🔥 EUR/USD Price Swings and Waves Before US Elections 🔥

Dear traders,

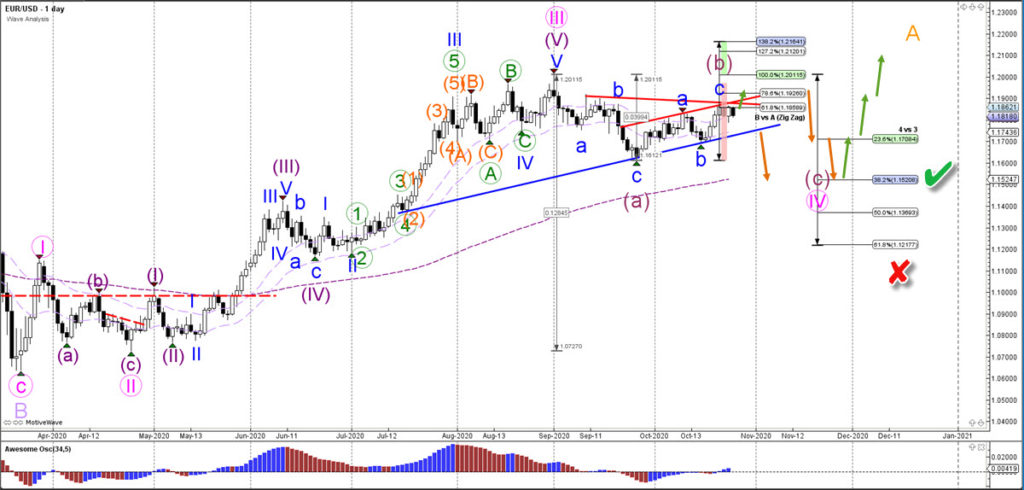

the EUR/USD is moving higher within a larger uptrend. But the bulls should remain cautious. Why?

Because the price action is corrective and choppy. Which is indicating a larger correction before the US Presidential elections on November 3. Let’s review the daily and 4 hour charts.

Price Charts and Technical Analysis

The EUR/USD is building a bullish ABC (blue) pattern. This remains valid as long as price stays below the Fibonacci levels of wave wave B vs A. A larger ABC (purple) correction is developing within the wave 4 (pink).

A wave 4 is usually choppy, corrective and long. A 38.2% Fibonacci retracement level is also very common. A strong bullish bounce at that Fib would confirm the wave 4. Only a strong bearish break below the 61.8% Fib makes the wave 4 (pink) invalid (red x). After the wave 4 ios completed, we are expecting a wave 5 to complete wave A (orange).

On the 4 hour chart, price action could be completing a final wave 5 (green). But price action must respect the Fibonacci levels of wave 4 (green) vs 3. A break below that support zone indicates that the wave C (blue) has already been completed.

A final push up is expected to complete wave 5 (green) and wave C (blue) of a larger wave B (purple) at the 78.6% or perhaps even 100% Fibonacci level. A bearish reversal or breakout could end the wave B and start the bearish wave C.

The analysis has been done with the indicators and template from the SWAT method (simple wave analysis and trading). For more daily technical and wave analysis and updates, sign-up to our newsletter.

Leave a Reply