DAX30 ? Bull Trend Continuation ? Targeting 14000

Dear Traders,

the DAX30 has been in an extensive correction since November 2017. But the index looks ready to resume its Bull trend, which provides exciting trading opportunities.

This analysis will take a look at the recent price-action and highlight potential trade setups.

DAX has Completed Bearish ABC

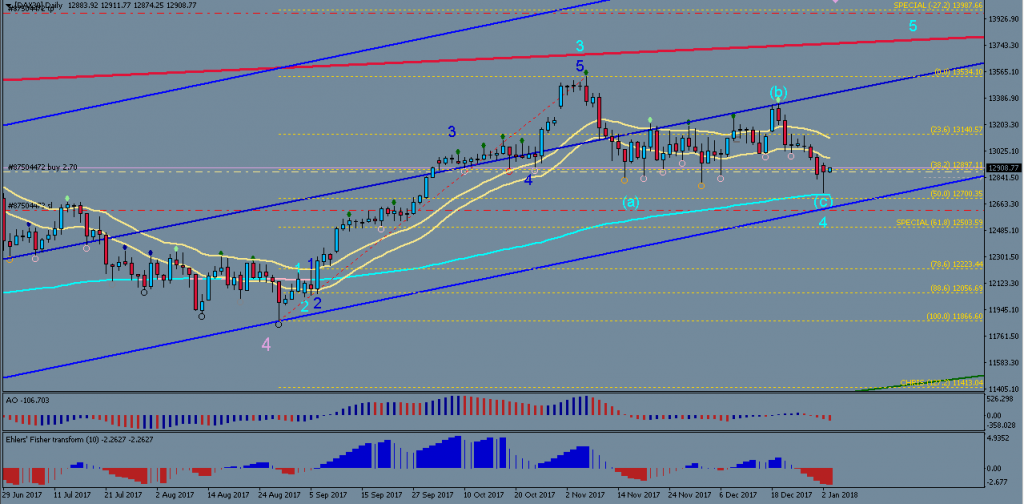

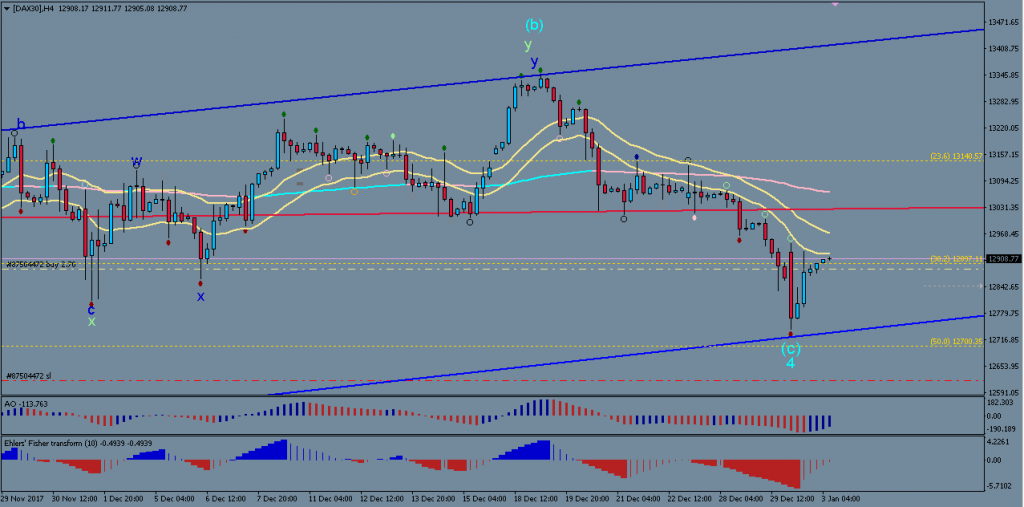

The Daily chart below shows a very classic bearish ABC price structure since the November 2017 high (turqouise Wave 3). As I mentioned in my earlier DAX analysis, an impulsive move down to the 50% Fib and 144 EMA was to be expected before a bullish trend continuation would be likely. This has indeed occurred over the last trading week. Yesterday’s daily candle close was a pinbar, so the POC zone created a good bullish reaction, which could mark the end turqouise wave 4.

Potential Trade Setups

Price should now continue upwards and create new higher highs beyond the November high. The main target for this next bullish turquoise wave 5 is 13900 to 14000 (-27.2% Fib target).

Price is probably in a bullish Wave 1 now, so a bearish retracement that creates a higher low compared to yesterdays low of 12700 should appear at some point soon, which would form Wave 2.

An ideal spot for new long positions could be once this higher low is confirmed via a bullish 4 hour pin bar candle (or other bullish candle stick pattern).

From then on, the DAX setup could lend itself very well to scaling in by buying dips while it makes its way up to to the main target of 13900 – 14000.

If yesterday’s low should break, it most likely means that the bearish Wave C is not yet fully complete and price could test the blue channel bottom around 12600, but the current bullish momentum makes this less likely. A bearish break of the channel line itself invalidates this analysis.

All the best along your trading journey…

Hubert Miranda

.

Leave a Reply