EUR/AUD ?? Bullish Momentum Building

Dear Traders,

The EUR/AUD is showing renewed bullish price action. The pair is looking promising for at least more short-term upside.

Today’s analysis will take a look at the EUR/AUD and highlight potential setups.

The EUR/AUD went into an extended bearish correction from the late march high.

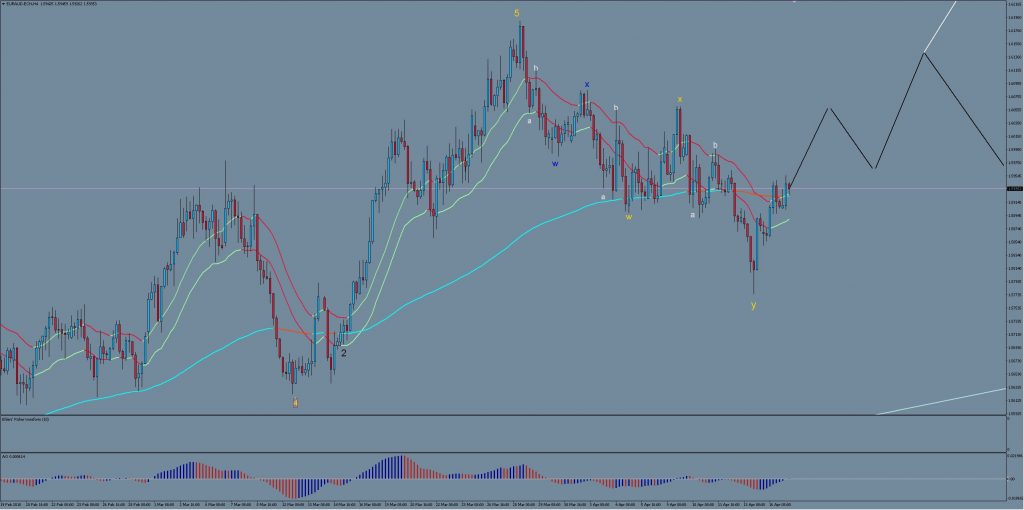

This bearish swing has now concluded a fairly clear double zigzag. (see wxy labels). This was followed by an impulsive move to the upside. Together this suggests that more upside continuation should be on the cards.

The price structure since the low of … could be series of 1-2 waves or a corrective move. Even if it were to be part of an extended correction, price should be heading towards the top of the range in both case. Both scenarios are highlighted via black/white lines in the chart below.

Trade Setups

Buy opportunities exist at the next bearish retracement. Price could retest 1.59 and 1.5870. In the most bullish scenario, price should not break below 1.5850 anymore. The key to watch out for is that the bearish move doesn’t show a purely impulsive 5 wave structure, which could indicate renewed downside pressure. A bullish bounce at the above mentioned price levels, in conjunction with a preceding ABC structure and slowing bearish momentum, could as as an entry signal.

Potential targets could be 1.5980 and 1.6050, which are previous resistance zones.

All the best along your trading journey

Hubert

.

Leave a Reply