? EUR/JPY Tests Critical Decision Zone for Bounce or Break ?

Hi traders,

The EUR/JPY is testing a key support zone which is the long-term moving average, 50% Fibonacci level, and support trend line (blue). The area is a critical bounce or break spot for an uptrend continuation or bearish reversal.

EUR/JPY

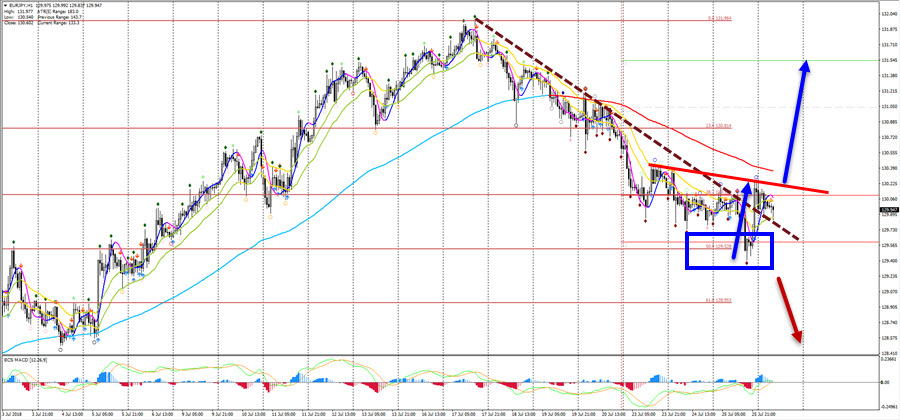

4 hour

A bearish breakout could see price fall towards the Fibonacci levels whereas a bullish bounce will see price move towards the pivot points at S1 and S2.

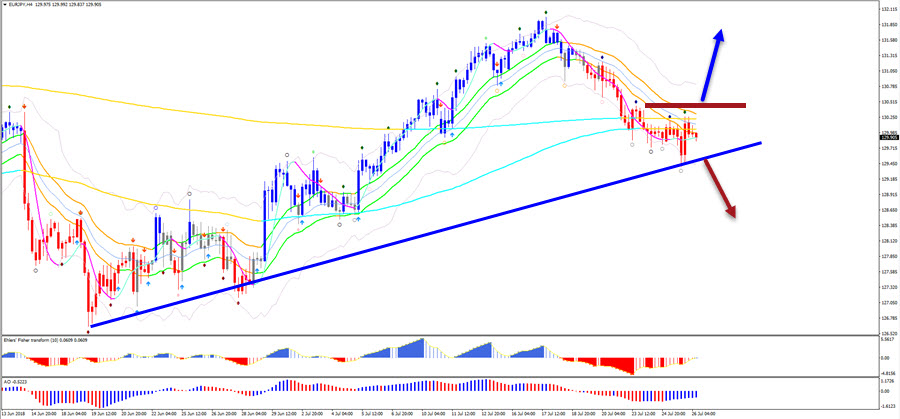

1 hour

The EUR/JPY made a strong reversal (blue arrow) at the 50% Fib (blue box) but price needs to break above the resistance zone before a bullish breakout and continuation is possible. A bearish breakout could see price move lower.

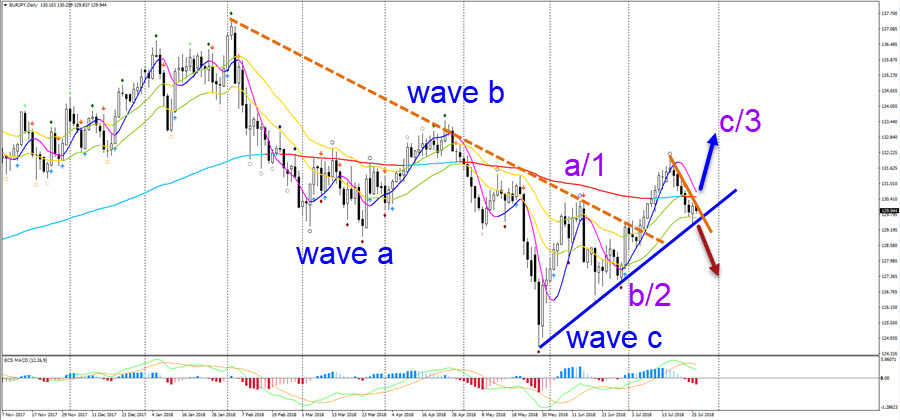

Day

The ecs.Candles of the ecs.SWAT system show how the bullish momentum was visible via the blue candles. Price is now retracing back to the moving averages with bearish candles (red). Price will need to break above the 21 ema and show blue candles before longs are safe. Shorts are possible but only if price breaks below HMA or support trend line (blue).

The EUR/JPY seems to have completed a bearish ABC (blue) and price is now either building an extended correction with a bullish ABC or price will confirm strong bullish momentum via a 123 wave pattern.

Good trading,

Chris Svorcik

Elite CurrenSea

Leave a Reply