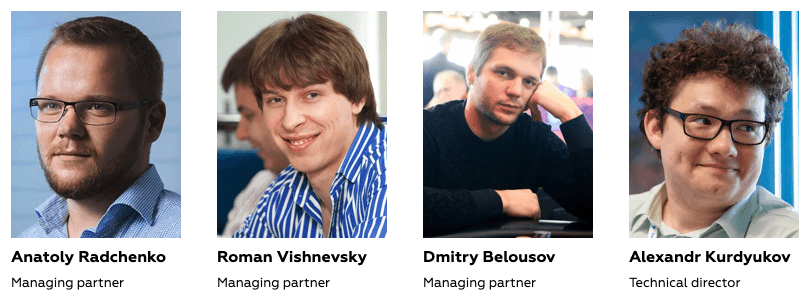

Background & Management Team

Incorporated in 2009, United Traders initially consisted of three young traders, who were unsatisfied with the low payouts their trading firms provided.

According to icorating.com, the team consists of 64 specialists, including experienced traders, marketers, technical specialists, financiers, sales managers, analysts and designers.

Although young by industry standards, UT’s management team has plenty of experience and consists of traders and investors who were previously involved in US & Canada based trading companies (no reference was available at the time of the review). UT also has a CTO with strong software architecture experience.

Roman Vishnevskiy

Roman is the head of the Russian division of UT, also working as a head trader. Many experts claim that he is the best scalper in the US stock markets (info taken from an icorating.com portal, that reviewed UT in Return for a $20,036 fee before its ICO).

Unfortunately, Roman’s LinkedIn profile link has been removed since it appeared on icorating.com (original link) – I did find Roman’s Instagram, Facebook & Twitter– hope he doesn’t mind ?.

Anatolii Radchenko

Second Managing Partner and a trader of various styles, Roman is also involved in the development of the UN’s Education service.

He’s known for sharing experience on the Cryptocurrency market with the likes of Forbes, he is often a guest at crypto panels and UT’s investment shows.

His LinkedIn profile was easier to find, alas, there wasn’t much info. You may learn about his line of thinking via Twitter & Facebook.

Dmitry Belousov

Managing partner overseeing the development of the educational offer, a great scalper and another media-savvy member of UT’s Russian leg.

Dmitriy Is believed to be a great scalper, which he supposedly picked working for Canadian Swift Trade (the company went out of business in 2010 according to Bloomberg, shortly after being accused of “layering” and consequently charged 8 mln pounds as reported by the guardian).

Alexander Kurdyukov

Taking the position of Managing a “Corporate Scale” in a wide range of applications, Alex is an active CTO at the company.

Before UT, Alexe’s list of achievements boasted of high profile employers, where judging by the brief stay (?), he has been primarily executing project-based work.

- Aeroflot payment solution working in less than 3 weeks

- American Express merchant integration with both front and back office in a month

- Payment solution implemented for Sberbank of Russia

- Payment solution implemented for TatFondBank

Overall, the Board of Directors consists of young specialists, who seem to have accumulated relative recognition in Russia. Their ambition could be to gain the same traction in the developed markets.

Regulations

United Traders is regulated by the Central Bank of Russia (license number №045-13982-300000) as of 18.05.2016. Keep in mind that the Russian government outcasted most of the brokers around the same time.

This makes United Traders a well-positioned player in the local market. Alas, Russia’s lack of reputation as on in the international trading arena makes me wonder if UT’s planning to obtain a more well-established regulatory body.

At the time of the review, it was suspiciously easy to open a trading account and make a deposit. EMSA rain and analogues of EU/US/AU regulatory bodies have not been used as an inspiration for UTs compliance practices (feels great to open and fund an account in under 5 min, doesn’t make it more trustworthy though).

