All in all, Land-FX is a decent player that doesn’t spread itself thin with fancy added value services. Instead, it offers you the needed minimum, leverage, trading conditions and execution, to make money. The rest is really up to you.

Land-FX

Summary

- Robust CFD on Currencies offering (1,7 typical majors spread)

- Flexibility with Leverage

- Bonus System

- Customer Support

- Online Reputation

- Limited Instruments offering

- Basic Platform (lack of macOS MT4/5 Support)

- Little public info on Board of Directors

Company Background

Land-FX origins come from Asia, a region known for it’s modesty at disclosing information about the decision makers.

To (over)compensate for its relatively low name recognition the company is eager to invest in second and third tier European football clubs while keeping its product offering limited to CFDs on currencies, commodities, and indices via MetaTrader 4/5 (MT4/5).

Regulations

Originating from Asia marks Land-FX as a company that grew to recognition by navigating through the complexities (and freedom to some degree) of uncharted territory, before committing to an FCA (FRN: 709866) license. This was followed shortly by FSA (reg number: 23627 IBC 2016) which is a ST. Vincent and the Grenadines that so many brokers prefers for it’s relative ease of compliance concerning:

- Leverage constraints

- Account verification

- Reporting

- Client disputes

- Other preventive methods

Given the availability of both jurisdictions I wouldn’t be surprised if most of the global clients are processed outside of the UK, whereas the UK licensing serves more for branding purposes (which land-fx seems to take seriously given the number of their awards and football club sponsorships).

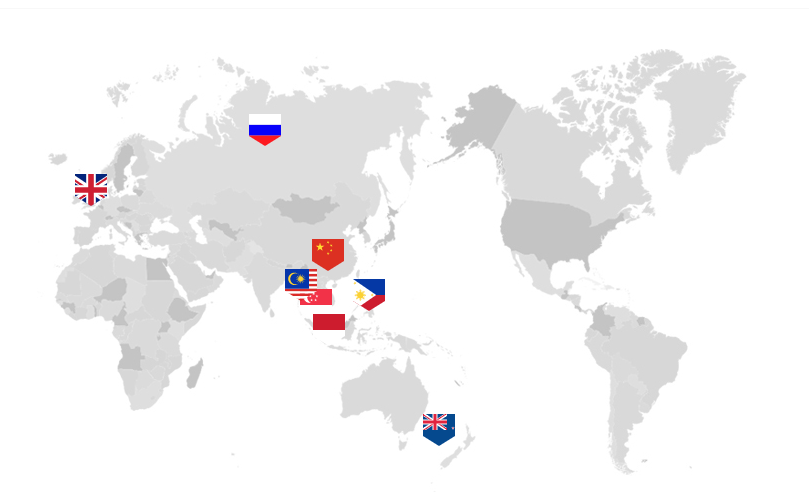

Global Presence

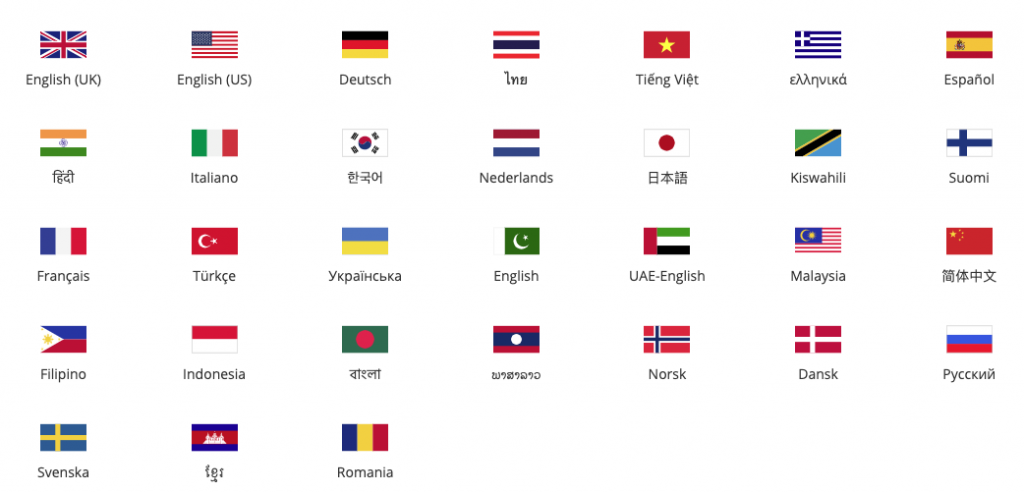

Present in most top EU Markets, Land-FX doesn’t shy away from spreading itself across multiple continents.

