Axi is a reputable broker offering a solid amount of FX instruments, albeit a relatively small number of CFDs via it’s FCA and ASIC-regulated entities. Despite some minor mixed reviews about customer service on Forex Peace Army, AxiTrader’s reputation remains solid and therefore we consider this broker to be reliable for trading currencies and CFDs – certainly for the core instruments. For a full list of all of the CFDs on stocks and local indices, check their website Axi.com.

Axi

Summary

- MT4 NextGen set of plugins, plus MT4 for Mac

- Offers 1:10 CFD on Bitcoin

- Regulated by FCA and ASIC

- Limited range of CFDs

- Subpart education and analytics

Company background

Axitrader started as Sydney based brand in 2007, the company expanded its operations into UK and China in 2012 and 2015 respectfully. By 2016 Axitrader has reached over €100bln in monthly volume, mainly from its original markets, as well as Germany, Latin American and Middle-East. The same year Axitrader received a significant investment from the Australian-local private equity firm RGT.

The company offers access to over 80 Forex and CFDs instruments. Besides currencies, traders also have access to indices, metals and Crypto (bitcoin at the time of the review). Traders can access the markets via MetaQuotes Metatrader 4 (also available for Mac) and MT4 Nexgen, which is available for Pro account clients.

Methodology

For this review we tested AxiTrader, standard account, plus we collected secondary information from reputable sources, as well as user generated reviews.

Regulation

At the time of the review, AxiTrader was offering its services via UK’s FCA regulated London-based entity, AxiCorp Limited (Reference Number: 509746), and Australia ASIC regulated-regulated AxiCorp Financial Services Pty Ltd (AFSL number: 318232).

| Clients from | Protection Amount | Regulator | Legal Entity |

| Europe and other eligible countries | No protection | Financial Conduct Authority | AxiCorp Limited |

| Australia, Rest of the world | No protection | Australian Securities & Investments Commission (ASIC) | AxiCorp Financial Services Pty Ltd (AxiCorp) |

What Other Forex & CFD Websites and Customers Say about AxiTrader?

Although nowadays there is plenty of information available on every broker, this does not make it easier to take a thoughtful decision. The abundance of information can quickly become overwhelming and confuse traders rather than provide clear answers.

We’ve gone through, authoritative user-generated and broker listings/reviews websites to, hopefully, offer more clarity on the reception among its clients.

User Generated

Most of the websites of this kind offer a raw stream of consciousness by angry and happy traders alike. It is, therefore, important to keep in mind that some of the reviews will be nothing more or less than such.

Given that a lot of traders lose funds, and may go to the websites like Forex Peace Army (FPA) to complain, we aim at distinguishing, well, more subjective from less subjective reviews and offer our limited view on the situation.

Forex Peace Army (FPA)

Being one of the most trusted user-generated Forex and CFD communities, FPA is making sure to mediate communication between traders and service providers.

Albeit generally positive sentiment on FPA, some customers find AxiTrader customer service a bit edgy. On a positive side, company’s reputation manager takes care of every query, which fosters a transparent discussion.

We couldn’t find clear cases of deliberate misconduct by AxiTrader, even though some users were not satisfied with some of the technical issues at one point or another.

Non-User Generated

While reviews from non-user generated website are usually more well-structured and in depth, they may also fall short on the objectivity spectrum. Brokers do incentivize many third party-websites to write favourable reviews. To get the most out of the review process, make sure to check multiple sources and examine their credibility.

You can find the feedback from Elite CurrenSea’s clients on our website and in FPA. We do provide incentives to our clients to open an account with our trusted brokers, you can learn more about that in our ecs.TradersClub loyalty program.

Keeping in mind the info above, we can attest that AxiTrader reviews appear to be mostly positive with only a few minor discrepancies from lesser known and sometimes suspicious websites.

Customer Service

Overall experience with Axitrader customer service was positive. The connection time was under a minute and account managers were professional, able to quickly answer both generic and more advanced questions.

Albeit, the somewhat negative FPA sentiment on that matter, we remain impressed by the quality of the support and invite our visitors to leave their feedback to form a more well-rounded opinion.

Account Types and Execution

AxiTrader utilises a hybrid execution method, which means that it can act as a market maker and, executing orders accross its account types, send orders directly to it’s liquidity providers (LP) as an STP provider.

AxiTrader utilises a hybrid execution method, which means that it can act as a market maker and, executing orders accross its account types, send orders directly to it’s liquidity providers (LP) as an STP provider.

This setup helps AxiTrader to offer competitive pricing on PRO account, with 0 spread and, standard account with tolerable spread fees.