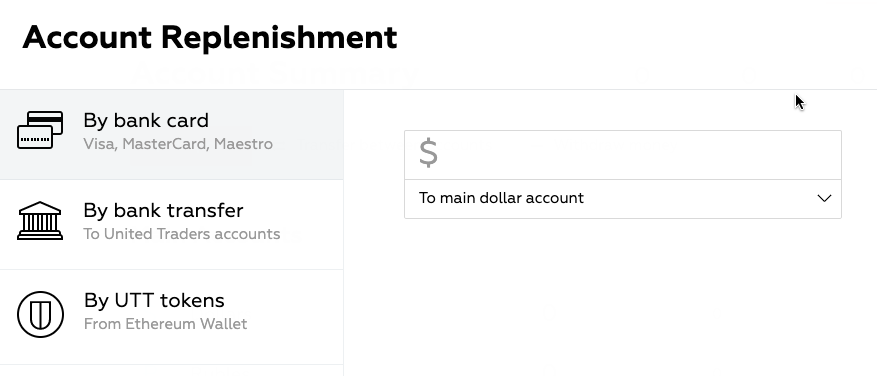

Deposit Withdrawals

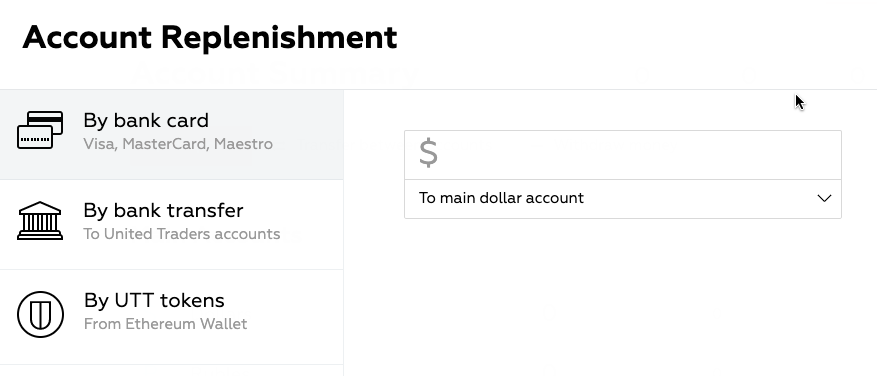

UT offers Ethereum, Wire Transfers and Credit Cards with banks located in several locations, including the EU.

I haven’t wired any funds yet at the time of writing the review. More info is to be updated as soon as I start testing the service.

