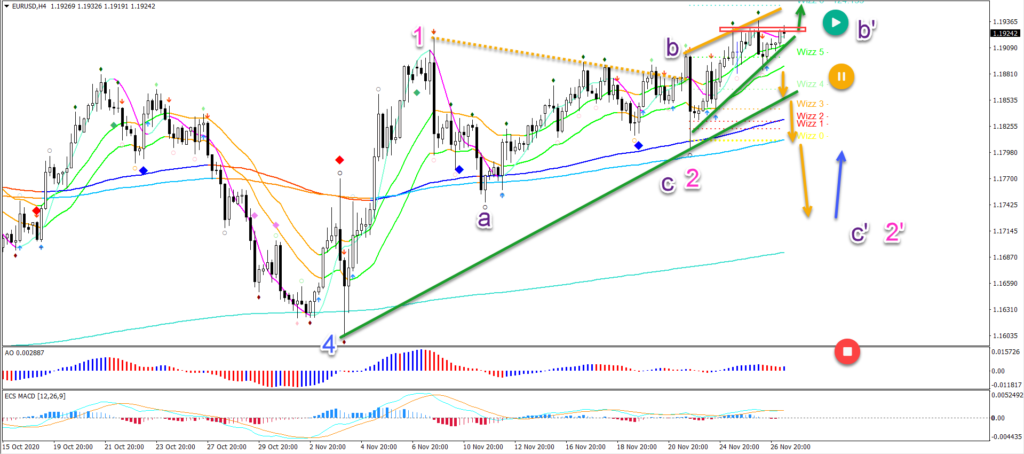

❗️ EUR/USD Prepares for Push to 1.20 Despite Reversal Patterns? ❗️

Dear traders,

the EUR/USD is in an uptrend but the reversal chart patterns are a strong warning.

The head and shoulders pattern and rising wedge could start a reversal but not if the bulls can push above 1.1930. Let’s review.

Price Charts and Technical Analysis

The EUR/USD is showing a potential rising wedge pattern (trend lines) and head and shoulders pattern (red box). But price action would need to confirm the reversal by breaking below the 21 ema zone.

Otherwise, the bulls remain in control. Simply because price action is above most of the moving averages on multiple time frames. The key breakout would be above the 1.1930 resistance.

This breakout should send the EUR/USD higher. Immediate targets, however, are located quite nearby at 1.1975 and the round 1.20 level.

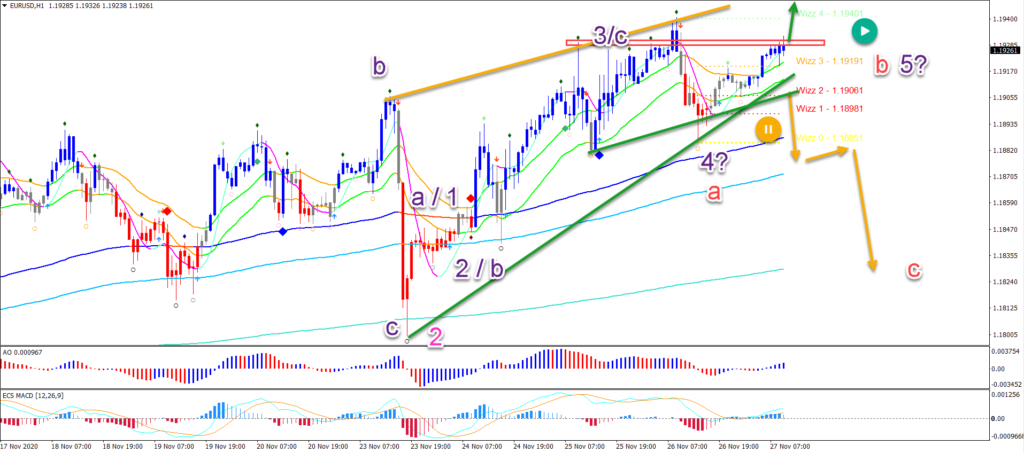

On the 1 chart, we see a clear and full uptrend alignment as well. Once again, the 21 ema zone remains a critical support and resistance area.

A break below the 21 ema strong hints at a bearish wave C downwards. A break above the 1.1930 local resistance, however, should cool off the ambitions of the bears. This could confirm a wave 3 or ending diagonal in wave 5.

If price action does reach the target zone at 1.1975-1.20, then this could be a strong resistance area. Price action could easily build a retracement or reversal here.

The analysis has been done with the indicators and template from the SWAT method (simple wave analysis and trading). For more daily technical and wave analysis and updates, sign-up to our newsletter.

Leave a Reply