Unveiling Recession Scenarios: Why Landing “Hard” Is Still in the Cards

The recent spell of alleviated inflation, flourishing job markets, and vigorous consumer expenditure has kindled a flame of optimism among investors, envisaging the possibility of a smooth economic descent or a ‘soft landing.’

However, a closer examination of historical patterns coupled with the present-day economic dynamics suggests a potential slip into complacency among investors, reminiscent of the prelude to past recessions in the US over the preceding four decades.

The likelihood of a rough descent or a ‘hard landing’ looms large, urging a prudent assessment of investment portfolios to withstand the tremors. Here’s an exploration of the varying economic landings, the challenges in steering towards a soft landing, and a guide to fortifying your financial fortress amidst the looming uncertainties…

Understanding the Landing Spectrum:

Economic overheating often births rising inflation, prompting a counteractive response from the Federal Reserve through escalating interest rates to cool down the economy and stabilize prices. The ideal scenario, dubbed a ‘soft landing,’ is a delicate balance where economic vitality is moderated to curb inflation yet remains resilient enough to sidestep a recession.

However, the journey is fraught with the risks of a ‘hard landing,’ where escalated rates jolt the economy into a recession, or a ‘no landing’ scenario where inflation prevails unabated despite the rate hikes. The present signs of growth deceleration and inflation dilution, however, cast doubt on a no landing outcome.

Critics argue that increased spending and associated deficits might be fueling higher prices, which could potentially hinder a soft landing scenario

The Elusive Soft Landing:

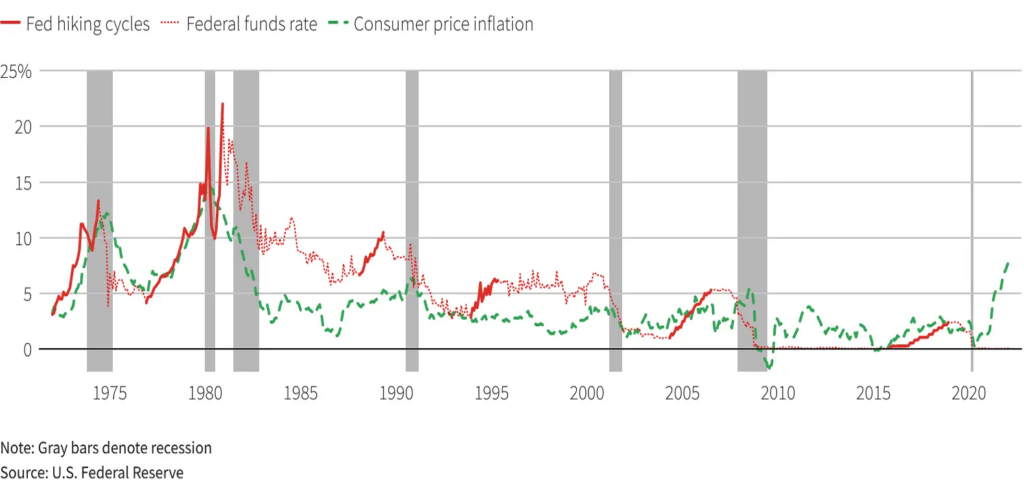

A glimpse into the Fed’s past rate-hiking endeavors since the 1970s, delineated by a solid red trajectory against the backdrop of US inflation and recession episodes, reveals a pattern where aggressive rate augmentations often heralded recessions, with a rare soft landing achievement in the mid-1990s.

The ongoing rate-hiking spree, second only to the intensity of the 1980s cycle, casts a long shadow on the prospects of a soft landing, given its historical propensity to trigger recessions.

However, some analyses suggest that with firming inflation data and an economy appearing to re-accelerate despite a rapid rate-hiking cycle, the narrative of a soft landing might be misleading.

The Resilient American Consumer:

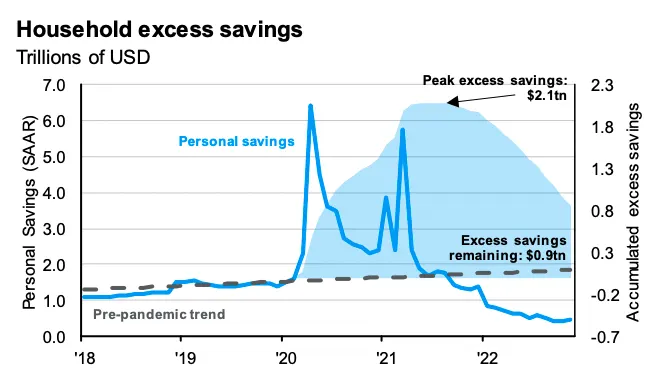

The cornerstone of the soft landing thesis is the robust consumer spending, which propels approximately two-thirds of the US economy. Despite rampant inflation, the spending vigor remains undeterred, partly fueled by pandemic-induced savings accrued from government stimulus and curtailed luxuries.

However, as the financial bulwark erodes with dwindling savings, especially among the less affluent, the rising costs of credit and essential commodities like oil present a conundrum of either curtailed spending or elevated borrowing.

There’s a threat to a soft landing from both recession risks and a “no landing” scenario, where economic activity reaccelerates, risking a reignition of the 2021 inflationary surge. Supply chain disruptions and a mismatch of labor demand and supply are highlighted as potential hindrances

What Lies Ahead?

The intertwining factors of diminishing savings, resumption of student loan repayments, and escalating interest and fuel costs cast a pall over consumer spending, the lifeblood of the US economy.

The visible deceleration in consumer spending, juxtaposed with an underestimation of a hard landing risk in market sentiments, underscores the imperative for a judicious approach in managing investments. Diversifying portfolios, reducing leverage, and perhaps a conservative shift towards more defensive assets could serve as a bulwark against potential economic tremors.

While a soft landing appears possible with declining inflation and a strong labor market, this doesn’t mean the economy is out of danger. Continued trends could lead to “immaculate disinflation,” but it’s premature to assume that risks have been averted.

Amid the economic complexities explored, market volatility manifests as a dual-faceted phenomenon. While posing challenges, it also unveils lucrative openings for adept trading systems like our Portfolio Flagship.

This system excels in identifying market inefficiencies, utilizing bespoke software, clever leverage techniques, and structural market analysis to exploit extraordinary trading opportunities in Forex & CFD markets, especially during volatile periods.

Such heightened market dynamics can lead to larger price swings, potentially expanding the window for profit. With our robust risk management strategies, traders are not only insulated from the negative impacts of volatility but are also well-positioned to harness the advantages it affords.

Safe Trading,

Team of Elite CurrenSea Team

Leave a Reply