Services

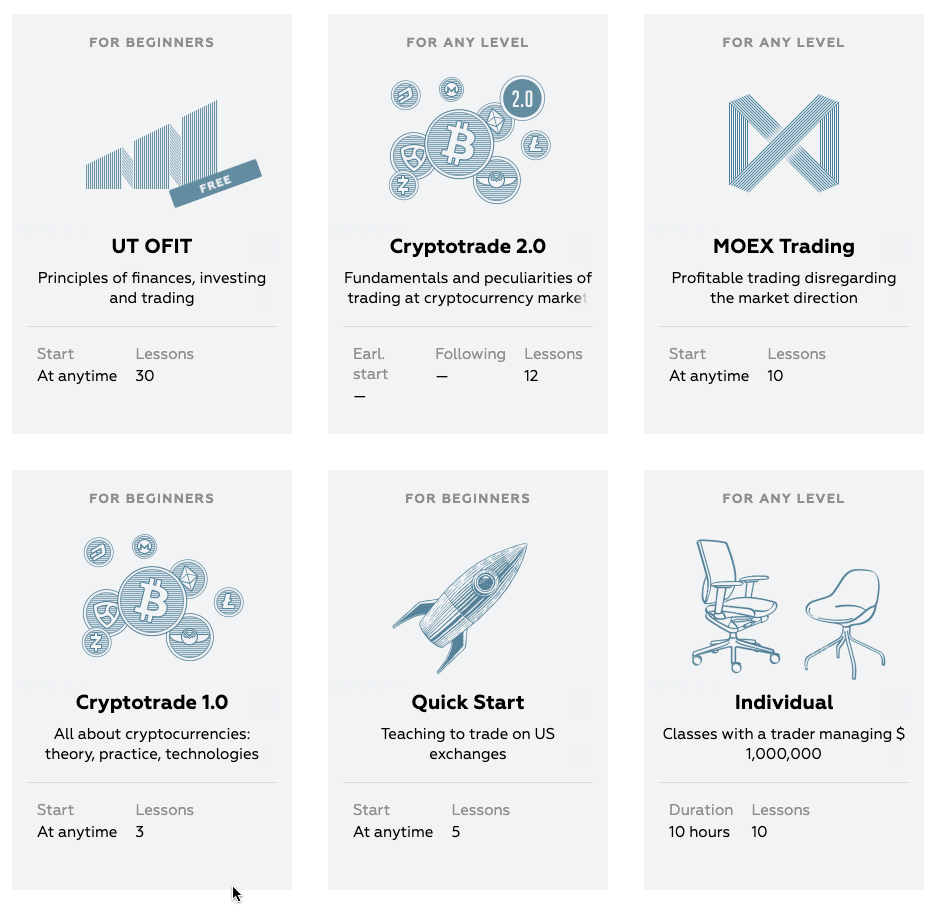

Thanks to the outstanding UX & UI (user experience and user interface respectively), UT’s abundance of services might not overwhelm the visitors at first scroll.

Thanks to the outstanding UX & UI (user experience and user interface respectively), UT’s abundance of services might not overwhelm the visitors at first scroll.

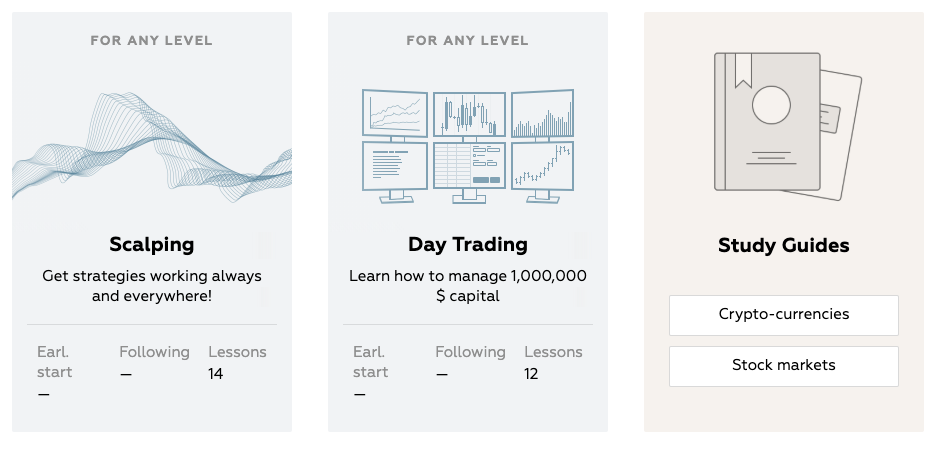

If you dig deeper, however, you might forget if you came to a make an investment/trading decision or came to a bistro restaurant in a shopping mall. At the time of the review, United Traders have been actively promoting:

- Crypto Exchange (not working as of July 2019)

- The US, RU Stock Market Trading

- Investment

- ICO

- IPO

- Stock Picks

- Algo Trading (Kvadrat Black)

- Community Ideas

- Education (as of July 2019 only available in Russian)

- Analytics & Media Blog “Umedia” (aiming at becoming an ultimate trading magazine ?)

Luckily for you, the website does a very good job informing you of any type of information.

The visual direction resembles Telegram, which UT doesn’t shy away from praising the Durov brothers for.

Now, let’s take a look at each service separately:

Exchange

According to its ICO promises a UTEx crypto exchange was to be unveiled at the end of the grandiose raffle in April 2019.

To avoid giving feedback on the motivation behind throwing a Gargantua show (likely inspired by the marketing gimmicks used during E-Sport events), I would only mention that after the publicity stunt was over, UTEX couldn’t handle the pressure technically. Its release has been pushed to the end of summer 2019. Among the promises UTEX is to feature:

- Interfaces to match the one currently holding the great variety of services on UT’s website

- Tools & Instruments: a standard number of tools and selected cryptocurrencies available from the start

- Fiat currencies are available from day one

UT decided to register its exchange in Estonia, a popular destination for many Russian businesses looking for diversifying from Russia, notorious for its crackdown on the FX industry in the past.