Products/CFD Portfolio

For it’s PRO accounts, the broker charges a $7.00 Round-Turn (RT) commission per standard lot (100k of the asset), for accounts in USD & AUD, and the equivalent in other currencies. For Standard account clients will pay no commissions which will be overset by spreads starting from 1 pip.

| Product | AxiTrader | LCG | Markets.com | Alvexo |

| CFDs on Forex | 1:400 | 1:500 | 1:300 | 1:300 |

| CFDs on Commodities | 1:400 | 1:200 | 1:200 | 1:75 |

| CFDs on Indices | 1:400 | 1:500 | 1:150 | 1:75 |

| CFDs on Crypto | 1:2 | ? | limited up to the total position value of $2,000 | 1:5 |

Forex

AxiTrader offers 80 different currency pairs, including all major currencies such as USD, EUR, GBP and JPY. At the moment of the review, available leverage for trading CFDs on FX was 1:400.

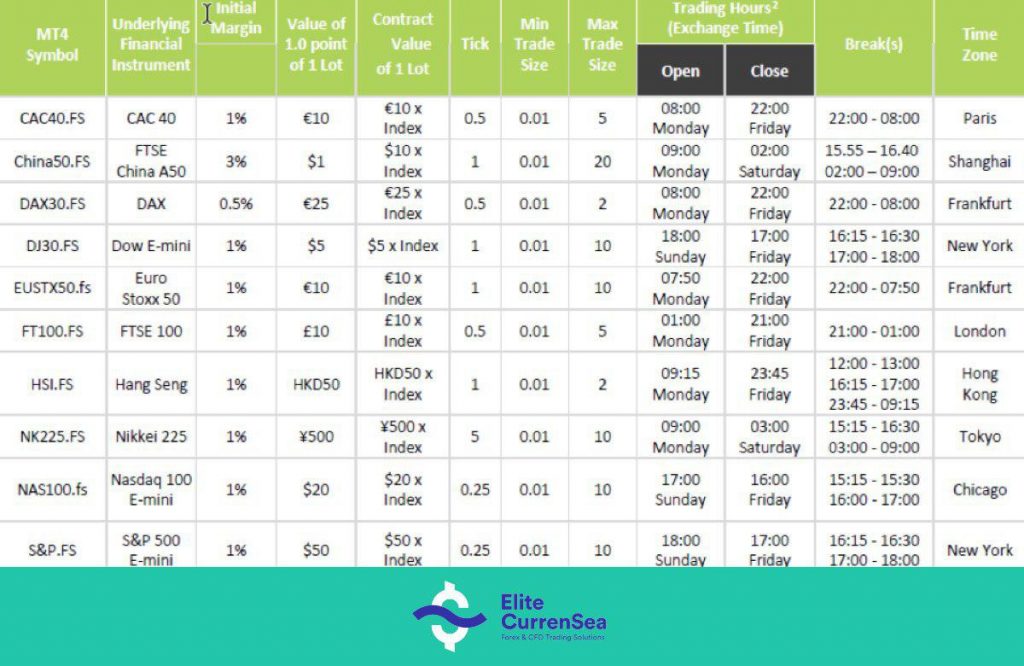

Indices

Axi offers core indices at competitive prices. Considering the reputation and leverage available, the offer makes sense for people looking into trading major indices. If you are looking for more exotic instruments, then check out our other trusted brokers.

Commodities

Available tradable commodities are categorised into one of four groups – energy (including crude oil), metals (such as gold, silver and platinum), agricultural (including coffee, wheat, sugar and cocoa) and finally livestock and meat (including cattle). At the moment of the review leverage available for trading CFDs on commodities was 1:400.

Cryptocurrencies

At the moment, the broker offers only BTC/USD pair (available not in all regions).

| MT4 Code | Market Name | Open | Close | Break | Time Zone |

| BTC/USD | Bitcoin | Monday 00:01 | Friday 23:58 | 23:59 – 00:01 | MT4 Server Time |

Fees & Commissions

The average spreads for Pro account, after factoring in the commission fees, was at 1.14 pips (0.44 commission + 0.7 commission) whereas Standard account offered 1.24 pips spread.

Unfortunately, the average spread info is inconclusive as AxiTrader hasn’t updated it ever since December 2016.

| Typical Spreads | Markets.com | LCG CFD Acc | LCG ECN | AxiTrader Standard | AxiTrader ECN |

| EURUSD (pips) | 1.65 | 1.45 | 0.2 | 1.24 | 1.14 |

| OIL (WTI) | x | x | x | ||

| GOLD | €0.2 | 0.1% | x | 27.54 | 15.73 |

Average spreads may vary as they haven’t been updated since December 2016.

Payment methods

AxiTrader supports Neteller, Wire and Credit Card deposits and withdrawals. For Neteller clients would need to ensure the account corresponds to the one registered with AxiTrader.

The company does not charge extra fees on account operations. Keep in mind that you local banks fees may apply. The usual time of withdrawals is 2-5 days, mostly dependant on your own bank.

