🔥 Silver Bulls Prepare for Massive Uptrend Above $25 🔥

Dear traders,

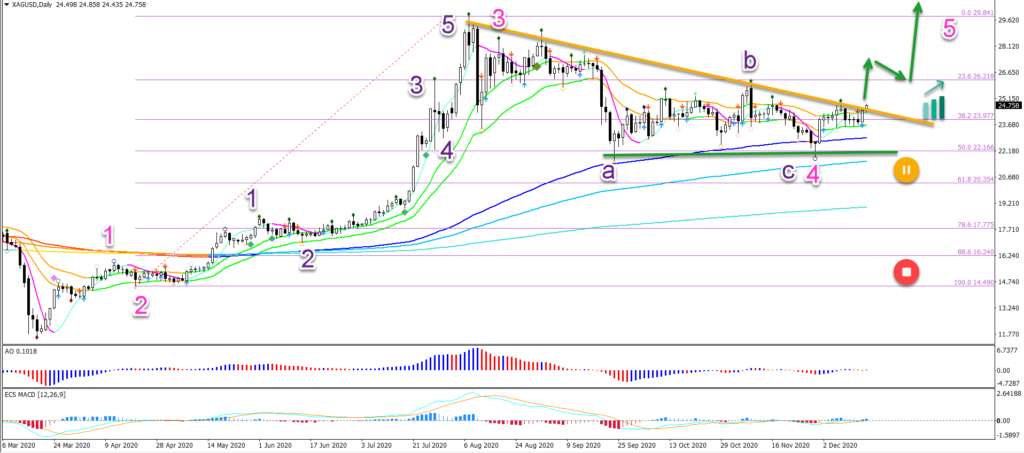

the Silver chart (XAG/USD) is showing a lot of potential for the bulls. The strong surge from $12 to almost $30 during March and July 2020 was an extremely impulsive price swing.

Is a breakout nearby? And what kind of bullish targets are possible? Let’s review the key chart and wave patterns.

Price Charts and Technical Analysis

The XAG/USD needs to break above the resistance trend line (orange) and fractal to confirm the uptrend continuation.

This break would confirm the currently expected wave pattern. Which is a wave 12345 (pink). The most recent top is probably a wave 3 and the current pullback a wave 4.

This wave outlook remains valid as long as price stays above the 50% Fib. A break below the support places it on hold (yellow) and a deeper break indicates an invalidation (red).

The main targets are located at the Fibonacci levels, such as:

- -27.2% Fibonacci target at $34.78

- -61.8% Fibonacci target at $41.07

- -100% Fibonacci target at $48 and previous top

- A break of the top

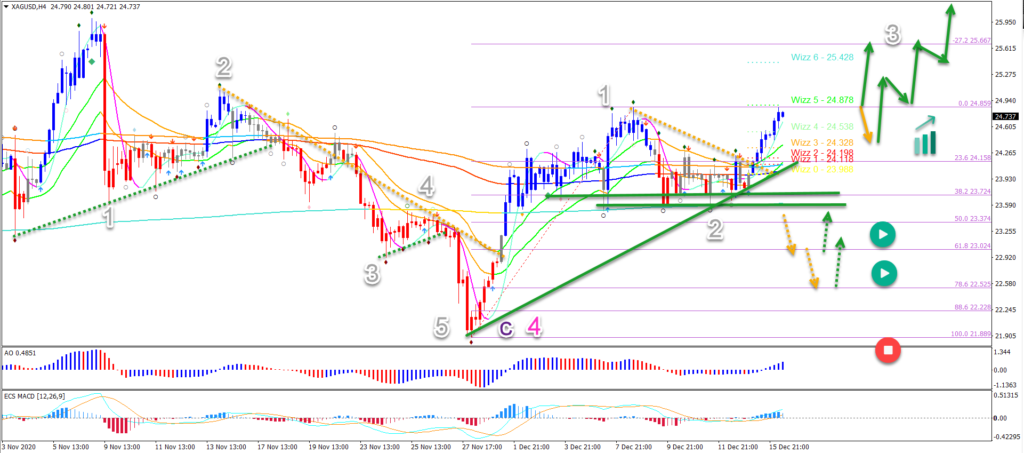

On the 4 hour chart, price action could have completed a 5 wave (grey) pattern within the wave C (purple) at the lowest low.

The current bullish momentum is probably a wave 1 (grey) pattern. And the pullback might have completed a wave 2 (grey).

But price action needs to break above the top. A failure to break could indicate a deeper pullback (dotted orange arrows).

The Silver chart looks bullish either after a breakout or after a pullback.

The analysis has been done with the indicators and template from the SWAT method (simple wave analysis and trading). For more daily technical and wave analysis and updates, sign-up to our newsletter.

Leave a Reply