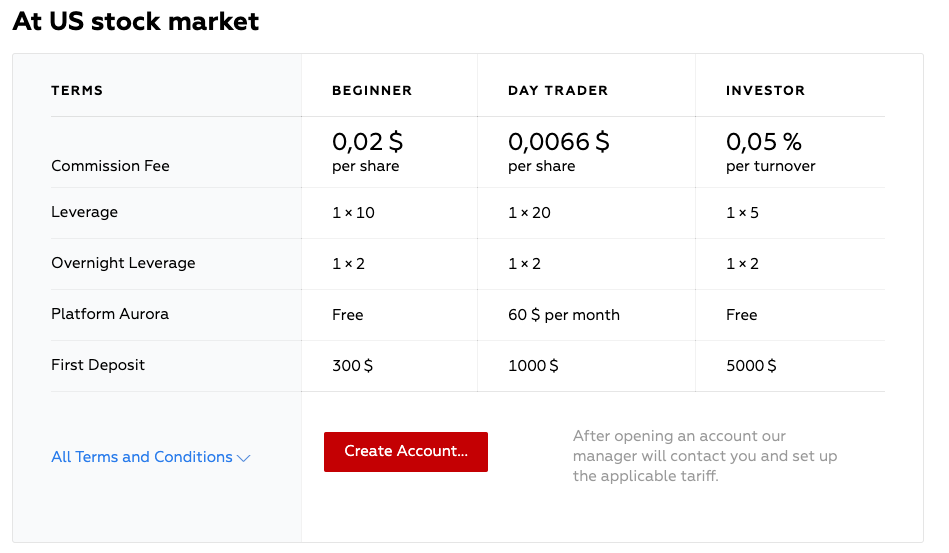

Trading

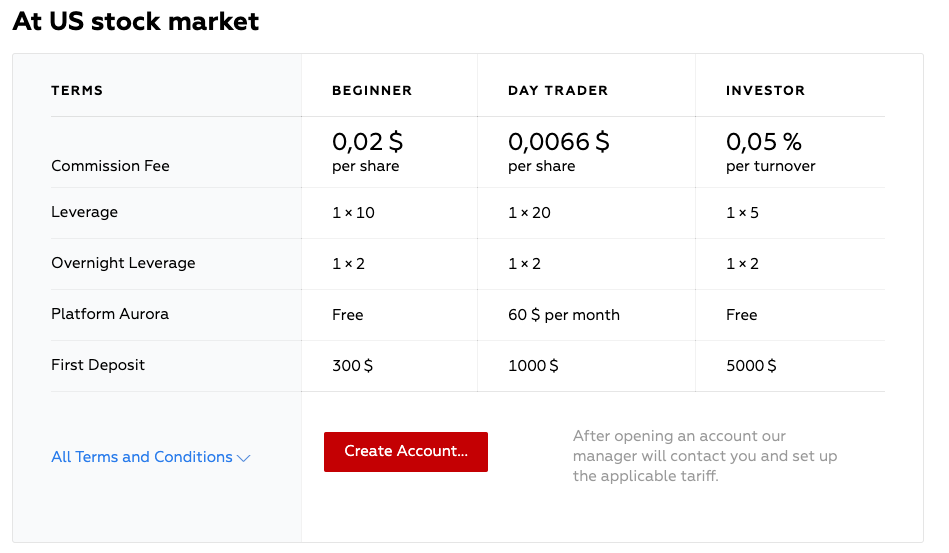

Russian and US (NYSE, NASDAQ, AMEX, BATS) stocks will be available via UT with leverage through its proprietary Windows only desktop platform Aurora. I will keep you updated on how the onboarding of EU clients will work after getting my hand on the platform.

The investors should not feel the difference, whereas traders, barring any hidden fees that I am not aware of, will have little to complain about with fees ranging from $0,02 per share to $0.0066 per share depending on the minimum deposit (see ☝).

Trading Platform – Aurora

Integrating standard risk management tools Aurora seems like a viable multi-asset solution that has been prematurely released to the market. The documentation is only available in Russian, and I wouldn’t suggest picking it up before UT make an effort to localise the solution.

