Another Advise From Goldman Sachs (& us) About Your Next Bets

In this unpredictable economic climate, oscillating between inflation and growth concerns, it’s crucial to adapt our investment strategies accordingly.

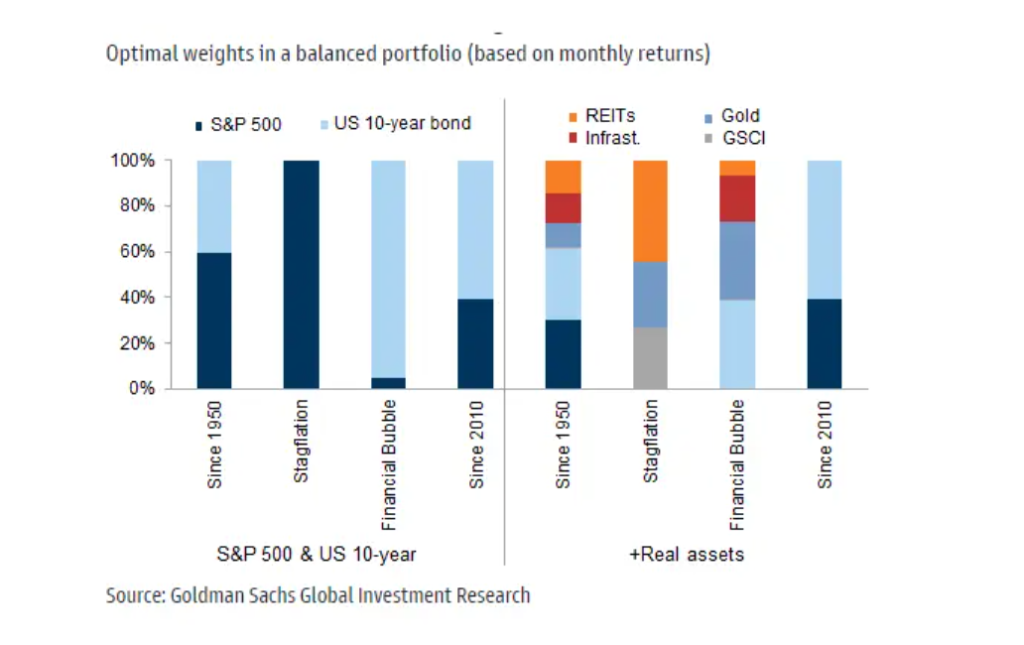

Goldman Sachs strategists analyzed 70 years of data to devise an all-weather optimal portfolio, revealing a surprising shift that could work better than you traditional 60/40 (equities/bonds).

The updated portfolio now includes a 30% allocation to real assets, such as REITs, gold, and infrastructure funds. Goldman’s research indicates that, barring the recent era of ultra-low interest rates, integrating real assets into your investment mix has consistently been advantageous.

Goldman’s call for change is due to the exceptional performance of nominal assets, like stocks and bonds, during the past decade, fueled by low inflation and yields.

However, with persistent inflation, real assets are essential to enhance your portfolio’s risk-adjusted returns, providing uncorrelated returns and competitive real return potential.

