market

First of all, we can use the SPY which is the SPX ETF. SPY is traded at 1/10 of the SPX value, so if SPX is 2950 then the value of SPY is 295. Options on this ETF are cheaper than Options on SPX.

If a bullish breakout above 3000 occurs, it would be reasonable to use the CALL option. Whereas if a bearish breakout below 2766 takes place, we would use PUT options.

The beautiful thing about Options is that we can also take advantage of a sideway market, such as the consolidation zone at 2950. The strategy uses time decay in our favour!

With Options it is possible to profit even in a sideways market. No other financial instruments give this possibility with a low risk.

How to Start with Options!

Thinking about options but not sure yet? There are a couple of ways to move forward before committing to the course or educational signal service. Here is how you can stay in touch:

- Join the free ecs.OPTIONS telegram channel

- Sign-up to the ECS newsletter with trading ideas in your email inbox

- Join the free live webinar options webinar with Marco & Chris

If you are ready to move forward, then you can choose from:

- €899 one time fee for Options course in English – this includes 1 month of option trading ideas (option.SWINGS).

Option trading ideas (option.SWINGS) – experience is required: - €97 per month (including VAT)

- €289 per quarter (including VAT) – receive 1 month for free for a total of 4 months

- €899 per year (including VAT) – receive 2 months for free for a total of 14 months

Subscribe to the live webinar now!

Win US Options Course

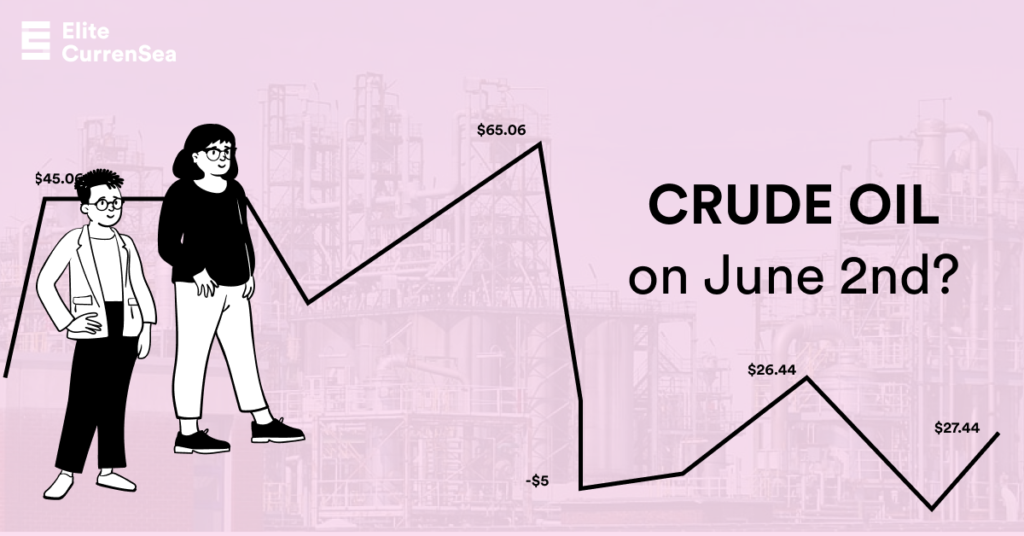

Make the most of options & participate in a US Options giveaway contest.

To be eligible you need to:

- Be a member of ECS community (newsletter or telegram)

- Predict the price correctly via facebook or twitter

- attend the webinar on june 2nd

Good trading,

Marco Doni – ecs.OPTIONS expert and CNBC contributor

Leave a Reply