Exact figures per country are not disclosed but my educated guess (judging by how active the company is at Asian expos/award shows, and at giving bonuses – discussed below) is that its main business is coming from China, Japan, and South Asia (Malaysia, Vietnam, Thailand).

EU traders feeling strained under ESMA, may benefit from Land-FX selection of jurisdictions when deciding on matter of leverage, trading bonuses and other hot topics circa 2019.

Blacklisted Countries

Clients are not accepted from:

-

- USA, Cuba, Sudan, Syria, North Korea and listed/relevant parties of Consolidated United Nations Security Sanctions Lists.

Land-FX Office Locations

Payment Methods

To accommodate the global nature of it’s business, Land-FX takes payment systems seriously. You will find traditional wire transfer and credit card options, next to an ample of payments systems (those might overcharge you during the withdrawal, but depositing/withdrawing in FX is a different ball game than buying a pair of socks ??♂️).

- Credit Card

-

- Refunds based on credit card payments. See more for clarification.

- Credit Card (Visa& Mastercard) withdrawals are processed within 4 to 7 working days – it must occur via refund bank to the same Credit Card

- Credit Card (VISA, Master) withdrawals can be up to the amount deposited using the same Credit Card.

-

- Wire Transfer

-

- Bank Wire withdrawal usually takes 2 to 5 working days to reach client accounts.

-

- Payment Systems

| Payment System | Deposit | Withdrawal |

| Neteller | No fee |

2%* (min1usd, max 30usd) per transaction applies |

| Skrill | No fee | 1% per transaction |

| Perfect Money | ||

| STICPAY | ||

| Union Pay | No fee | No fee |

| FASAPAY | No fee | No fee |

Other things to keep in mind:

- Any deposit fees will be waived for deposits over $100

(If your trading volume is not sufficient, your pre-covered deposit fee might be charged) - Transaction fee can be applied based on trading volume.

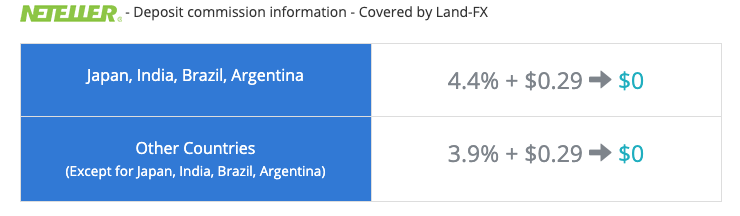

- For Neteller.

Services & Trading Conditions

Land-FX doesn’t try to reinvent the wheel and doesn’t spread itself thin across complicated R&D heavy developments or strategic partnerships. It does however provide a decent access to CFDs on indices, commodities and above all FOREX.

Among the benefits of such an approach is that Land-FX can focus on ensuring the commissions are minimised, leverage is flexible (via different regulations) and liquidity (if you go for a non market maker account) is there to get your orders filled at the right price.

Account Types

As probably 90% of FX brokers nowadays, land-fx offers a market maker standard account with bigger number of instruments, greater flexibility with leverage, and possibly higher bonuses, as opposed to the “ECN” account which ostensibly provides a direct market access at a cost of fewer asset types and higher commissions.

In general, I don’t see anything bad in market making accounts (standard), esp if trading under a regulated entity – these days brokers are less frivolous when it comes to fake gaps, slippages and other “woodo” tricks popular in the 00’s.

Make sure to understand the strategy (trading frequency, swing, scalp, momentum, long/short term) and trading instruments before settling on the account type. Also, try to reach Land-FX for an offer – you might be surprised how eager brokers can get to snitch a client from the competitor.

Trading Instruments

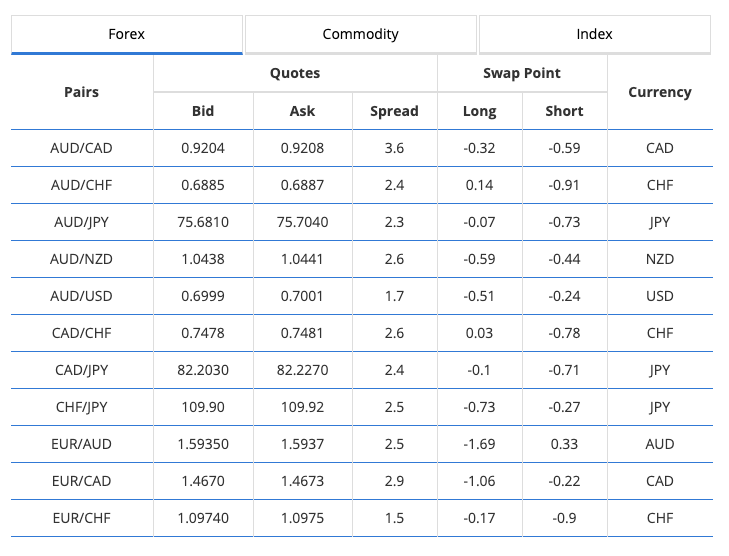

Below is a brief overview of the main CFDs offering under a standard account (market maker account).