UT does offer other trading solutions, which you would need to configure manually. For that, your best chance is to contact UT’s customer support for assistance.

The Aurora trading platform offers a fresh design with easy navigation. All new platforms require some time to discover and familiarize with but Aurora seems to offer a short learning curve and an intuitively simple logic. The multiple windows offer a long list of data from new bid and ask prices to new daily highs and lows. Of course, traders can also open up financial instruments and analyse prices in multiple ways.

The advantage of the windows is that traders can build a custom design that suits the viewer and their pc screen(s). That said, some traders might find the 8 panels that open up with the platform too overwhelming. Also, the availability of technical indicator options seems to be limited as far as we can see in our first round of testing (if we are wrong, please let us know of course). Otherwise, the platform seems simple to understand and simple to use.

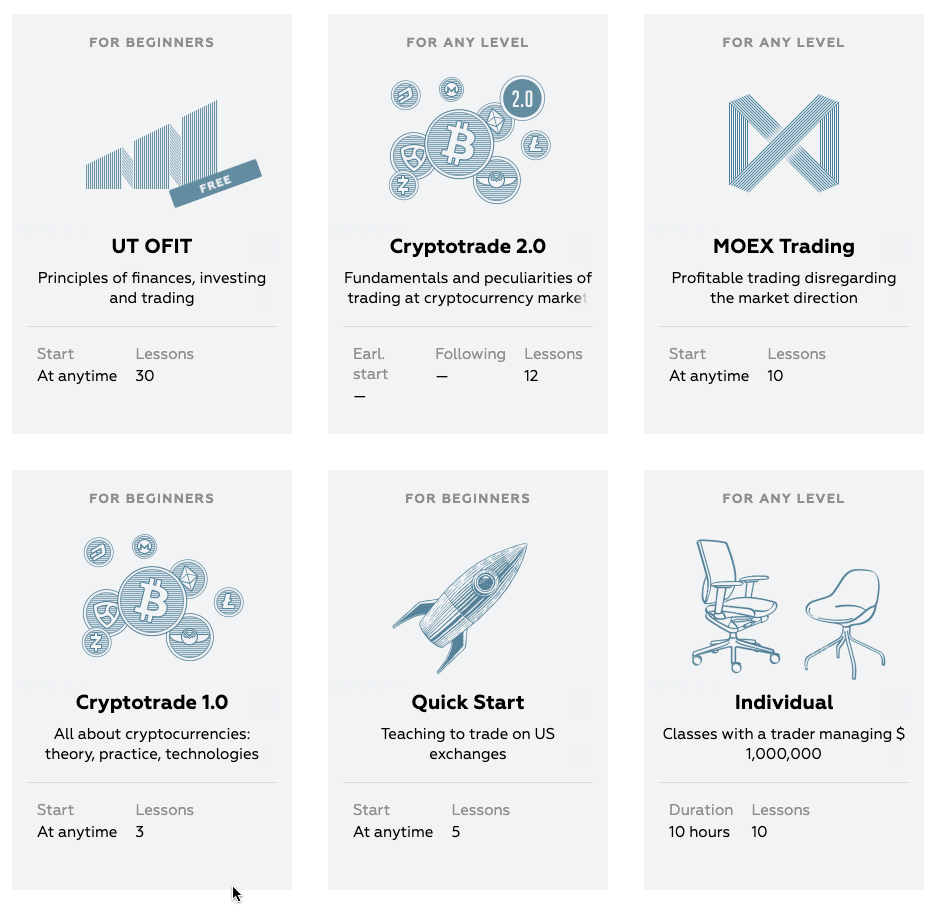

Education

Albeit only partly available in the Russian language, the many courses are led by managing members of the company as well as several articulate traders (one of its co-founders speaks Russian).

Among the key benefits of the education:

- Private Chats

- Access to the community of investors

- Mentorship Programs

- Actionable Strategies

Drawbacks

- Lack of localisation

- Unclear pricing model

- Unfinished interface

All in all, the global audience won’t be able to benefit from UT’s education. It stays unclear why the ostensibly well-versed team rolled out the service without ensuring its basic capabilities of the service.

