? EUR/USD Bullish Pullback After Break Below Key 1.11 ?

Hi traders,

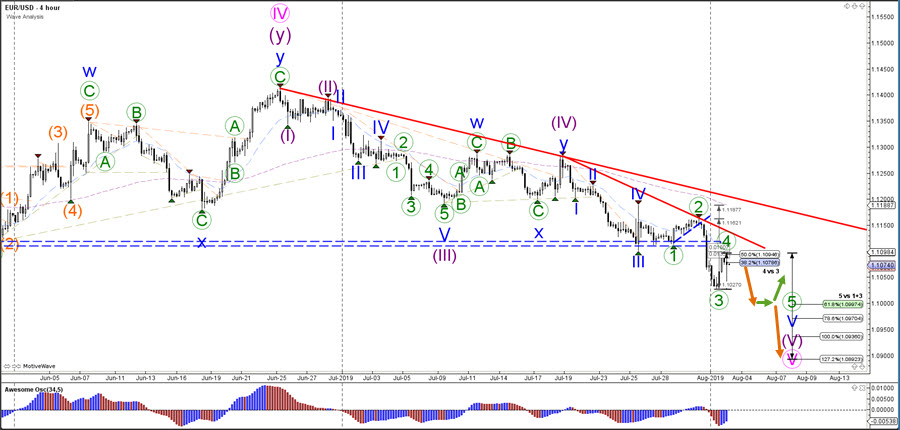

the EUR/USD made a key bearish breakout below the 1.11 support zone, which has changed the wave outlook to a bearish wave 5 (pink). Can the EUR/USD continue the breakout after the Non-Farm Payroll (NFP) event on Friday 2 August?

EUR/USD

4 hour

The EUR/USD support zone at 1.11 was a critical level because of the lengthy range and consolidation zone between 1.11 and 1.15 since October 2018. The breakout could indicate a downtrend continuation towards 1.10 and later on 1.09 and 1.08. The breakout remains risky as previous bearish breaks did not manage to move much lower, which is why the price reaction at the Fibonacci levels of wave 4 vs 3 is key: a bounce could indicate a move lower where as a break above 1.11 could indicate a false bearish break.

1 hour

The EUR/USD could be building a wave 4 (orange) pattern as long as price stays below the 61.8% Fibonacci retracement level of wave 4 vs 3. A break below the support line (blue) could indicate a bearish breakout. Keep in mind that the US news event on NFP and unemployment rates could send the pair up and down too.

For more daily wave analysis and updates, sign-up up to our ecs.LIVE channel.

Good trading, Chris Svorcik

Leave a Reply