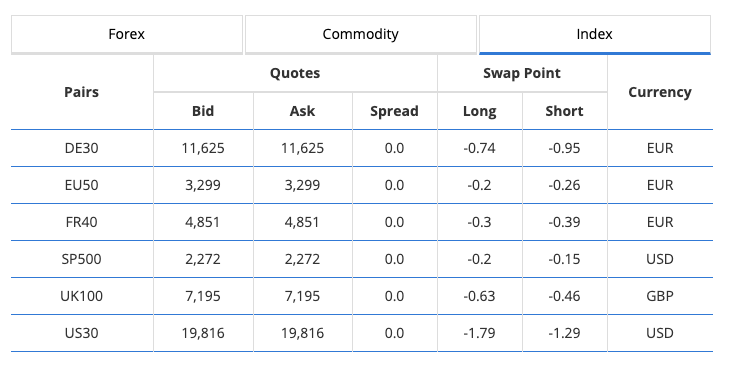

Key CFD on Indices

Albeit not the most competitive index offering, Land-FX does offer a great flexibility with leverage.

| Pair | Leverage | Typical Spread | Commissions/Swaps (if applicable) | Extra info (if applicable) |

| DE30 | 1000:1 | 4.3 | SWAP for Muslims | |

| EU40 | 1000:1 | 4.6 | SWAP for Muslims | |

| FR40 | 1000:1 | 2.5 | SWAP for Muslims | |

| SP500 | 1000:1 | 2.2 | SWAP for Muslims | |

| UK100 | 1000:1 | 5.6 | SWAP for Muslims | |

| US30 | 1000:1 | 1.9 | SWAP for Muslims |

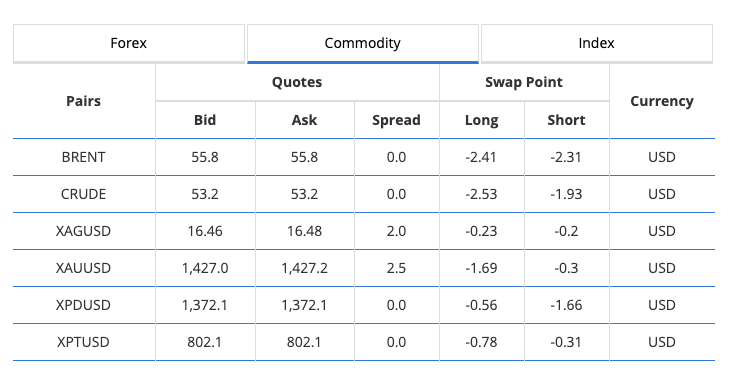

Commodities

Land-FX offers competitive spreads, with no commissions on swap-free accounts.

| Pair | Leverage | Typical Spread | Commissions/Swaps (if applicable) | Extra info (if applicable) |

| Brent | 1000:1 | 1.4 | SWAP free for Muslims | |

| Crude | 1000:1 | 1.7 | SWAP free for Muslims | |

| Gold | 1000:1 | 3.2 | SWAP free for Muslims | |

| Silver | 1000:1 | 3.4 | SWAP free for Muslims | |

| Platinum | 1000:1 | 14.8 | SWAP free for Muslims | |

| Palladium | 1000:1 | 68.8 | SWAP free for Muslims |

| Pair | Leverage | Typical Spread | Commissions/Swaps (if applicable) | Extra info (if applicable) |

| Major Pairs | 1000:1 | 1.7 | No commission & SWAP free for Muslims |

Key CFDs on Forex

Since Currency trading is the main line of business, Land-FX makes sure that the offer is clear and affordable. The typical spread on majors is at around 1,7 pip and includes high leverage and availability of bonuses.

| Pair | Leverage | Typical Spread | Commissions/Swaps (if applicable) | Extra info (if applicable) |