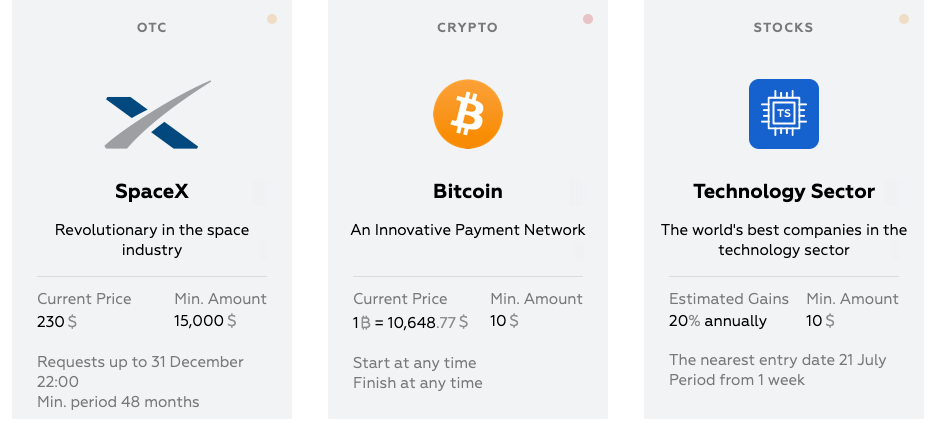

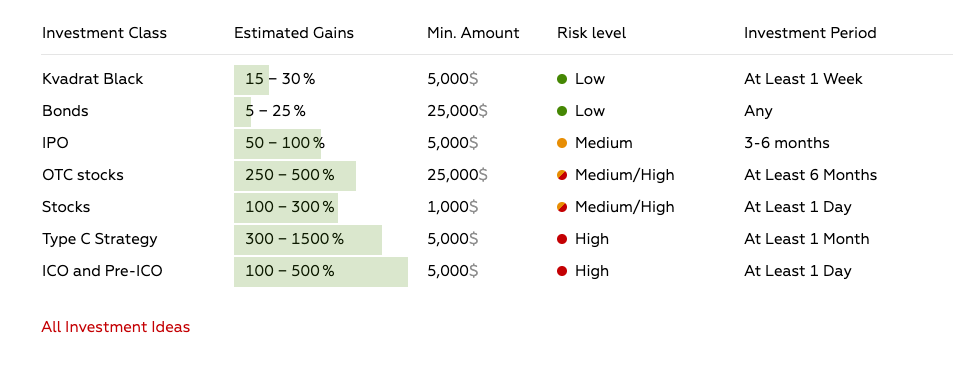

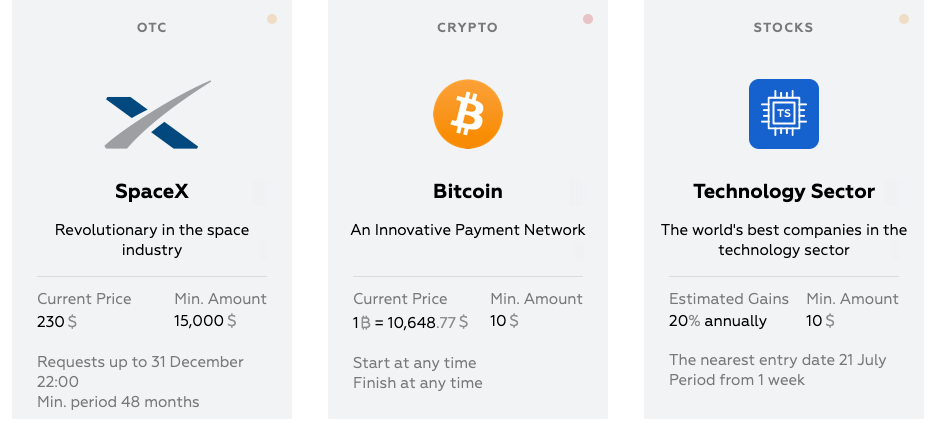

Investments

In its current state, an Investment service appears interesting mainly to beginners, looking to find an alternative to their more rigid investment (cash-under-the-pillow / in-fear-of-market-collapse / or a bank deposit).

