Forex and CFDs on Stocks, Cryptocurrencies, Indices & ETFs are the core of Monfex’s business.

Monfex Limited is also registered in Saint Vincent.

Forex and CFDs on Stocks, Cryptocurrencies, Indices & ETFs are the core of Monfex’s business.

Monfex Limited is also registered in Saint Vincent.

👍 We recommend Monfex for manual and EA Forex trading, as well as speculating (short term trading) on Stocks, ETFs and Cryptocurrencies via Contracts for Future Difference (CFD).

Ok trading fees and no non-trading fees on Forex, within which fees on CFDs are more expensive.

| Assets | Fee Level | Fee Terms |

| US Stock | High | Only available via CFD |

| EU Stocks | High | Only available via CFD |

| EURUSD | Low | ≈ €4.5 per lot + spread |

| Inactivity FEE | Low | No inactivity Fee |

Let’s first go through the fees terminology:

To put things in a proper context we compare Monfex with the competing services, based on product offering, fee structure and customer profile.

| Monfex | Axi | XM | |

|---|---|---|---|

| Account fee | No | No | No |

| Inactivity fee | No | No | No |

| Withdrawal fee | $0* above $300 | $0 | $0 |

Except for a slight difference depending on your country, non-trading fees are low to non-existent. You won’t be charged for inactivity, as well as a deposit of over €100.

Raw account holders would have to pay both commissions and spreads, whereas Fixed & Classic traders are limited to just spreads.

Comparing trading fees among CFD brokers may get convoluted pretty quickly, for the purpose of making things more straightforward, we’ve decided to showcase all fees for trading the most common set of products using a Raw account. The leverage we used is:

We define a typical trade as a $10,000 and $100,000 buy position for stock/indices and forex respectively, held and sold after 7 days.

The benchmark fee takes into account commissions, spreads and financing costs. Below is the result for Monfex.

Forex Fees are low in comparison to XM & AxiTrader.

| Monfex | XM | AxiTrader | |

| EUR/USD benchmark fee | 65$ | 17.1 | 13.8 |

| GBP/USD benchmark fee | 81$ | 13.8 | – |

| AUD/USD benchmark fee | 90$ | 13.9 | 9.5 |

| EUR/GBP benchmark fee | 80$ | 12.2 | 11.0 |

Stock & Index CFD are similar to XM & AxiTrader.

| Monfex | XM | AxiTrader | |

| Apple CFD benchmark fee | 35$ | 3.4 | – |

| Vodafone CFD benchmark fee | 95$ | 5.6 | – |

| S&P 500 CFD Benchmark | 16$ | 2.4 | 1.7 |

| Europe 50 CFD Benchmark | 20$ | 2.4 | 1.2 |

These fees occur when you decide to hold your position. The longer you stay in CFD or FOREX trade, the more fees will accumulate, making the final amount rather hefty.

| Monfex | Axi | XM | |

|---|---|---|---|

| Apple financing rate | 5.7% | - | $3.4 |

| Vodafone financing rate | NA | - | $5.6 |

Focused on CFDs & Forex Monfex will only let you trade CFDs on Stocks & ETFs, Commodities, Crypto and Indices.

| Monfex | Axi | XM | |

|---|---|---|---|

| Stock | - | - | - |

| ETF | - | - | - |

| Forex | 48 | 34 | 48 |

| Fund | - | - | - |

| Bond | - | - | - |

| Options | - | - | - |

| Futures | - | - | - |

| Cfd | 122 | 51 | 122 |

| Crypto | 5 | 3 | 5 |

Monfex offers a ok amount of CFDs, most of the traders will find the most popular instruments around here.

⚠ Keep in mind, CFDs are complex instruments and are usually traded with leverage, which significantly increases the chances of losing money. At the time of the review 56% of retail investor accounts were losing money when trading CFDs with this provider. It’s your responsibility to understand the inner workings of CFD instruments and understand the underlying risks.

At the time of the review Monfex hasn’t offered any stock and ETFs directly.

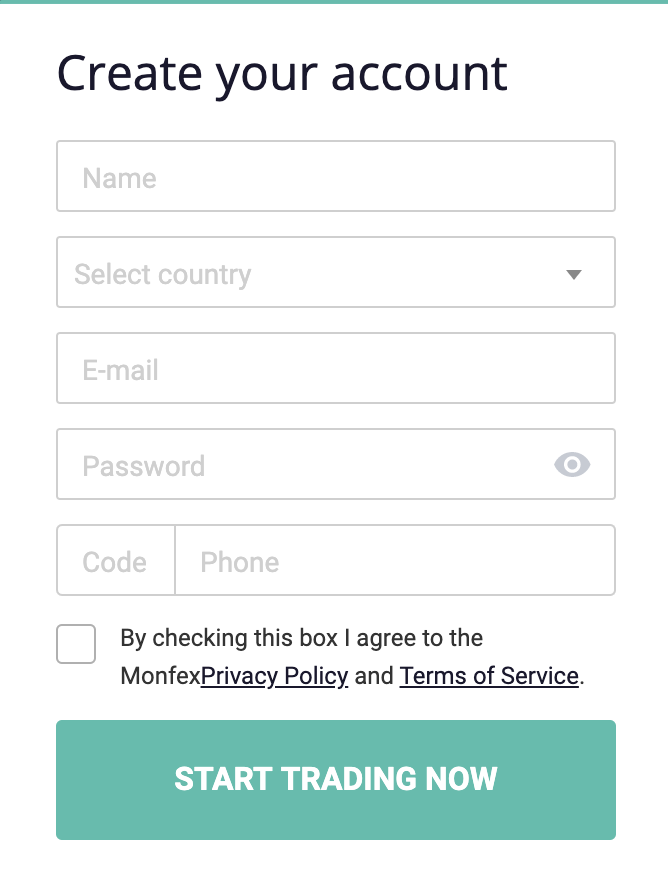

Despite sales people trying too hard sometimes, the account should be ready within the same day – without complicated procedures involved.