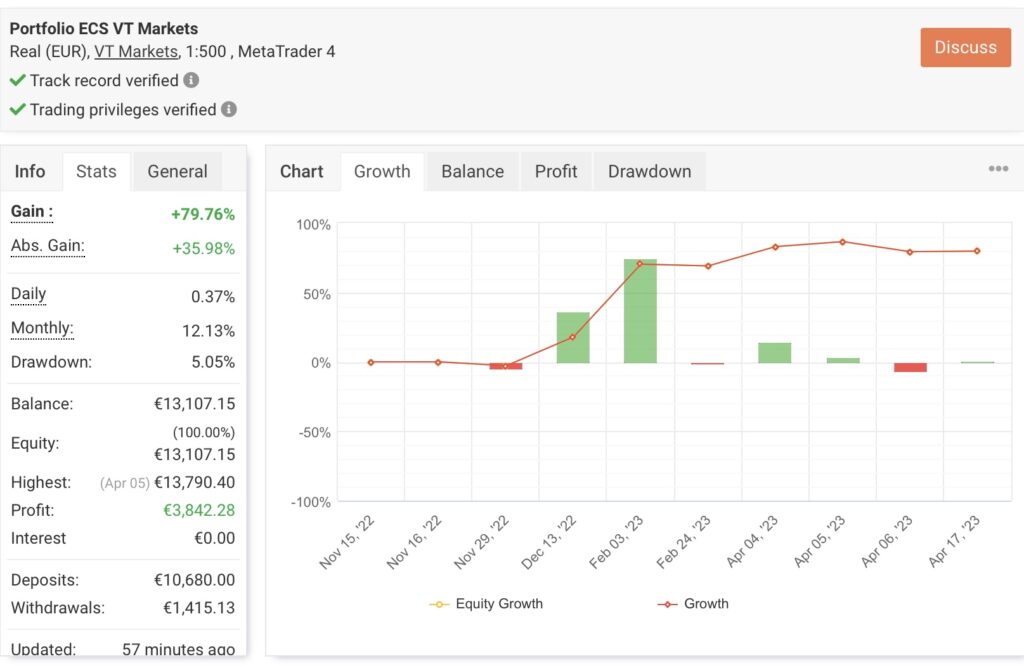

When comparing our Portfolio Flagship managed account and general markets, which could be a good diversification for your more well-rounded traditional investment.

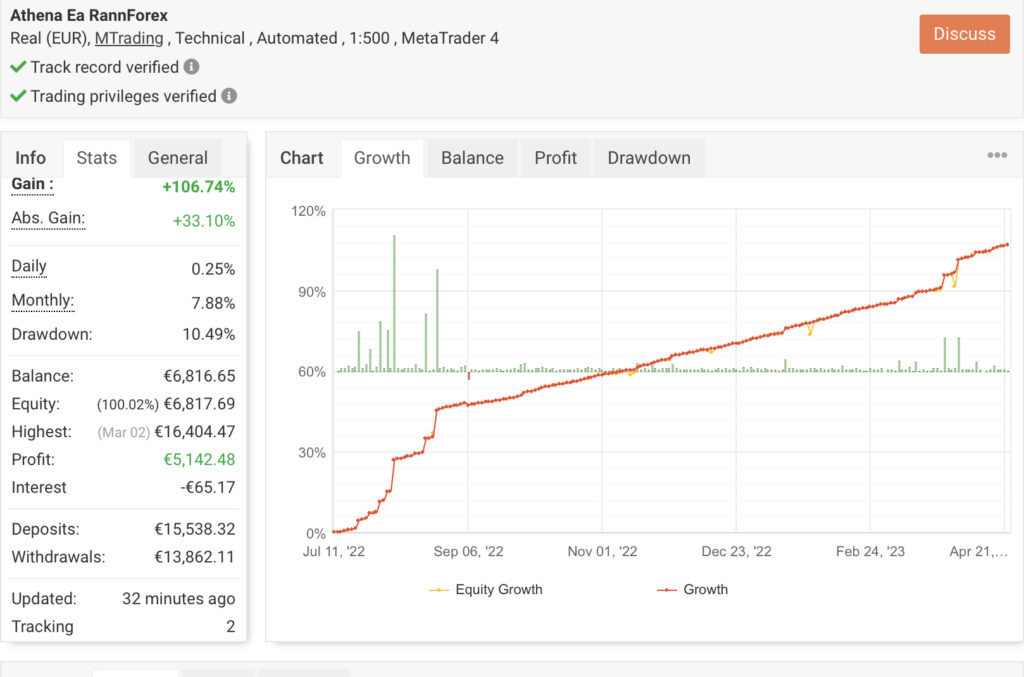

Yet another alternative investment in your portfolio could be a bet on EUR/USD ambivalence, that has been presiding over the pas 3 years, which we have successfully been capturing with a help of a simple Grid trading method – Athena EA.

To incorporate these assets, consider investing in real assets directly or through REIT, gold, and infrastructure ETFs.

In short, we encourage you to consider both options:

- Diversifying from Crypto (70% up this year) & Tech Stocks (20% up this year) into value stocks as per Goldman advise or;

- Betting in Portfolio Flagship (multi-asset momentum and latency trading – averaging 10% per month over the past 3 years) and Athena EA (EUR/USD grid trading – averaging 7% per month over pat 3 years).

- Do a bit of both 😉

Safe Trading

Team of Elite CurrenSea

Leave a Reply