VIX (Volatility Index) Is Hot Right Now

Amid the bustling activity of Wall Street, one gauge sits quietly yet potently capturing the essence of market sentiments – the VIX. Often dubbed the “fear gauge,” the VIX delineates the anticipated volatility in the US stock market for the ensuing month. The flavor of the season seems to be options trading tethered to this index, poised to register record volumes as the year unfolds.

A substantial chunk of this uptick is credited to investors acquiring “call options” on the VIX, a lucrative venture should volatility swell. The underlying narrative is poignant – a surge in volatility is oftentimes synonymous with severe market downturns, rendering the boom in call options an omen of investors bracing for a significant market recoil.

An upswing in interest rates coupled with escalating oil prices are siphoning a larger slice of Americans’ disposable income, denoting the funds remaining post taxation. In August, a tally of these expenditures constituted 4.7% of US disposable income, marking a zenith unseen in nine years.

Historically, a surge in the fraction of income channeled towards either interest payouts or fuel costs has been a precursor to recessions, making the recent ascent in both a dual threat to the US economic fabric.

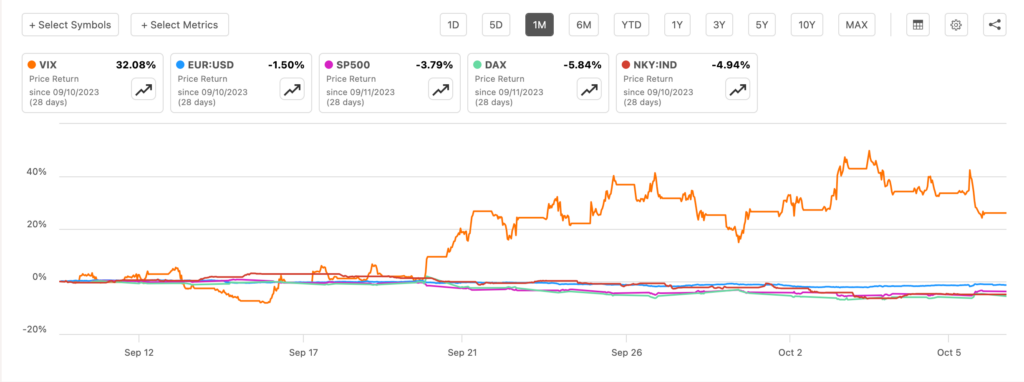

The tentative nature of the VIX in October 2023 reflects the wary tread of investors. The VIX oscillated between 17.19 and 20.88 over the first week of October, settling at 18.25 on October 9th1. The nuances of these fluctuations can be perceived as a bellwether of investor sentiment, wavering between caution and optimism.

The descent from 20.88 on October 4th to 17.19 on October 6th suggests a tentative ease among market participants, although the situation remains fluid and susceptible to broader market forces.

Fast forward to today, the VIX opened at 19.54, peaked at 19.60, bottomed at 18.10, and closed at 18.262. This depicts a continued cautious optimism among investors with a mild increase in the VIX, reflecting the uncertainties entwined in the market dynamics.

With an equity of $0.7 million and a laudable track record of performance, including a 229.04% growth as per the latest metrics, the Flagship portfolio is not just a haven in the storm but a vessel to navigate through it, towards a horizon of financial growth and stability.

Safe Trading,

Team of Elite CurrenSea Team

Leave a Reply