Weekly Waves 7 November: EUR/USD, Bitcoin and Gold

November 7, 2022

4 min read

Hi Traders,

Our weekly Elliott Wave analysis reviews the EUR/USD 4 hour chart, the XAU/USD 4 hour chart, and the Bitcoin 4 hour chart.

EUR/USD Bullish Bounce at 61.8% Fibonacci

The EUR/USD made a strong bullish bounce at the 61.8% Fibonacci retracement level:

- The EUR/USD bullish bounce at the golden ratio (61.8% Fib) increases the odds of a larger bullish retracement.

- The bullish correction could take place via a WXY (pink) correction.

- There was an ABC zigzag (green) within the wave W and X (pink) waves.

- There could be another ABC (green) within wave Y (pink) of wave 4 (gray).

- After the wave A (green) is finished, we expect a bearish ABC (red arrows) back to the support trend line (green) within the wave B (green).

- A bullish bounce (blue arrow) could take price up to the -27.2% target near 1.025.

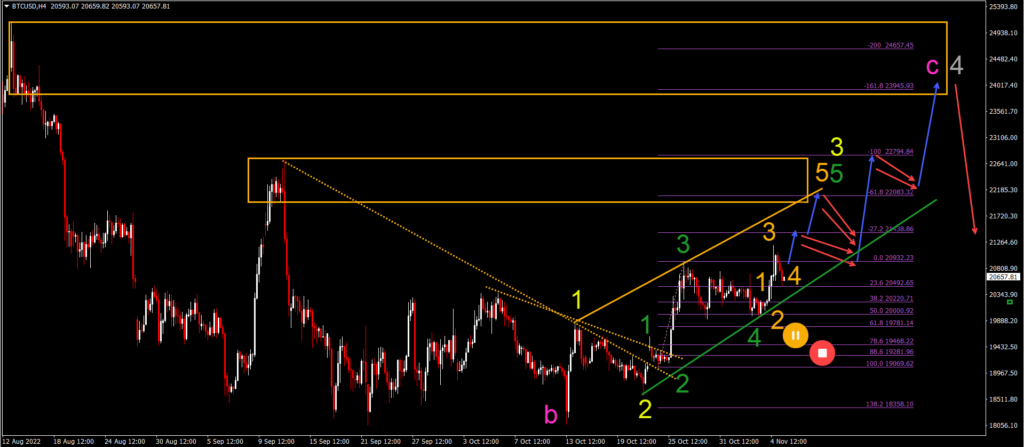

Bitcoin Uptrend after Bullish Breakout

Bitcoin (BTC/USD) is in a short-term bullish uptrend after breaking above the resistance trend lines (dotted orange):

- BTC/USD is in an uptrend channel with higher highs and higher lows.

- Bitcoin seems to have completed a wave 4 (green) recently.

- A move up within wave 5 (green) of wave 3 (yellow) is now expected.

- This remains valid as long as price action does not break below the support line (green) of the uptrend channel.

- There seems to be a 5 wave (orange) pattern within wave 3 (yellow) that could take price action up to the -27.2% and -61.8% Fibonacci targets.

- A retracement is then expected, followed by another push up.

- Ultimately price action should complete a wave C (pink) within wave 4 (gray).

Gold Creates Double Bottom Pattern

Gold (XAU/USD) has bounced at the previous bottom without breaking it:

- The bullish bounce indicates a double bottom reversal chart pattern.

- The bounce however did not break below the previous bottom, which means that the wave 1-2 (pink) pattern is not invalid.

- A break below the bottom would invalid it.

- The breakout above the resistance trend lines (dotted orange) indicates a bullish swing.

- This bullish swing could either be part of 1) a wave 3 (pink) or 2) a larger WXY (yellow) within an extended wave 2’ (pink).

- The wave pattern will depend on the price reaction at the previous top.

Good trading,

Chris Svorcik

Leave a Reply