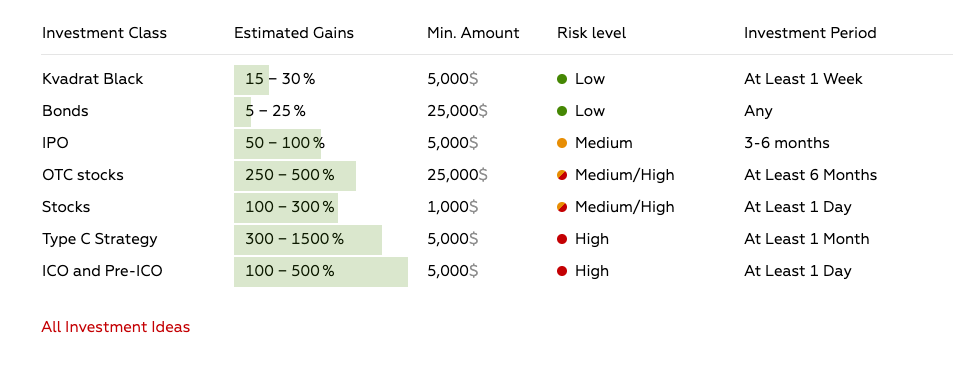

Meanwhile, except for the pre-IPO/ICO picks, most of the investment ideas (before July 2019) are mainly based on obvious choices (very talked-about companies), which sheds little light on the expertise of the authors.

I’ll try to elaborate below:

Those who believe that the market acts at random would argue that to earn substantial returns one needs to place many high-risk bets with a limited downside – ideally via options (N.Taleb, Black Swan). With an option, you limit the loss to the price of the option, whereas the benefit is nearly limitless.

The same, albeit much riskier could be applied to the cryptocurrency market (altcoins are very volatile if you are lucky enough you can catch that spike and your loss is limited to the amount you are ready to dedicate to such a portfolio).

So, if you believe that long term markets are random and can’t be predicted, the majority of UT’s ideas (Airbnb, Hyperloop, SpaceX) and other major technology or cannabis sector investments might seem too obvious to hold a high level of possible returns.

Don’t get me wrong, those are not bad picks but it’s just not clear why a seasoned trader would pay up to 20% commission of profit share for unsurprising investment ideas?

Mind that deposit and withdrawal fees might raise the costs by approximately 5%. Furthermore, some investment options have a minimum capital requirement, as well as a holding period of up to 6 months.

Among the investments UT offers:

- Algo Trading

- ICO

- IPO

- US Stock

I like the clear information on risk and investment opportunities UT gives to the reader and will be putting some money into empirically testing their investment genius.

United Traders ICO

Reaching around $24m in the market cap the coin settled at $11m market cap at the end of 2019 (data according to coinmarketcap.com).

- Short story of an IPO

- The low trading volume of Utoken

- Drop-in Value by 70%

- Paid ≈ $20,000 for review on icotrading.com

- Behind the schedule on the implementation of the plan re-exchange & trading platforms

More on the ICO (a more peachy take) could be found on https://icorating.com/ (keep in mind – they’ve received $20,000 for writing a review – a usual practice in the world of ICOs).

Dragging behind the ICO roadmap, albeit expected, without a functioning exchange, English version of the educational module and other less on the surface components, “UT seems to be leveraging on its pre-ICO development, leaving us wondering whether the company is spending an ICO raised capital on product development as promised to the investors.”

Summary:

Value Proposition:

- Access to Investment in IPO/ICO and US Stock Market with minimal capital

Catch:

- Up to 30% in commission (20% profit sharing, approx 5% depo + withdrawal, some

Thanks to the outstanding UX & UI (user experience and user interface respectively), UT’s abundance of services might not overwhelm the visitors at first scroll.

Thanks to the outstanding UX & UI (user experience and user interface respectively), UT’s abundance of services might not overwhelm the visitors at first scroll.