Weekly Waves 28 November: EUR/USD, GBP/USD and Gas

November 28, 2022

4 min read

Hi Traders,

Our weekly Elliott Wave analysis reviews the EUR/USD daily chart, the GBP/USD daily chart, and the Natural Gas 1 hour chart.

EUR/USD Reaches Key 38.2-50% Fibonacci Resistance Zone

The EUR/USD is showing a short-term uptrend with higher highs and higher lows but what is the long-term picture? Let’s review:

- The EUR/USD made a bullish breakout above the resistance trend lines (dotted red).

- The EUR/USD is approaching a key resistance zone at the 38.2%-50% Fibonacci levels (red box) at the 1.05-1.0575 zone.

- A bullish breakout would indicate a larger bullish retracement such as a 12345 (green) pattern.

- A bearish bounce makes a different ABC (yellow) pattern possible within a complex WXY (pink) pattern of wave 4 (gray).

- The key pattern is the bull flag pattern after the bullish breakout, which makes a wave 4 (green) pattern likely.

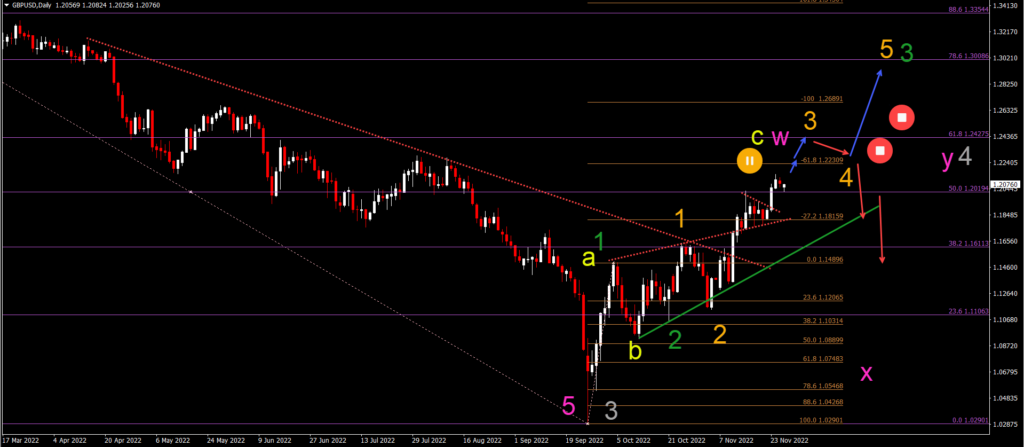

GBP/USD Breaks Above Key 50% Fibonacci Level

The GBP/USD is breaking above the 50% Fibonacci resistance level, which is undermining the long-term bearish wave analysis:

- The GBP/USD bullish breakouts above the resistance trend lines (dotted red) indicate a large bullish retracement.

- A bullish continuation followed by a bull flag pattern indicates a wave 345 (orange) pattern.

- A strong bearish bounce, however, could still indicate an ABC (yellow) within a complex WXY (pink) of a larger wave 4 (gray).

- The GBP/USD is at a key critical zone where price action is testing a bull-bear line. A break or bounce is critical for the next price swing.

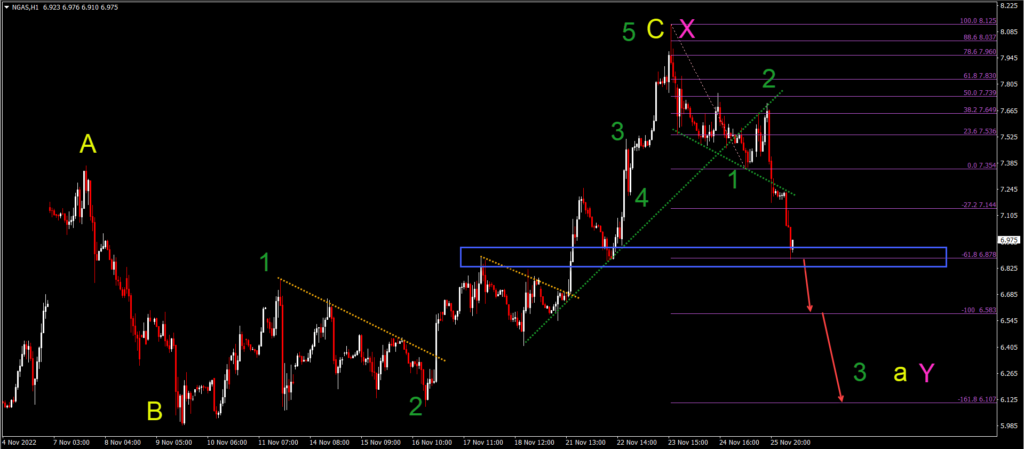

NGAS Reaches Key -61.8% Fibonacci Target

NGAS is back into a bearish mode after making a strong move up:

- The NGAS has completed a 5 wave pattern (green) in wave C (yellow) of a larger wave X (pink).

- Price action has reached the -61.8% Fibonacci target which is a key level.

- A bearish breakout below the support zone (blue box) could indicate a decline towards the Fibonacci targets.

- The bearish breakout could confirm a new bearish 5 wave pattern (green).

Good trading,

Chris Svorcik

Leave a Reply