You are fine as long as you don’t currently reside in the following countries:

Depending on your country, a minimum deposit may or may not apply. Contact your local sales team for more info.

Despite at times pushy sales processes (prepare yourself to accept frequent emails and call attempts), the account opening is very straightforward and mild when it comes to identity verification and money operations.

You’d need to:

Available via several options, the deposit & withdrawal (d/w) process is quick and inexpensive (except for digital wallets).

With an exception of electronic wallets (≈ 2% of the amount) the fees are free. Among the popular transfer options are:

| Monfex | Axi | XM | |

|---|---|---|---|

| Bank transfer | Yes | Yes | Yes |

| Credit/Debit card | Yes | Yes | Yes |

| Electronic wallets | Yes | Yes | Yes |

You can only d/w from entities on your name. The debit/credit card and digital wallets deposits arrive instantly, whereas wire transfer might take up to 3 business days.

| Monfex | Axi | XM | |

|---|---|---|---|

| Bank Transfer | Yes | Yes | Yes |

| Credit/Debit card | Yes | Yes | Yes |

| Electronic wallets | Yes | Yes | Yes |

| Withdrawal fee | $0* above $300 | $0 | $0 |

Basically traders can download MetaTrader 4, but also personal manager can help with setup of MetaTrader 5.

MetaTrader is the most popular forex and CFD platform, available in multiple languages and supported by the largest FX community. Unfortunately, the platform is also quite dated and unlike with competitors, lacks any added features.

The website and back office offer a comfortable browsing experience at the first glance. Most of the information is easy to find and comprehend.

Trader is free to request MT5 account, and Monfex`s managers will walk you through the account setting at MT5.

MetaTrader 5 allows you to configure the following notification:

Although Monfex is less impressive over the email, you will always find help via phone or their live chat. Make sure to time your queries during the traditional 24/7 hours.

Available in many languages, the Monfex support is available to you 24/7, over the phone, live chat and email.

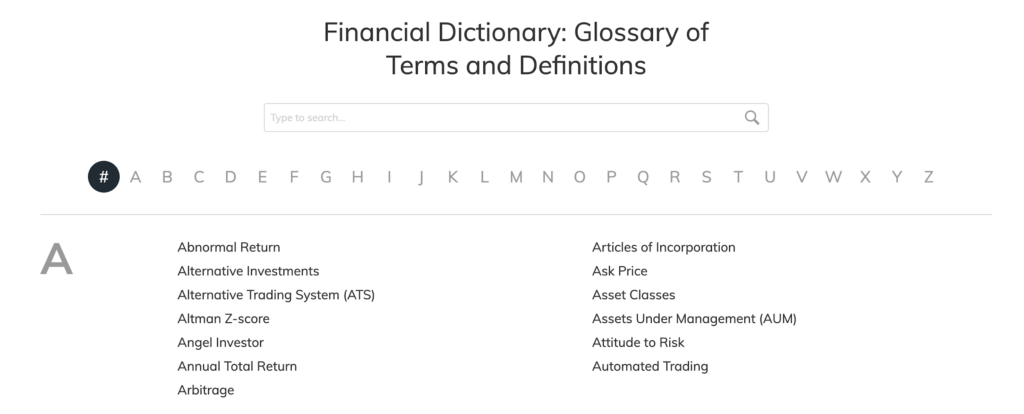

Monfex offers several tutorials and knowledge base for traders. Despite the lack in video education, Monfex offers extensive education library on:

At the first glance the information is prepared to appeal to novice traders who are actively looking for trading methods and general guidance.

For more in depth learning, make sure to check Monfex sponsorships to get discounted/free access to an award winning automated trading solutions, wealth management (PAMM/MAM) and education.

Charting tools are quite robust, packing over 20 indicators. Surprisingly, you won’t be able to save the chart settings for later.

At the time of the review (11.20), monfex replied to have been in the process of obtaining several licenses.

Established in Saint Vincent and Grenadines in 2018, currently Monfex operates under SWISS-SVG HOLDING LTD legal entity.

Despite a sometimes-pushy sales team, Monfex manages to offer competitive services. Wide selection of trading instruments and super user-friendly platform makes Monfex one of the best trading platforms nowadays.

| 💸 Trading fees class | Average |

| 💸 Inactivity fee charged | No |

| 💸 Withdrawal fee amount | No |

| 💸 Minimum deposit | $250 |

| ⏰ Time to open an account | 10 min |

| 💳 Deposit with credit card | Available |

| 👛 Depositing with electronic wallet | Available |

| 💱 Number of base currencies supported | 4 |

| 🎮 Demo account provided | Yes |

| 📊 Products offered | Forex, CFDs on Crypto, Stock and ETF and Commodities |