🏁 Bitcoin Awaits Breakout as Bulls Test $60k High Again 🏁

Dear traders,

the Bitcoin (BTC/USD) uptrend is slowing down with corrective price action in the past few weeks. But another bullish bounce this week is challenging the previous top.

Will price action finally break the $60,000 resistance and continue for a new higher high?

Price Charts and Technical Analysis

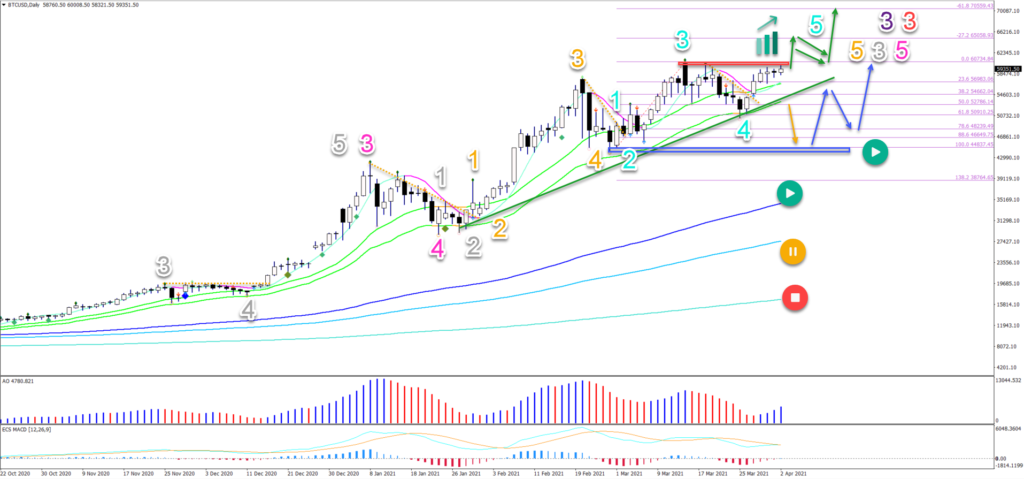

The BTC/USD price patterns indicate that the uptrend is still active and far from completed. The choppy price action, however, does point to a wave 4 pattern. Let’s review the key decision zones:

- The resistance at the previous top is critical. A bullish breakout (green arrows) could confirm the immediate uptrend continuation.

- A bull flag pattern after that breakout is also key. A retest of the broken resistance and $60k level could take place via a flag pattern. A bullish bounce at the support zone would solidify the uptrend.

- The main bullish targets are the -27.2% and -61.8% Fibonacci levels at $65k and $70k for the moment.

- If price action breaks down or if price action shows a false bullish breakout with a weak daily candlestick, then a deeper retracement could take place. A break below the 21 ema (orange arrow) could indicate a retest of the previous bottom (blue box). A bounce is expected at the support (blue arrow).

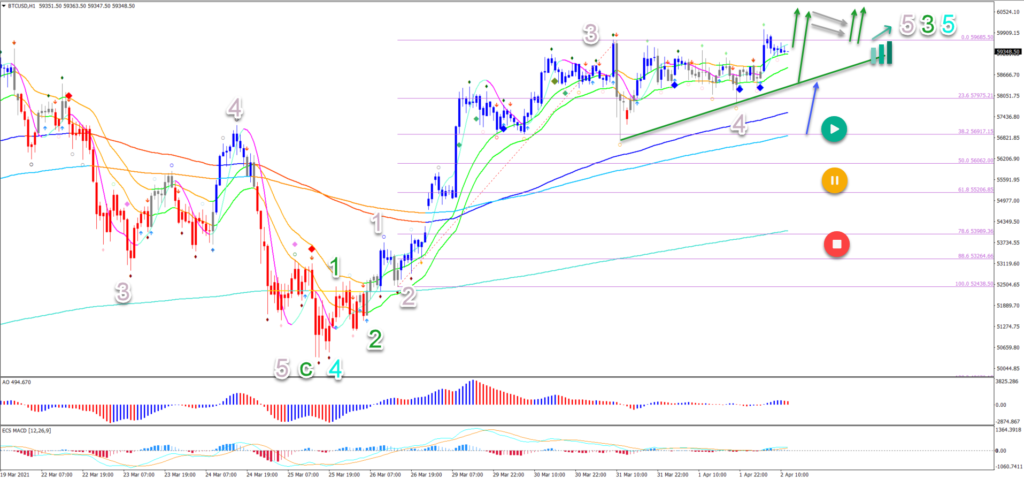

On the 1 hour chart, price action seems to have completed a wave C (green) within wave 4 (blue) at the most recent lowest low:

- The quick impulsive bullish price swing is probably a wave 3.

- The corrective and choppy correction is usual for a wave 4.

- The wave 4 retracement respected the usual 38.2% Fibonacci level.

- A bullish breakout or bounce (green arrows) could indicate a bullish move.

- A break below the support line (green) means a retracement. The 38.2% Fib could hold and create a double bottom.

- A break below the 50% Fib indicates a deeper retracement.

The analysis has been done with the indicators and template from the SWAT method (simple wave analysis and trading). For more daily technical and wave analysis and updates, sign-up to our newsletter.

Leave a Reply