Weekly Waves 9 January 2023: EUR/USD, GBP/USD and NGAS

Hi Traders,

Our weekly Elliott Wave analysis reviews the EUR/USD daily chart, the GBP/USD monthly chart, and the NGAS daily chart.

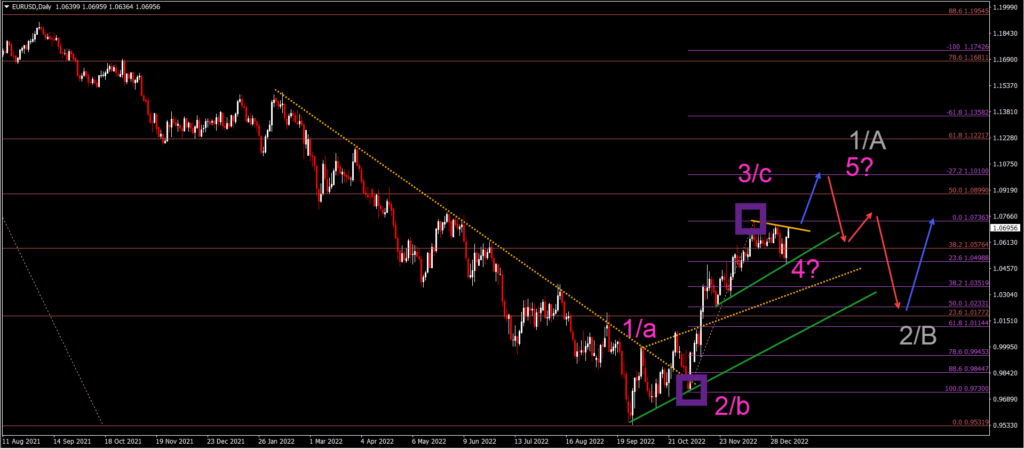

EUR/USD Downtrend in Serious Danger of Reversal

The EUR/USD has reached a critical spot, which will determine whether the long-term outlook remains bearish or whether the trend will switch to bullish:

- The EUR/USD is testing the key 38.2%-50% Fibonacci resistance zone (purple levels).

- But the bullish price action is surprisingly strong and impulsive, which indicates a potential wave 3 (pink).

- Until now we have labeled the bullish price swing as a wave C (pink), but the shallow corrective price action is indicating a wave 4 (pink) pattern.

- The shallow price action is because price has bounced at the 23.6% Fibonacci support level of the purple price swing.

- A bullish breakout (blue arrow) above the resistance (orange) could confirm a wave 5 (pink) of a larger wave A or 1 (gray).

- A breakout below the 38.2% Fibonacci support level (purple) of the wave 3 could indicate that the ABC (pink) correction is valid (not the 12345).

- If the price action does break north, then it could indicate the pause or end of a long-term downtrend and a larger bullish correction or uptrend.

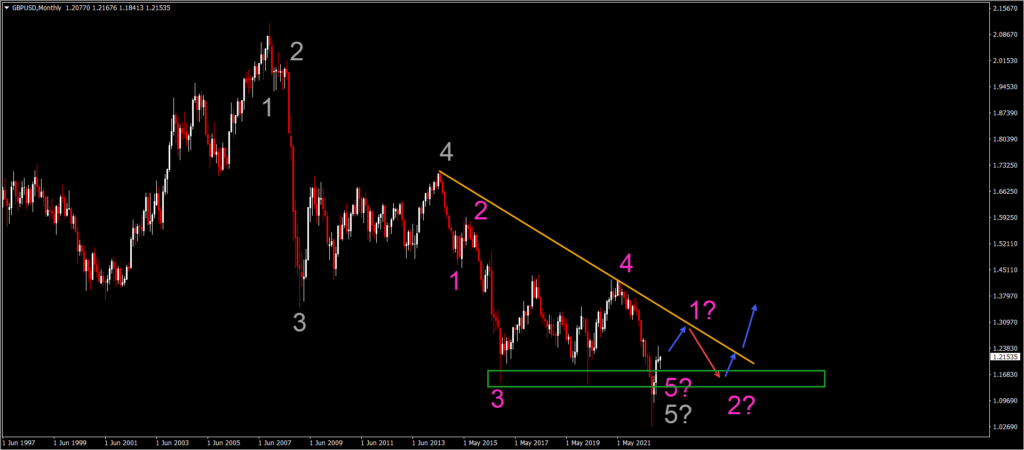

GBP/USD Bears Losing Control of the Trend

The GBP/USD is showing strong bullish price action as well. The strong monthly candlesticks are indicating that the Cable could go higher before finding resistance (orange line):

- The GBP/USD Elliott Wave count has remained bearish since the decline started at the top where wave 4 (pink) has ended.

- But the bullish price action followed by the weak bearish reaction could indicate that the downtrend might be finished.

- In that case, the lower low could complete a wave 5 (pink) of a wave 5 (gray).

- Another bullish push higher could confirm a wave 1 (pink), after which we expect a bearish wave 2 (pink).

- The support zone (green box) is expected at the previous lows, which could create a long-term inverted head and shoulders reversal chart pattern.

- The bearish outlook could remain intact if price action is able to break below the 1.17 support zone.

NGAS Falls Down Quickly in Bearish Impulse

The NGAS chart has made a strong downtrend continuation – as we expected in our regular Elliott Wave updates on NGAS in 2022:

- The NGAS chart’s downtrend is expected to be a wave 3 (green) because of the strong impulsive decline.

- The wave 3 (green) could continue lower. A small retracement (blue arrow) could follow up with another bearish swing lower (red arrow) before the wave 3 (green) is finished.

- Eventually once the wave 3 (green) is completed, a larger bullish correction should emerge within a wave 4 (green).

- Usually waves 4 are complex and lengthy, but eventually a new push lower within the wave 5 (green) of wave C (pink) of a potential wave W (gray).

Good trading,

Chris Svorcik

Leave a Reply