Platforms

AxiTrader bets on MetaQuotes’ MetaTrader 4 as it’s only platform for web, mobile and desktop. Pro account clients will have access to MT4 Nexgen, a platform closely resembling MT4 Supreme by Admiral Markets. Depositors of over $1,000 will enjoy the extended features including:

- How to add features to your workspace

- Mini-Terminal

- Session Map

- Connect Terminal

- Trade Analysis

- Trade Terminal

- Market Manager

- Alarm Manager

- Correlation Matrix

- Correlation Trader

- Sentiment Trader

Although it may not be fully unique, the MT4 NextGen is one of the core strengths of AxiTrader. If you find any of the features appealing to you, reach out to AxiTrader to test the functionality on a demo or a live account.

Traders should still be well-equipped to trade with Elite CurrenSea’s Wizz, Camarilla indicators and SWAT or CAMMACD tools.

Autochartist now brings the world’s first market scanner directly to the MT4 platform, saving valuable time by allowing traders to watch all symbols and all time periods from a single chart.

PsyQuation is one of the world’s most advanced data analytics platforms for retail traders. Using highly sophisticated algorithms it works like your own private trading coach, analysing your individual trading style, identifying mistakes and helping you avoid making similar mistakes again.

As an AxiTrader client, you get completely FREE access to this powerful and proven tool to help you become a better trader and make more profit.

Mobile Trading

Since AxiTrader is a MetaTrader-only broker, iOS and Android versions of the MT4 app come standard and are both available for download from the Apple iTunes store and Android Play store, respectively.

Research

AxiTrader provides research in the form of technical and fundamental analysis from its in-house team of analysts with daily articles published on its Market News & Blog. Staff also stream videos throughout the week, including the Market Morning video and Weekly outlook.

In addition, automated technical analysis and signals are provided via AutoChartist – a third-party technology provider known for its pattern-recognition software. AxiTrader also offers automated trading signals via the Auto Trade feature in Myfxbook – a third-party service provider that also powers AxiTrader’s economic calendar. Further social copy-trading features are available from ZuluTrade, and via the Signals Market in the firm’s MT4 platform offering, and in 2017, AxiTrader added the MirrorTrader platform powered by Tradency.

In terms of trading tool-related research, aside from AutoChartist, there are premium research tools packaged into AxiTrader’s MT4 NexGen add-on, which consists of a series of plugins developed by FX Blue LLP.

Education & Analysis

At the AxiTrader Education Center, beginner traders can benefit from free training on the basics of Forex. The course is in video mode and traders have the flexibility to go over lessons as often as they need. The tutorials are available in 24 different languages and cover topics such as risk management, greed and overcoming fear of loss, charts, technical analysis, support/resistance, what is slippage and others.

At the AxiTrader Education Center, beginner traders can benefit from free training on the basics of Forex. The course is in video mode and traders have the flexibility to go over lessons as often as they need. The tutorials are available in 24 different languages and cover topics such as risk management, greed and overcoming fear of loss, charts, technical analysis, support/resistance, what is slippage and others.

Free market reports are delivered three times a day and the Market Snapshot emails provide an outlook of the markets for the following 24-48 hours. This snapshot is sent three times a day for markets such as Forex and Commodities and once a day for the Tokyo, London and New York Stock Exchanges.

Traders can subscribe to the high impact economic news emails and receive notification of events scheduled to take place in the Asian, European and US Sessions.

The FAQ list is comprehensive and since some of the basic information was not easily accessible on the website pages, this was a clear benefit to new traders.

There is also a financial glossary with key terms and their definitions.

Video Tutorials

For more advanced trading education, if you choose to trust our judgement, we suggest you to go through our trading strategies, tools and analysis to get professional help for free.

Fly or Frie Verdict

AxiTrader is a smart choice for savvy forex traders looking for a MetaTrader 4 Forex broker with enhanced features, strong customer service matched with relatively high leverage. The only factors that work against this broker is the fact they only offer the MT4 forex trading platform and have limited risk management tools such as guaranteed stops. Experienced traders who like MT4 though won’t find this a major issue and should consider AxiTrader within their Forex broker mix.

The broker provides competitive pricing on its PRO account offering, combining low average spreads with its round-turn commission per trade, making it a slightly cheaper option than its Standard account offering. With no minimum deposit outside of its Australian brand, AxiTrader can cater to a wide audience, yet the lack of an active trader offering puts it at a disadvantage when catering to high volume traders.

The firm’s in-house and third-party research tools, including AutoChartist and add-ons provided in the MT4 NextGen package, help AxiTrader differentiate itself among other MT4-only forex brokers.

Research done by Chris Svorcik and Nenad Kerkez Co-founders of Elite CurrenSea, Nenad and Chris are award-winning traders with over 10 years of technical analysis and teaching experience. They also offer education and technical analysis on top industry websites and constantly works on his proprietary trading system based on wave analysis ecs.SWAT and technical analysis ecs.CAMMACD.