Trading Results Overview April 22

The EUR/USD downtrend accelerated at the end of April with price action dipping below the round level of 1.05 for the first time since January 2017. The downtrend was unfortunately too much for the Zeus EA system, but the other methods managed to handle it adequately.

Summary of All Systems in April 2022

Here is a summary of all our main systems and methods:

| System |

Performance

|

Total running performance |

| Portfolio ECS | +5.8% | -13.7% |

| Zeus EA (PAMM) | -79.4% | -75.0% |

| Zeus EA Retail Rental (€2.5k / account) | -99.9% | -99.9% |

| Athena EA (PAMM) | +3.4% | +5.9% |

| Athena EA Rental (min 4k) | +5.8% | +186.4% |

| SWAT EA | -0.35% | +68.8% |

| Options | +8.2% | +19.2% (from 04.2021) |

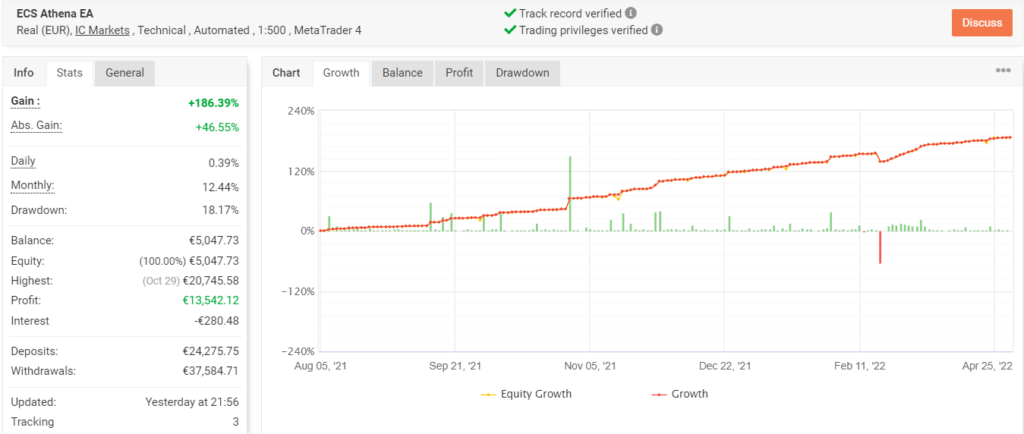

Athena EA

Athena EA continues its winning streak with its 9th positive month in a row. The Athena EA is now close to the magical border of +200%. Last month yielded a decent +5.8% for our account and +3.4% for the PAMM account.

| Total performance Athena EA April | +5.8% |

| Total performance Athena EA – all time | +186.4% |

Both accounts can be followed via Myfxbook:

Zeus EA

The Zeus EA had another weak month in April with our accounts – just after an already tough month in March. Although our accounts experienced heavy losses, not all Zeus EA traders were affected in the same way. Some renters did not see any draw-down and even booked profits. This is because the EA trades each account from a different starting moment, which explains the differences in entries and exits. Nonetheless, our accounts ended up with heavy losses, which of course shows and confirms that trading Forex and CFD is risky and always needs to be done with capital that you can afford to lose.

Zeus EA has never had one losing month after years of live trading. There are two ways to join:

| Performance Zeus EA | -79.4% (pamm) / -99.9% |

| Total performance | -75.0% (pamm) / -99.9% |

SWAT EA

The SWAT EA from Chris Svorcik closed slightly below the break-even mark with a loss of just -0.3%. The total performance, however, remains solid with a gain of almost +70%.

| Performance | -0.3% |

| Total performance | +68.8% |

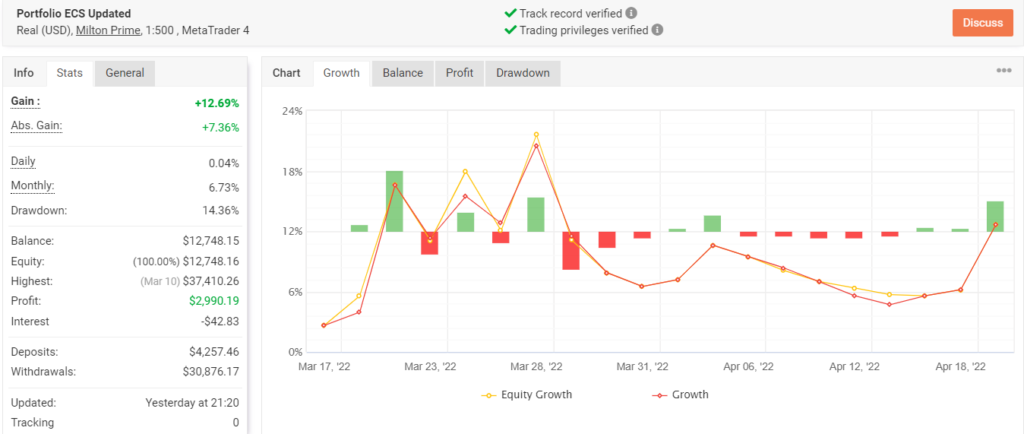

Portfolio Method

ECS Portfolio had a good performance in April 2022 with a gain of +5.8%. The total performance still remains in negative territory due to the large loss in March, which was created due to the large price volatility as a consequence of the Russian-Ukrainian war.

The Portfolio method has shown a positive restart with different systems that have been added. April confirmed that the new systems are off to a positive start.

| Performance ECS Portfolio | +5.8% |

| Total performance | -13.7% |

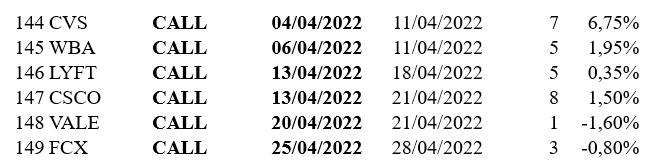

Options Trading

Uncertainty prevails. The breakdown of the March highs was taken as a sign of medium-term recovery, but there was none.

The market began a descending phase lasting almost the entire April. It created a close near to the low of March but ultimately failed to break below it.

This means that there is a monthly inside bar. This probably indicates that the market has not yet decided the direction to take.

The geopolitical situation remains highly unstable and even on the economic front the trend of inflation and expectations on the behavior of the Fed causes uncertainty in the short term.

The downward phase of the market has generated, thanks to the numerous cases of oversold, only long opportunities on the rebounds. The didactic signals filled on the market have been six, four closed in profit and two closed in loss. The average return for the month was 27% and CVS closed with a profit of 135%.

Positive trade was also for the last signal of March, EBAY, that realized a profit of 96% bringing the average final yield of March to 21%.

Our Options service from Marco Doni (CNBC Italy contributor)

| Performance | +8.2% |

| Performance since 04.2021 | +19.2% |

| Win rate | 67% |

Leave a Reply