? JPY Weakness Not Losing Steam After Gap ?

Dear Traders,

a new trading week is ahead of us and the Forex market could be offering interesting potential setups at the beginning of the week.

Mondays are typically slow trading days but the Japanese weakness seems here to stay after price gapped higher with the USD/JPY, EUR/JPY and GBP/JPY.

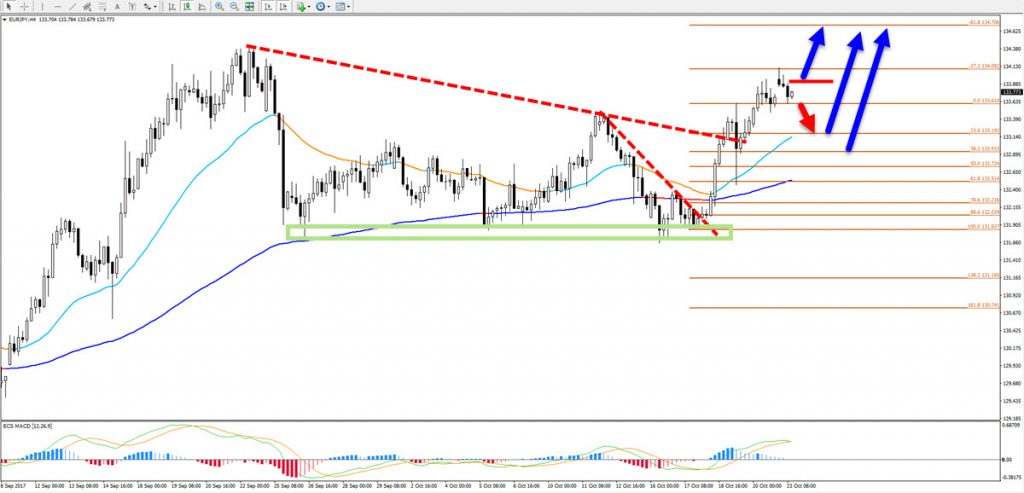

EUR/JPY uptrend seems to offer continuation setups for more long trades as price builds a slow and corrective pattern lower.

EUR/JPY Bullish Trend

The EUR/JPY bullish price action continued at the market open of this week when price gapped up above 134. The bullish breakout from last week saw a strong continuation take place with bullish momentum clearly visible. A move higher on the 4 hour and daily seems likely considering the overall trend as well.

EUR/JPY Gap Closed and Corrective Pattern

In the meantime, price has closed the gap but the bearish price action has been corrective and choppy. This indicates that the bulls are probably still in control of the overall market structure and traders could expect a continuation of the uptrend.

Entries can be done in 2 ways:

- Break, pullback and continuation of the corrective pattern

- Bullish 4 hour candlestick patterns

Once the breakout of the correction occurs, traders often should see a corrective chart pattern on a smaller time frame – like a bull flag. This indicates a high chance of bullish continuation.

EUR/JPY Target

The main target for the bullish continuation is aimed at the -61.8% Fibonacci target at 134.75 which is also near the psychological round level of 135.

The invalidation level of the bullish outlook is around 133.50. A break below this support zone could indicate a larger correction for the JPY pairs and price could retrace down to 133 on the EUR/JPY, which is still a zone that could provide support.

Many green pips,

Chris

Leave a Reply