| Major Pairs | 1000:1 | 1.7 | No commission & SWAP free for Muslims |

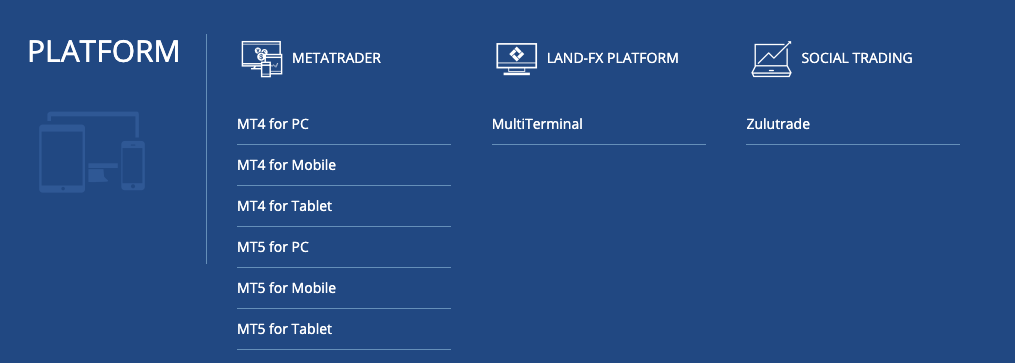

Platforms & Tools

MT4 & MT4 for Windows, Web & Mobile – but no macOS Support

Albeit, Metaquotes’ MetaTrader 4 & MetaTrader 5 are decent platforms, the lack of variety here is a bit disappointing – Land-FX doesn’t seem to work with vendors to enhance it’s experience (see MTrading’s effort with it’s Supreme Edition, or AxiTrader’s NexGen).

This is especially clear from the lack of macOS native support (Land-FX does offer a “play-my-mac guide”, but, let’s be honest, with most of the major MT4/5 brokers offering the support from the get go – Land-FX has little excuse to not offer the solution).

On the other hand, focus on delivering the best MT4/5 experience deserves respect, “the less is more” concept could clearly benefit other players in the industry.

Social Trading via ZuluTrader Partnership

Social trading has been around the block for over a decade now, opening up a whole new niche for trading – Finding Profitable traders, while avoiding all the bogus, one-trick poney shemes.

It’s reassuring to see Land-FX teaming up with ZuluTrade, meaning that it’s clients can easily connect to Zulu’s platform to sell or automatically copy the selected traders.

I’d like to see more supporting materials on avoiding the common pitfalls at selecting copy trading “masterminds”, as well as more statistics on Land-FX clients performance out in the open, before praising them for this partnership.

Let’s see how it goes in the future.

Bonus & Promotions

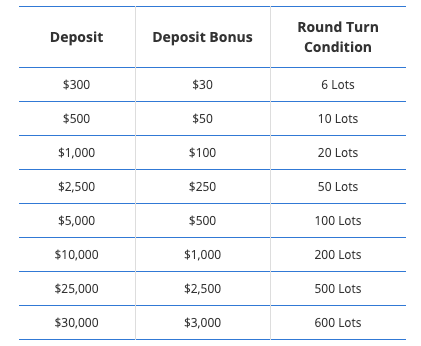

Land-FX offers deposit bonuses (under non eu jurisdictions ) that require traders to complete a minimum number of lots. Next to high leverage, bonuses are the second most popular marketing ploy to bring new clients, as well as encourage them to trade more frequently.

To be fair to Land-FX, minimum trading requirements protect brokers from enthusiasts looking to gorge on free money (toxic clients tend to breed extremely well when bonuses are offered).

If you are trading, you should be aware of the “Pareto Rule in the FX World” – 70%-80% of traders lose money in the long run, and trading more frequently may increase your chances of joining the herd (losing to b-book broker is revenue for them).

Take a look at Elite CurrenSea’s tools and methods to stand better odds (no promises, though as it totally up to you how to make it, elite currensea only provide the tools that has been around for the last 8 years) against the market. Elite CurrenSea shares its trading performance on a weekly basis, you are free to become a member.

Land-FX Deposit Bonus

The offer allows you to make up for the transaction fees, however you should be aware of there minimum trading requirements mentioned above.

- 10% Deposit Bonus on First deposit up to $3,000

- 10% bonus applies equivalently to first deposit amount above $30

Land-FX 5% Recovery Bonus Rules Details

As a truly old-school brokerage, Land-FX offers a symbolic 5% on top of anything above $300 you decide to put on top of your margin-called account (we’ve all been there..).

The bonus should be enough to cover up for the possibly transaction fees, here are the rules you’d need to keep in mind:

- Ought to be at least second deposit or;

- Under an account with max of $30 balance

- Margin call on recovery bonus is not eligible for another recovery bonus

- Only applies on above $300 first deposit

- Recovery bonus can’t be withdrawn prior to minimum round turn conditions apply

Analysis & Education

Yes, but the analysis is basic and offered by relatively unknown analysts. Not much to say here. Most likely you will do better following independent programs.

Elite CurrenSea offers analysis, education and tools, but you are free to search the internet for the mediums that suit you best.

To Sum Up

All in all, Land-FX is a decent player that doesn’t spread itself thin with fancy added value services. Instead, it offers you the needed minimum, leverage, trading conditions and execution, to make money. The rest is really up to you.